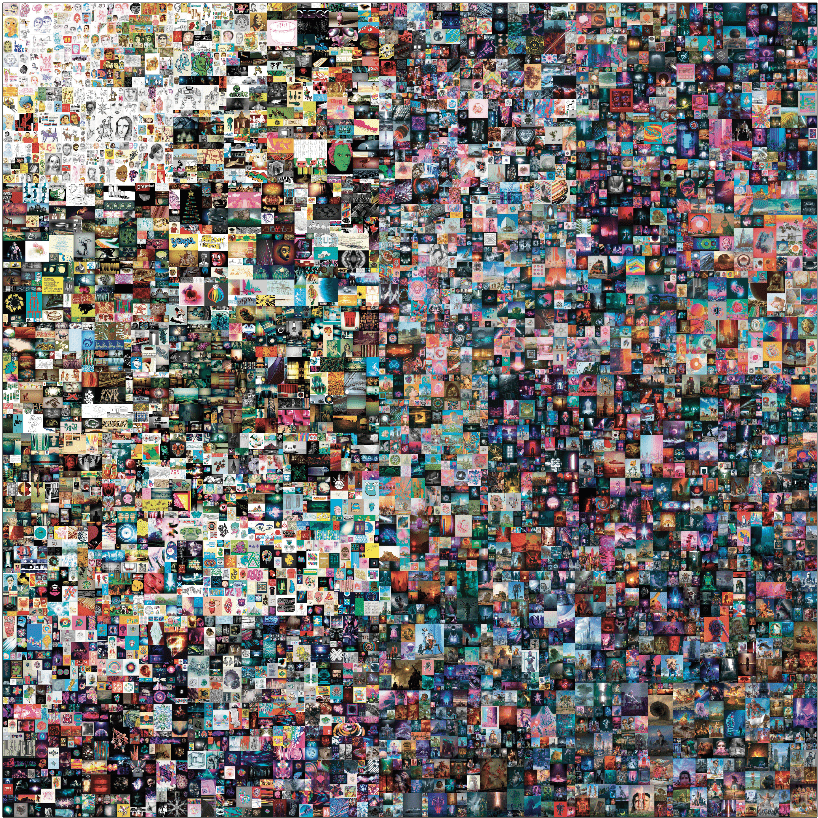

Score Your Piece of a Picasso

Don’t have millions of dollars to invest in artwork? A private investment platform fractionalizes high-value art so nearly everyone can get a piece of the action.

