Diversifying with Futures: Lowering Portfolio Volatility

Futures are attractive because they allow investors and traders access to robust diversification—especially as it relates to the underlying correlation between different futures markets.

Investors and traders looking to try out new products in 2023 may want to consider futures.

Futures are attractive because they allow investors and traders access to robust diversification —especially as it relates to the underlying correlation between different futures markets.

For example, when trading stocks—especially stock indices—there’s often a high degree of correlation. That’s because many of the same stocks are included in the same indices, as highlighted below:

- 80% of the Nasdaq is in the S&P 500

- 100% of the Dow Jones is in the S&P 500

As a result of the above, equity indices often move in the same direction, to the same degree—the definition of a strong positive correlation. As illustrated in the graphic below, positive correlations in index and sector ETFs are currently averaging roughly +0.80.

Market participants can circumvent high correlations by trading individual stocks (aka single stocks), some of which are not as highly correlated to their counterparts.

However, that approach opens market participants to stock-specific risk, or “unsystematic risk.” Depending on one’s unique trading approach and risk profile, that may or may not be acceptable.

Alternatively, investors and traders can seek diversification (i.e. lower correlations) using the futures market.

Some of the best-known futures markets include crude oil (/CL), natural gas (/NG), gold (/GC), government bonds (/ZB), foreign currencies (/6E), agricultural commodities (/ZS) and cryptocurrencies (/BTC). Exposure to equity indices is also offered in the futures market, such as the S&P 500 (/ES).

Market data shows that futures markets are far less correlated to each other—especially as compared to the aforementioned correlations between equity index and sector ETFs.

The average 3-month correlation between some of the best-known futures markets is currently +0.38, as highlighted below.

As a reminder, market correlations are typically expressed as a number between negative 1 and positive 1.

When two underlyings are positively correlated—meaning they move in the same direction—the correlation will range between somewhere 0 and 1. When two securities are negatively correlated—meaning they move in opposite directions—the correlation will range between -1 and 0.

For example, 0.15 might be considered a weak positive correlation,” whereas 0.80 might be considered a strong positive correlation. On the other hand, -0.20 might be considered a weak negative correlation, while -0.90 might be referred to as a strong negative correlation.

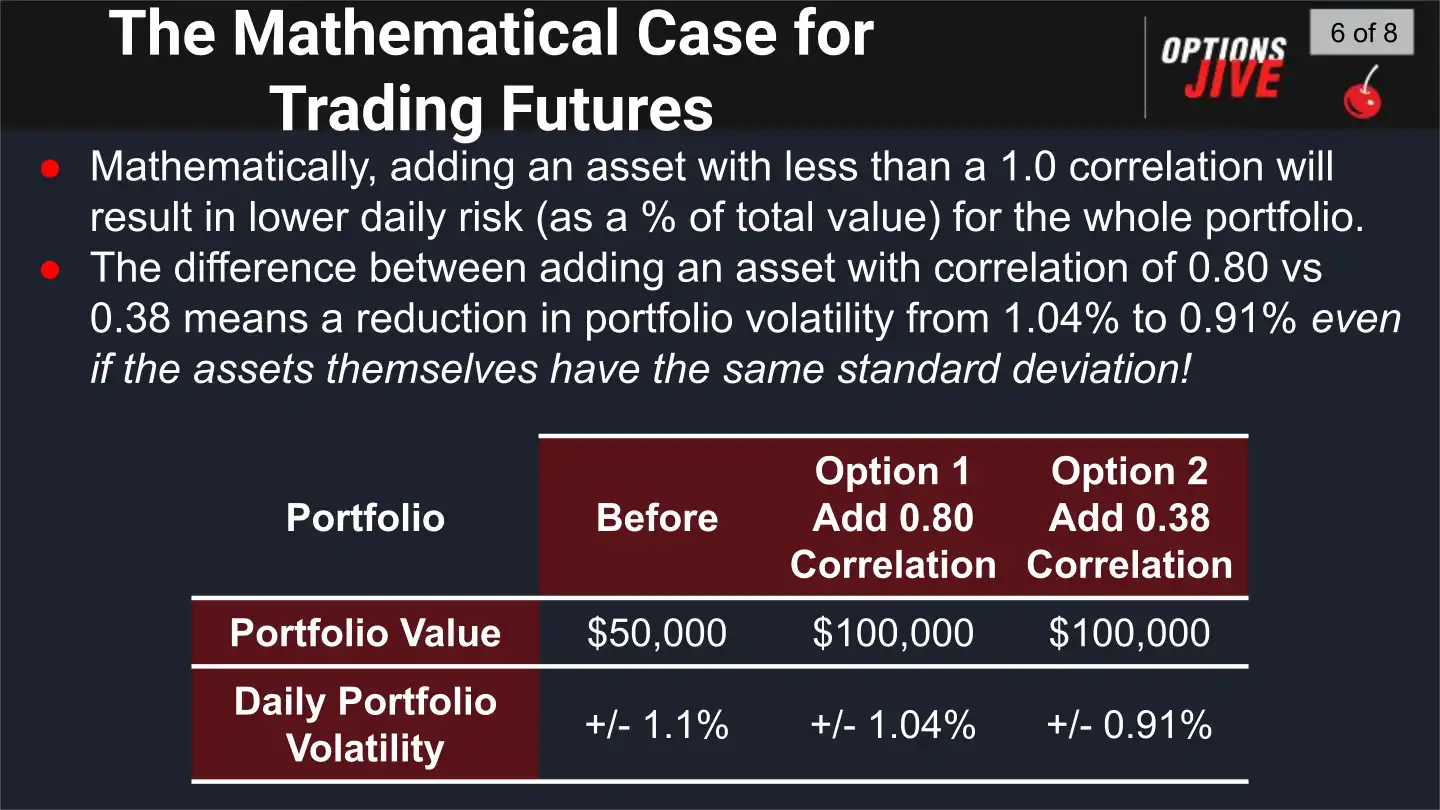

According to research conducted by tastylive, investors and traders can reduce risk in their portfolios by trading underlyings with lower correlations. For example, by trading one of the aforementioned futures markets, as opposed to another highly correlated equities-focused security.

The graphic below highlights how portfolio risk changes when adding non-correlated underlyings to the portfolio, as compared to adding additional underlyings with a high degree of correlation.

The above illustrates how the average daily volatility of the overall portfolio changes when adding highly correlated—or non-correlated—underlyings to the portfolio.

As one can see in the graphic, when adding underlyings that are less correlated, daily portfolio volatility declines. This is known as diversifying across asset classes.

Of course, portfolio volatility will also be impacted by the individual volatility of each unique underlying.

Adding highly volatile underlyings to the portfolio—even if they are not highly correlated to the existing assets in the portfolio—can also result in higher daily volatility for the portfolio as a whole. For example, by trading high-beta stocks, as opposed to low-beta stocks.

To learn more about reducing portfolio risk by diversifying with futures, readers can check out this new installment of Options Jive on the tastylive financial network. More context on portfolio diversification is also available via this episode of Splash Into Futures.

To follow everything moving the markets, tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.