Currencies’ Future

Most traders don’t pay much attention to foreign currencies or their value relative to the dollar. But everything that’s traded has a dollar component. Whether it’s gold, crude or soybeans, traders buy and sell them priced in dollars. That’s why rises and falls in the value of the dollar can have a direct impact on the performance of the products we trade every day.

The dollar has played a major role, not just in foreign currency markets, but also in stock market performance. Investors have a number of ways to trade the dollar. Using specific currency pairs, such as euro or yen, offers partial diversification.

But for a better tool, look to a basket of currencies that affords a more holistic way to gain or manage currency exposure. Adding currencies to a portfolio has become much more popular in recent years.

One way to do so is with a dollar index product like the Invesco DB U.S. Dollar Index Bullish Fund (UUP) or the U.S. Dollar Index (DXY). UUP is an exchange-traded fund (ETF) and DXY is the futures equivalent, both constructed in the same fashion.

To gain a better understanding of how the index works and what role it plays in a portfolio, take a look at what it can and cannot do.

Defining the U.S. Dollar Index

The U.S. Dollar Index measures the value of the U.S. dollar in relation to the value of a basket of some of America’s most important trading partners. The index comprises six foreign currencies.

Because these regions aren’t all the same size—the euro, for example, is used in 23 countries—the USD Index assigns varying weight to each currency. The biggest proportion of the Dollar Index (USDX) is made up of the euro, which has a 57.6% weight.

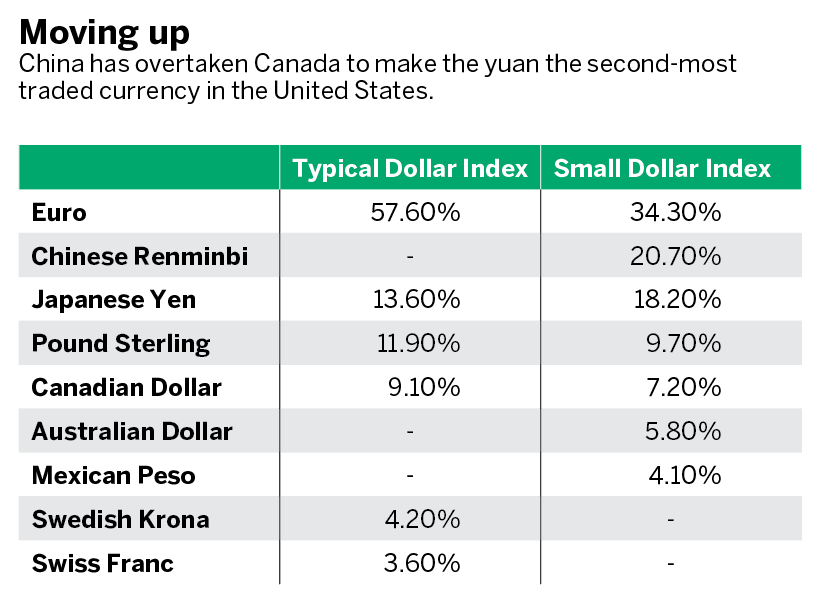

The currencies are weighted in the following ways:

- The euro

(EUR), 57.6%

2. The Japanese yen

(JPY), 13.6%

3. The British pound

(GBP), 11.9%

4. The Canadian dollar

(CAD), 9.1%

5. The Swedish krona

(SEK), 4.2%

6. The Swiss franc

(CHF), 3.6%

Because it’s an index, the USD index functions much like the S&P 500 or NASDAQ 100, but instead of indicating the health of the equities market, it shows the relative strength of the U.S. dollar.

As many traders have discovered recently, foreign currency markets can affect the results of U.S. multinational corporations. When the dollar is strong, the foreign-currency revenue that a company gets from its overseas operations translates into fewer dollars, hampering growth in sales and profits.

Moreover, for companies whose costs are mainly in dollars, a strong U.S. currency can make them less competitive against foreign rivals that have costs denominated in cheaper currencies.

As an example, sales at Philip Morris International (PM) come mostly from outside the United States, with exposure to dozens of international currencies. A strong dollar has hurt its results lately, and the tobacco giant believes that weak foreign currency performance could cost it as much as $1.15 per share in earnings this year.

Alternatives to the weighted U.S. Dollar Index

Because of its concentration in the euro, the traditional U.S. Dollar Index has started to lose its appeal as an investable index. In the past, the ability to combine exposure to the German mark, the French franc, the Italian lira and other key European currencies hedged much of a company’s or trader’s risk of forex exposure and Dollar Index moves.

The need for a relevant index

The Chinese renminbi already ranks among the world’s five most-used currencies. The International Monetary Fund recently announced it will add the renminbi to the basket of reserve currencies in the IMF’s Special Drawing Rights, known as SDRs. The renminbi is part of the SDRs because of China’s importance in the global economy and its position as the world’s largest trading nation, IMF officials said.

Based on the currency weights used by the Federal Reserve in its trade-weighted Dollar Index, China has overtaken Canada to make the renminbi the second-most traded currency by the United States, just after the euro. (See “Moving up,” below.)

A new dollar index

With China’s influence in global markets and its growing relevance in the forex world, wouldn’t a basket of currencies that included the renminbi be a more useful and relevant tool for traders in today’s markets?

A new futures exchange, the Small Exchange, has created the Small Dollar Index. It is a combination

of the euro, renminbi, yen, pound, Canadian dollar, Australian dollar, Mexican peso and the Korean won.

Weights are determined according to each country’s gross domestic product and dollar-denominated trade volume. Taking into account the size of a nation’s economy, and not just trade volume, provides a more relevant dollar index for today’s markets. This index creates a more global view of currency pairs weighted against the U.S. dollar.

More than ever, traders need products that offer exposure to the most relevant part of any asset class.

Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the flagship programming slot called Splash Into Futures.