Bond Basics

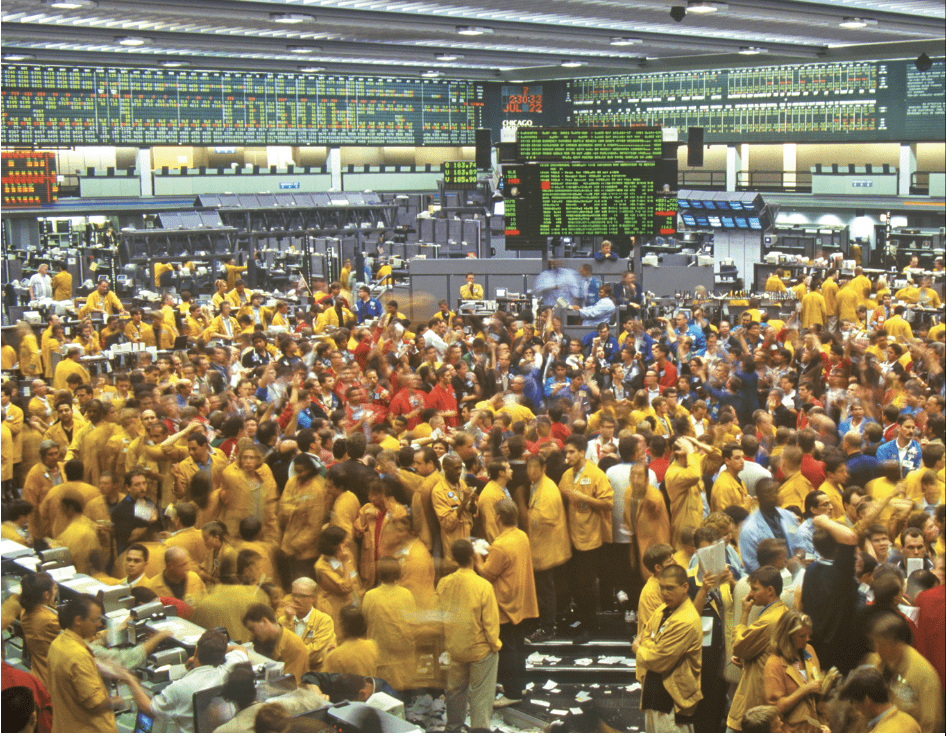

The stock market comes to mind when people think of trading. After all, stocks breed excitement. Equities have been on a tear for most of 2020. Some potential investors find bonds mysterious, but it all comes down to lending. Companies and governments require funding as well, and they often meet their need for capital by issuing bonds that investors can buy. The buyers, in effect, loan money to the bond issuer.

The issuer of a bond must pay the investor something extra for the privilege of using their money. This “extra” comes in the form of interest payments, which are made at a predetermined rate and schedule. The date on which the issuer must repay is called the maturity date. Bonds are known as fixed-income securities because buyers know the exact amount of cash they will get back, provided they hold the security until maturity.

Bond price confusion

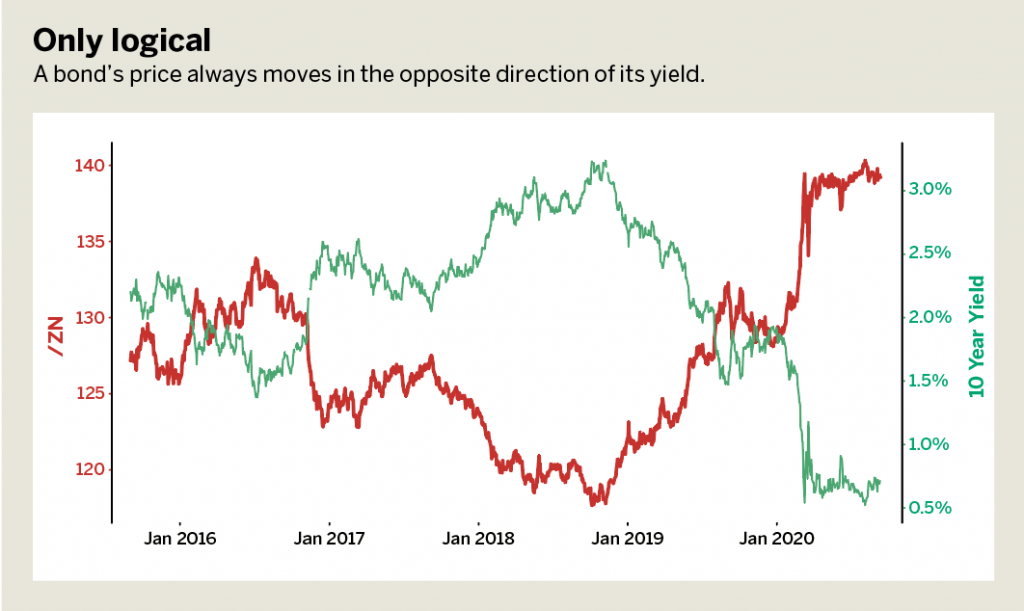

Bond pricing involves many factors, and the way bonds are traded makes determining the price even harder. Because stocks are traded in dollars and cents, profit and loss are straightforward. Trading bond futures in 32nds or 64ths of a point adds to the confusion of trying to understand the world of yield traded in terms of bond price. Yield is the anticipated return on an investment, expressed as an annual percentage. For example, a 6% yield means that the investment averages 6% return each year. Investors can calculate yield in several different ways, but with each method the relationship between price and yield remains constant: The higher the price of a bond, the lower the yield, and vice versa.

Here’s the simplest way to calculate yield:

For example, if a trader pays $20,000 for a bond paying $1,200 each year, its current yield is 6%. To understand bonds in relation to Treasury futures prices and yields, be aware of the following challenges.

Challenge No. 1

What is DV01 and why should anyone care?

DV01 is the dollar value change in price (value) of a fixed income instrument, such as a bond, in response to a change of one basis point in the yield of the instrument. A basis point is one hundredth of 1% (1% of 1%). The yield referred to above is the yield-to-maturity, the interest rate at which the present value of cash receipts (coupon and principal payments) equals the current price, assuming the investor holds the instrument to maturity. DV01 measures the sensitivity of the value of a bond in response to changes in the interest rate.

DV01 never remains constant for any bond. It differs depending upon the level of interest rates.

Challenge No. 2

Measuring bond risk: What is duration?

The inverse relationship between price and yield is crucial to understanding value in bonds. Another key is knowing how much a bond’s price will move when interest rates change.

To estimate how sensitive a bond’s price is to interest rate movements, the bond market uses a measure known as duration.

Duration, like the maturity of the bond, is expressed in years, but as the illustration shows, it’s typically less than the maturity. Duration will be affected by the size of the regular coupon payments and the bond’s face value. Thus, it is always changing.

The link between price and yield

When price goes up, yield goes down, and vice versa. Technically, the bond’s price and its yield are inversely related.

Trading bonds or bond futures comes with a great deal of baggage. If traders live in the world of yield, why wouldn’t they bypass the lingo and confusion. Instead, they could trade what they know.

A yield-based treasury future may be the answer for anyone looking to make trading interest rates straightforward, taking ideas to execution without the confusion.

Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the flagship programming slot called Splash Into Futures.