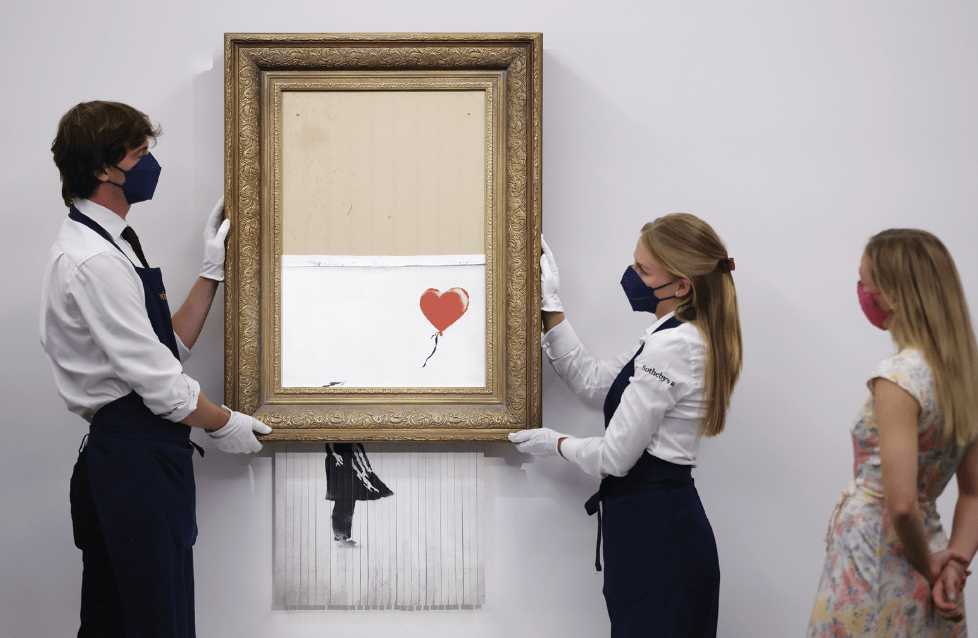

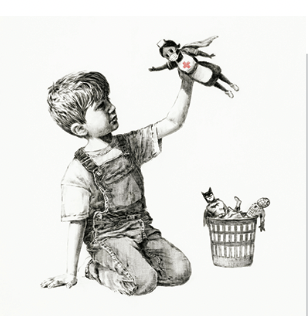

Masterworks flipped Banksy’s Mona Lisa for an annualized return of 32% in about a year. During the same period, the S&P 500 rose 15.6%.

Buying and selling high-end artwork has been a tradition among the world’s wealthiest few, but fractionalization aims to bring the art market to the masses. Masterworks is paving the way for that to happen.

Founded in 2017 by Scott Lynn, an art collector of over 15 years, Masterworks’ mission is to “democratize art investing” by enabling retail investors to participate in blue-chip art deals. For that to be feasible, Masterworks buys artwork outright, sells shares of the works to its users and, after reselling the pieces at a later date, divvies up the profits proportionally to shareholders.

“If you wanted to buy really high quality art, for a very long time you were going to have to spend millions of dollars on just a single painting,” said Allen Sukholitsky, Masterworks’ chief investment officer. “What we’re doing is we’re making art accessible to mainstream investors all over the globe.”

Because “accessible” has different meanings to different people, the Masterworks sales team talks one-on-one with investors who request an invitation to the platform, Sukholitsky told Luckbox. Risk tolerance, time horizons and investment goals are all discussed, after which sales team members help identify asset allocations appropriate for individual investors’ portfolios.

More than a quarter of a million people have already signed up for Masterworks, with shares for some artwork going for as low as $20 a piece. Of course, shares cannot be redeemed for physical portions of paintings—shareholders enjoy all the benefits of buying and selling fine art except the art itself.

But investing in fractionalized art is nonetheless compelling. The contemporary art market’s high appreciation rate and low correlation with other asset classes mean it would add diversification to most portfolios. Art and the S&P 500 Index, for instance, have a long-term correlation coefficient of just 0.12, according to Citi Private Bank calculations.

For context, the closer a correlation coefficient gets to 1.0, the more highly correlated two assets are—meaning it’s more likely their price fluctuations will move in similar ways. The S&P 500’s correlation coefficient with bitcoin, by comparison, was 0.35 as of Jan. 3, nearly three times as correlative as the contemporary art market.

“You want investments in your portfolio that don’t move similarly to each other,” Sukholitsky noted. “If you had a whole bunch of investments and they all moved similarly to each other, why would you own all of them?”

Add to that the appeal of the contemporary art market’s outperformance of the S&P 500 and it becomes hard to write off the asset class. Contemporary art enjoyed an annual appreciation of 13.6% over the same 25-year period that the S&P 500 saw 9.5% annualized returns, according to Masterworks research.

One of the most daunting hurdles to entering the contemporary art market, however, may be a lack of knowledge about contemporary art. That said, would-be investors can rest easy knowing they don’t need to become art aficionados to get involved. Masterworks is highly selective about the pieces it buys and the prices it pays.

“We are one of the only institutions out there that actually went into old auction catalogs and hired a large team of interns to transfer all of the information from all of those old auction catalogs into a computer, digitizing all of it,” Sukholitsky said. “We now have data on the art market that goes back decades.”

The universe of art Masterworks could focus on is staggeringly large, but its decades of auction sales research helps identify what trends have the most staying power in the market. In the hedge fund world, that type of proprietary data is referred to as a “unique identifiable edge,” providing Masterworks and its investors with the advantage of information asymmetry.

The result is a shortlist of artists and paintings that the company uses to make purchasing decisions. In total, Masterworks has 86 offerings amounting to over $300 million at press time.

