Crypto & Cannabis Contrarians

The repeated highs of recent years don’t guarantee stock prices will never again dip, crash or go sideways

Some investors prefer to buy a stock or option that’s up 100%, while others grab up a security that’s down on the year. It’s the classic debate between following the trend or taking the contrarian view, and it’s playing out in two of this decade’s most novel markets: cannabis and crypto.

Both bitcoin and MJ, a pot stock exchange-traded fund, rose 100% early this year only to fall back to unchanged; the former has eclipsed those elevated levels in recent trades, while the latter is sitting near its lows.

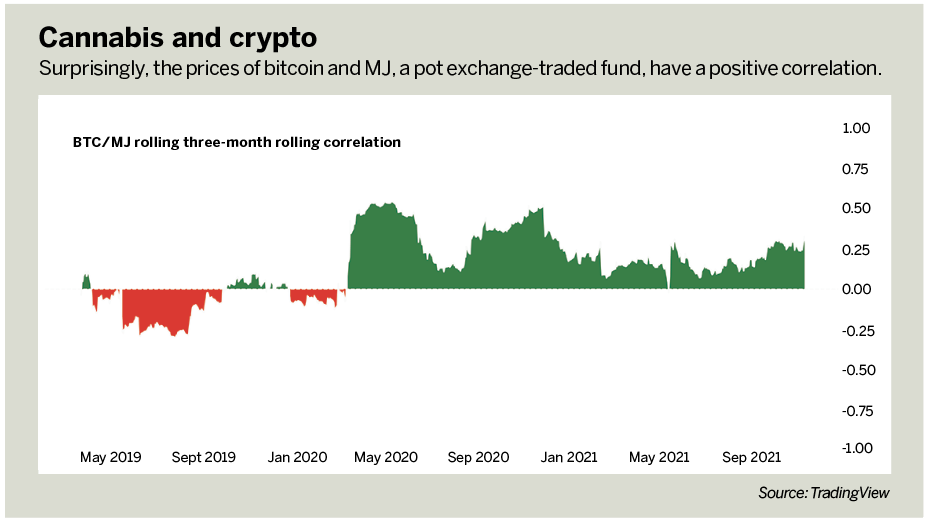

Though the two surprisingly have a positive correlation, it might not be prudent for contrarians to play convergence between cannabis and cryptocurrencies or for trend followers to play further divergence.

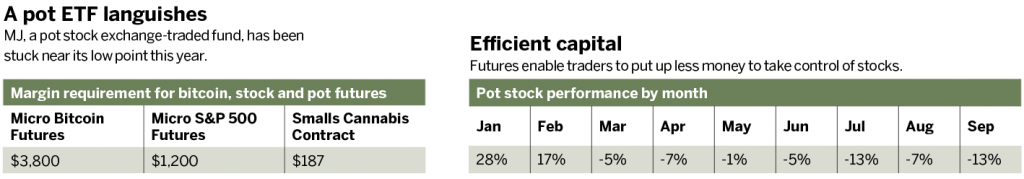

Focusing on cannabis as a standalone opportunity could show potential for both sides as a simple price extreme play. The do-or-die moment for pot stocks might pose an asymmetric return relative to risk, given that they haven’t posted a positive month in the last seven and many single names are under $10.

Micro futures vs. small futures

What’s better than buying a market (potentially) on the cheap? Doing so with the capital efficiency of futures. Small cannabis futures not only share a +0.9 correlation to MJ shares but also require capital equal to only 20% of the product’s size.Inventorying this out-of-fashion stock sector while waiting for it to reach in-vogue status once again can be much less costly than doing the same thing with hot crypto or tech stock markets. Every so often, trend followers and contrarians can set aside their rivalry and get on the same side of a major market extreme. Who knew pot could promote peace?

For less than $200, a trader can control nearly $900 in pot stocks. Even if being right on the cannabis resurgence requires time and patience, the Smalls futures product makes holding out a relatively affordable endeavor.

Think pot stocks have further to fall? That’s the beauty of the Smalls futures product—contrarians and trend followers alike have access to the same manageable, capital-efficient markets. This allows traders to express their outlook on the future of the pot sector, regardless of their bias.

Pete Mulmat, tastytrade chief futures strategist, hosts Splash Into Futures on the tastytrade network.

@traderpetem