The Diversification Myth

Buying a wider variety of stocks won’t decrease risk much if their prices are closely correlated

Investors often believe having more positions decreases risk. The truth is a bit more gray.

While adding positions does “spread the burden” among more stocks, it may not actually create diversification relative to the overall market.

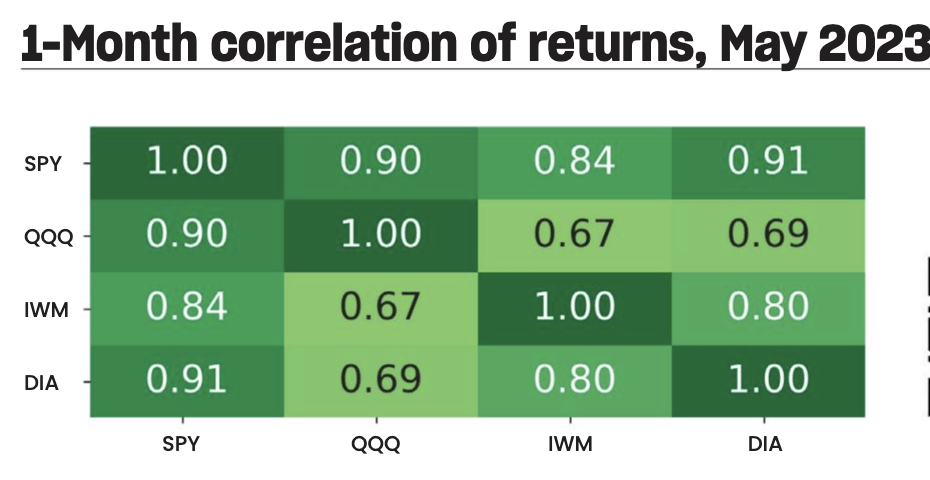

Take, for example, a portfolio of four strangles in the S&P 500 (SPY), the Nasdaq 100 (QQQ), Russell 2000 (IWM) and the Dow Jones (DIA), each with a 70% probability of profit.

The probability of all four losing money is about 30%. That’s because these indices are highly correlated because they represent different segments of the overall stock market.

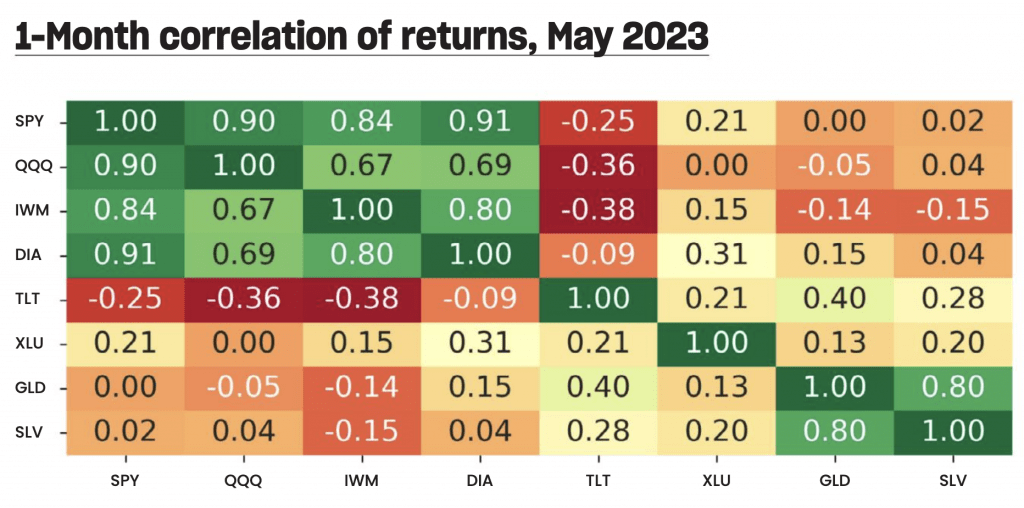

In an ideal scenario, investors want trades that aren’t heavily correlated (not dark shades of green or red in the correlation matrix). But it’s also crucial to remember correlations can and do change.

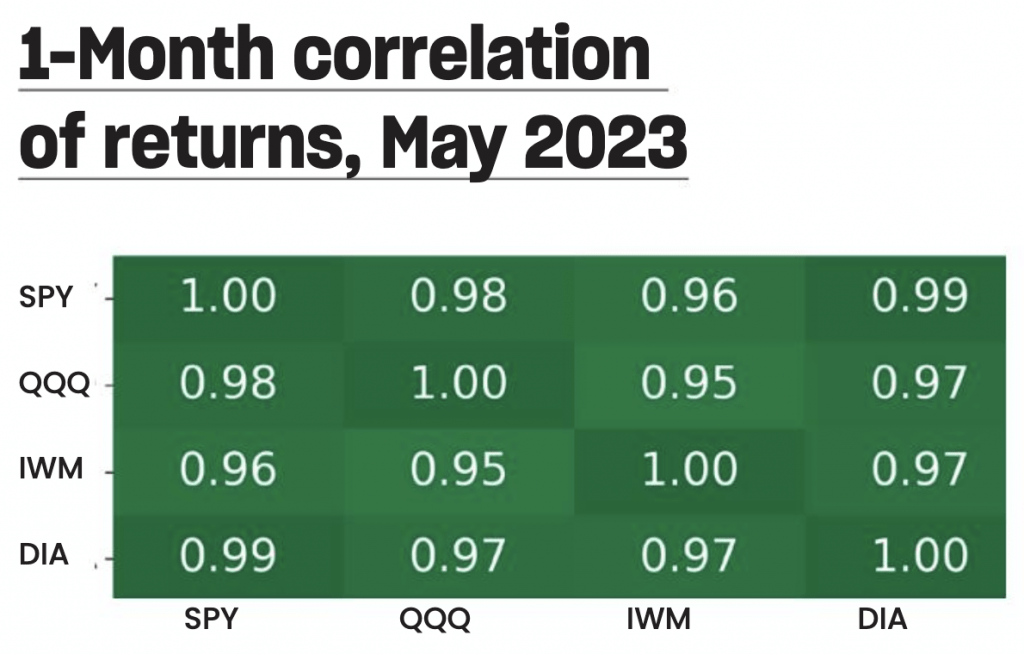

During times of market turmoil, for instance, we can see increased correlations among products. As the saying goes, “When the sh*t hits the fan, all correlations go to one.”

Look at the market in April 2020 during the COVID-19 chaos. The correlations were almost perfect.

In a “perfectly” diversified market—one with perfect independence—the probability of a loss would be 30% x 30% x 30% x 30%, or a mere 0.81%. The problem is finding markets perfectly independent of each other.

Right now, a few exchange-traded funds seem to provide a portfolio with consistent and relatively high level of diversification because they have low levels of correlation. These are the Utilities (XLU), Silver (SLV), Gold (GLD) and Bonds (TLT).

Another way to diversify is by using a variety of options strategies, such as strangles, verticals, jade lizards, calendars, diagonals, and short put and call options.

Choosing options with differing expiration months can also enhance diversification. Instead of selecting options with the same expiration, opting for varying expirations across different months may be advantageous.

Michael Rechenthin, Ph.D. (aka “Dr. Data”), is head of research & development at tastylive.

@mrechenthin