The Future of the Future of Money

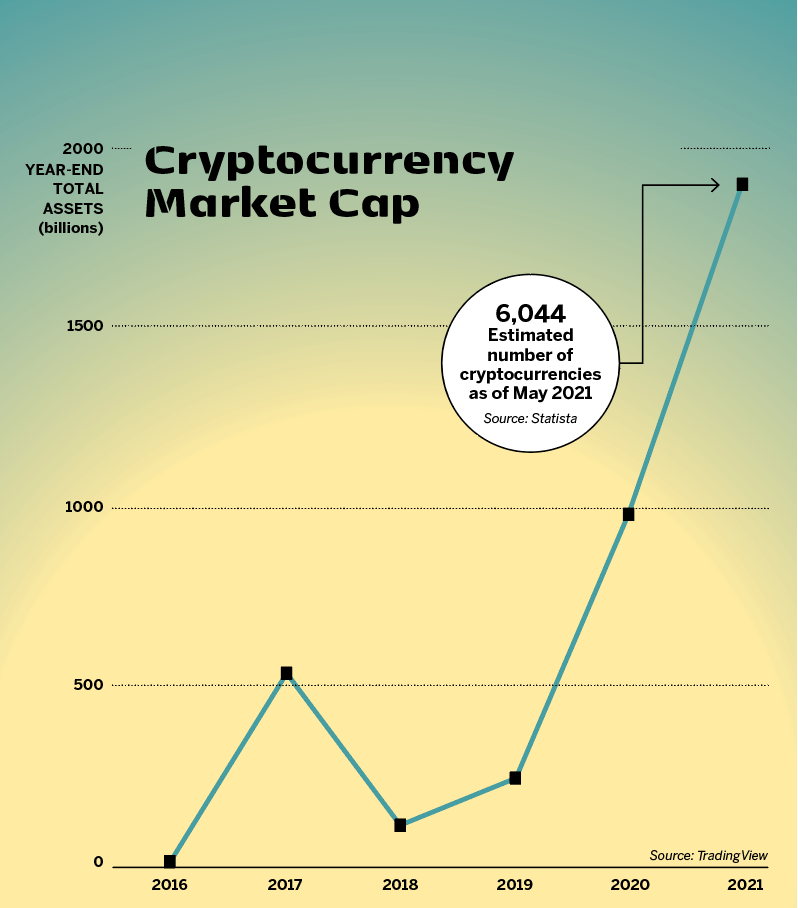

No one can see or touch cryptocurrency, but that’s not stopping it from entering the mainstream. It surpassed a market capitalization of $2.5 trillion this spring after beginning the year at less than $1 trillion.

While it’s uncertain that cryptocurrency can maintain that blistering pace of expansion, continued growth seems assured, according to Sam Bankman-Fried, CEO of FTX, a cryptocurrency exchange, and founder of Alameda Research, a quantitative cryptocurrency trading company.

“A combination of regulatory clarity, community growth and mainstream integrations would be the largest drivers of growth this year,” Bankman-Fried said.

Retail investors will become more comfortable with cryptocurrency when it’s available through trusted third parties, said Patrick Sells, chief innovation officer at NYDIG, a technology and financial services firm dedicated to bitcoin.

“Our research shows that 81% of respondents would be interested in buying bitcoin through their local bank if it was offered,” Sells observed.

But Bankman-Fried noted that a new version of an old conundrum could stand in the way.

“There’s a chicken and egg problem here: You can’t pay for things with crypto if merchants don’t accept it, but merchants won’t get many crypto payments unless there’s demand from the consumer side,” Bankman-Fried said. “So you have to either work within existing distribution channels or simultaneously get adoption on both sides in order to really grow out network usage.”

That’s beginning to happen as financial institutions provide merchants with better access to cryptocurrency, according to Sells.

Cryptocurrencies may be the most volatile

major asset class ever.

“A small business may want to accept payments in bitcoin but is unable to complete such a transaction independently,” Sells maintained. “Now, there’s a growing list of third-party platforms acting as the go-between to facilitate the process of offering centralized treasury services in one interface so as not to disrupt account management.”

Meanwhile, the public is becoming more attuned to cryptocurrency’s potential. Consumers, merchants

and potential investors are finding its ethereal nature less intimidating as adoption increases.

That’s because they’re beginning to understand that many cryptocurrencies are protected by blockchains—the software protocols stored on computer networks and filled with information that’s nearly impossible to alter.

They’re realizing blockchains, which can store any type of data, serve as digital ledgers for cryptocurrency transactions. A bitcoin block, for example, might contain the sender, receiver and the number of bitcoins transferred.

