Buns Up?

A veteran futures trader’s take on the markets

On Fridays, the Ceres Cafe at the Chicago Board of Trade squeezes about five inches of fish between two slim hamburger buns. The fish gets a lot of attention, but nobody cares too much about buns.

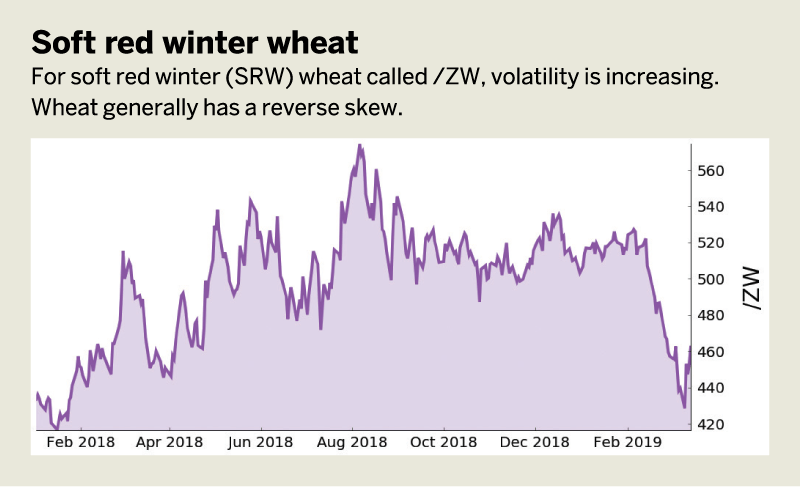

The wheat that’s used to make the buns doesn’t command much respect, either. Wheat futures fell on March 11 to log their lowest finish since January 2018. The most-active May futures contract had been heavily sold for several weeks.

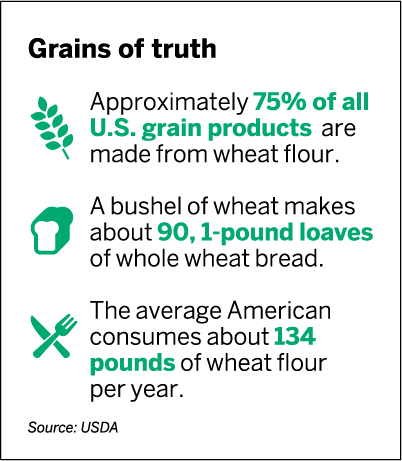

Slow export concerns were confirmed on the U.S. Department of Agriculture’s World Agriculture Supply and Demand Estimates report issued Friday, March 8. The report also showed slowing domestic use as well. Ceres must be onto something.

Competition From Abroad

Prices are under attack due to foreign competition, which is hurting U.S. farmers’ ability to sell grain abroad. Normally, a third of American wheat is sold to foreign buyers, but exports have been slow this year, bottling up grain.

The biggest competition comes from Russia, Ukraine and other former Soviet Union nations; whose wheat has been consistently cheaper than U.S. wheat, forcing American farmers to sell at increasingly lower prices.

Flooding along the Mississippi River, a waterway that plays a crucial role in the shipment of corn, soybeans and wheat from the Midwest to ports along the Gulf of Mexico, has disrupted barge traffic and could heighten volatility in agricultural markets.

Reverse Skew

Seasonally, a pick-up in wheat volatility begins as the crop emerges from the ground. Wheat usually has a “reverse skew” where equidistant calls are more expensive than puts. At depressed prices, the skew becomes nearly flat, with calls trading relatively cheaply and puts trading relatively rich.

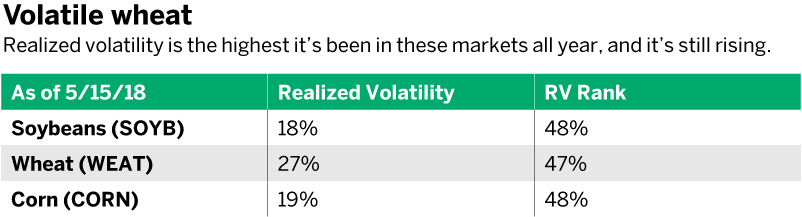

With wheat down 26% from its highs last year, a contrarian play (a long bias) may be interesting. Realized volatility is the highest it’s been in these markets all year, and it’s still rising. For the next 60 to 90 days, wheat may provide higher volatility and expanded ranges to trade.

Plus, agricultural markets have almost no correlation with the equities markets, making trades in wheat a potentially complimentary uncorrelated trade to a core portfolio. With / ZW option skew the way it is and a higher volatility overall, a bullish wheat trade could be a short out-of-the-money put in the June expiration. In the meantime, it’s almost Friday… Where’s my fish sammich?

Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the main flagship programming slot called Splash Into Futures.