The platform has a lot of incentive to make money for its users. It collects an annual 1.5% asset management fee regardless, but its 20% commission on profits when a piece of art sells aligns Masterworks’ interests with those of its users, and its track record is telling.

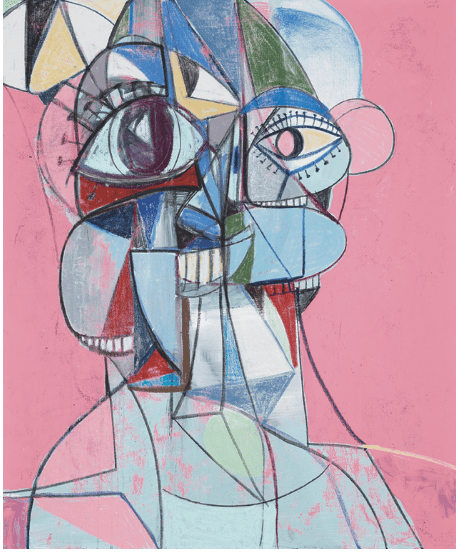

Masterworks has completed two sales so far: Banksy’s Mona Lisa and George Condo’s Staring into Space. Mona Lisa sold for $1.5 million with a net return of 32%, and Staring into Space sold for $2.9 million with a net return of 31.7%.

Although impressive, sales like those can be few and far between. Asked what investors ought to know before signing up with Masterworks, Sukholitsky said expected holding periods can range from roughly three years to 10 years, with the possibility of being longer or shorter.

While investors don’t know when Masterworks will choose to sell a particular piece

of art, the company offers a secondary market where shareholders can sell their positions early—something Sukholitsky emphasized isn’t meant to be the primary reason

for investing.

So, what does the future hold for Masterworks? After raising $110 million in Series A funding last year, the company reached a valuation of over $1 billion. It’s been profitable for quite some time, too, Sukholitsky noted, something that’s rare for a startup. The goal now is shifting toward broadening Masterworks’ distribution channels and offering more art products with more diversity in more places, including financial intermediaries and institutions.

“My vision is that every investor in the world is going to at least consider whether art is worthy of investment—at least consider whether it’s worthy to put in their portfolio,” Sukholitsky said. “Of course, we’re not there yet, but we will be. We most definitely will be.”

Making Banksy

Not much is known about the British street artist who goes by Banksy, but his works were among the most prominent in the art market last year. Around 320 Banksy pieces sold at auction in 2021, more than doubling the pseudonymous graffitist’s 2020 auction count while outselling every other living artist.

Two of his works, Love is in the Bin and Game Changer, fetched last year’s two highest prices for post-2010 paintings when they sold for $25.4 million and $23.2 million, respectively. It’s hard to discount Banksy’s impact on the art world, but one can’t help but wonder: How does an unidentified artist interact with auction houses, and how do prospective buyers know they’re bidding on the real deal?

“Well, his dealer knows who he is,” said Georgina Adam, a journalist and art market expert. “He’s very clever because he has his own authentication.”

That authentication is handled by “Pest Control,” an office that serves as the sole point of contact for Banksy. There, a detailed database of artwork records is used to authenticate Banksy originals and screenprints. Works already authenticated can also be checked against the database to make doubly sure they’re legitimate before a sale.

An online form—and a fee if the art is genuine—are all that stand in the way of authenticating Banksy works, and the process is free if the art in question is deemed fake.

Considerations

— As an asset class, fine art has performed well over time and particularly in recent years, but trends in the art market are unpredictable.

— Fine art investments should be considered generally illiquid longer-

term holdings.

— While fine art has demonstrated a low correlation to U.S. equity markets, fractionalized ownership of a single piece of art does not replicate the portfolio characteristics of art as an asset class. There’s no guarantee that an individual Masterworks offering will be profitable.

— While Masterworks’ 1.5% asset management fee and 20% carried interest fee are similar to hedge funds and higher than more traditional mutual funds, the profit incentive fee aligns Masterworks’ interests with its investors.