But how does a vigilant retail or institutional investor know a block hasn’t been compromised and falsified? A unique string of numbers and letters called a “hash” serves as a block’s fingerprint. If a criminal tampers with the information in a block, the hash changes.

Each block contains the hash of each block preceding it in the chain, so modifying a single piece of information changes everything, thus making cryptocurrencies extremely secure.

So, investors feel certain they’re buying something real when they put their faith in cryptocurrency. Prices for the most expensive cryptocurrencies have exploded and imploded and exploded again, creating opportunity for savvy traders and lucky speculators alike. Bitcoin flipped a total of more than

40% in July from a low of $29,308 to a high of $41,598.

That might make bitcoin the most volatile major asset class ever. But unlike many investment vehicles, cryptocurrency also has political connotations.

It fits the credo of the cypherpunk movement, whose advocates began networking in the 1980s to spread information on using cryptology to ensure privacy on the internet and to push for political change.

Cryptocurrency’s decentralized nature and relative freedom from government intervention—so far—also coincide with conservative ideals of small government and libertarians’ longing to have virtually no government. It allows the markets to take their own course.

Yet some liberals view cryptocurrency as menacing. If enough citizens used it, governments would lose control of the money supply and thus forfeit the power to expand or contract it at will. With enough cryptocurrency changing hands, governments would also become powerless to track the movement of funds, leading to difficulties with taxation and roadblocks to fighting crime.

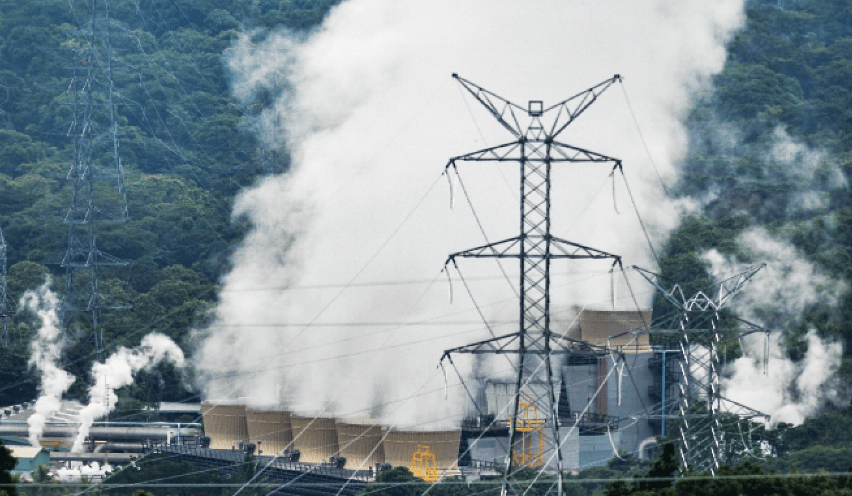

Environmentalists decry bitcoin’s energy consumption, complaining that a single transaction consumes as much energy as a typical household in a developed country uses in a day and a half. They cite the fact that bitcoin’s mining and transactions combined require as much electricity as some countries, with Ukraine or Finland often mentioned as equivalent users.

But China’s moratorium on bitcoin mining has had no lasting impact on the market. And efforts by miners in other countries to convert to cheaper renewable energy have likewise lessened cryptocurrency carbon emissions.

A more personal, more social aspect of the cryptocurrency story emerges, too. A service called Bitbar enables patrons at hundreds of American bars to use bitcoin to buy drinks. When a cocktail’s ready, the bartender calls out the imbiber’s secret alias.

And what better topic of conversation could denizens of a Bitbar establishment choose than the ups, downs and future of cryptocurrency? Coming together in such an establishment nurtures the cryptocurrency subculture.

Members of that in-group could go a step farther and take an interest in art that lives in the same sort of blockchain that supports cryptocurrency. Critics have deemed some unique non-fungible tokens to be masterpieces, and they’ve sold for millions of dollars.

So far, nothing’s kept cryptocurrency from climbing to the pinnacle of human endeavor. Could it even take its place among world religions? A writer for Rolling Stone characterized a cryptocurrency conference in Miami as feeling akin to a fringe religious gathering.

That faith in the goodness of cryptocurrency differs starkly from the fear that criminals and terrorists use cryptocurrency to launder dirty money. But the distrust appears at least partly exaggerated. The percentage of cryptocurrency transactions tied to illicit activity remains small, and it’s declining. It fell from 2.1% of transaction volume in 2019 to 0.34% in 2020.

While cryptocurrency ATMs are popping up around the nation and an increasing number of businesses are beginning to accept cryptocurrency payments, a lot of merchants still decline to honor it.

So, cryptocurrency could accomplish something seldom achieved. It could become nearly all things to all people—and an agent for good, ill or both.