ETFs Move Over: Smaller Futures are Here

That’s the greatest financial innovation of the last 20 years? Weekly options? Digital currencies? Zero commissions? It may come as a shock that many consider exchange-traded funds (ETFs) the biggest and most important change.

After trading ETFs for so long, it’s easy to forget how capital markets used to look—illiquid and expensive. But it’s important to remember that at one point, mutual funds were a cutting-edge financial innovation.

Mutual funds transformed investing by seamlessly diversifying portfolios for individual investors. By pooling assets, mutual funds provide exposure to several markets for a lower cost than building a diverse portfolio from scratch.

Instead of constructing a $2,500 portfolio with just a few stocks, an investor can buy a mutual fund for the same price and gain exposure to 50 or 100 stocks, thus immediately diversifying.

The drawback with mutual funds is latent pricing. Unlike a stock that changes price on a per-trade basis, a mutual fund updates its price only once per day, making active risk management nearly impossible.

The ETF solved that problem with prices that update in real time, making it possible for individual investors to buy, sell and manage their positions throughout the trading day without sacrificing diversification.

Because more than 7,000 ETFs are listed globally—covering everything from volatility to vegan-friendly companies—there’s a product for every investor. However, only a handful of these funds are liquid enough to support active trading, and the unrelenting stock market rally of the last decade has made buying many of them prohibitively expensive.

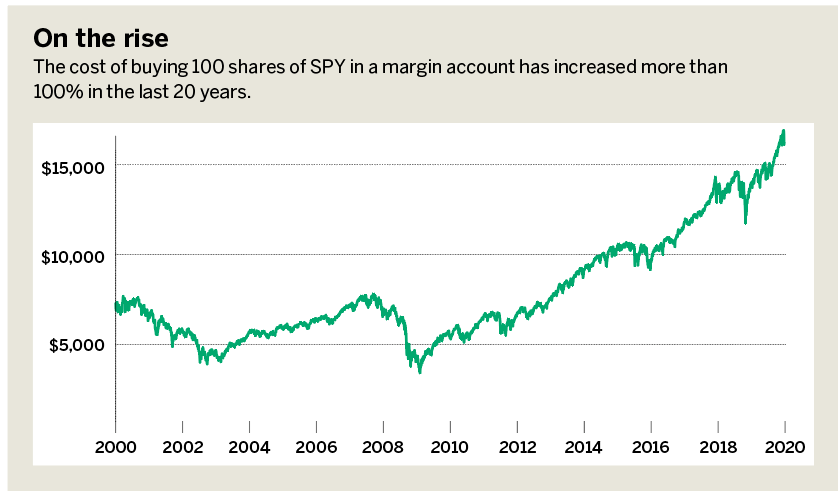

So, there’s a new market issue to solve. Every day, companies are hitting record high prices and refusing to split their stock, which makes market access more expensive than ever before. For example, the top 10 companies in the S&P 500 are all priced over $100, and the average price of all constituents is above $130. Twenty years ago, the average price was only $40.

Meanwhile, data from the New York Stock Exchange reveals that the number of odd-lots—trades of fewer than 100 shares—has reached the highest level ever recorded. Investors can simply no longer afford to buy stock.

While fractional shares may make stocks more accessible, they don’t bypass the Regulation T margin requirements that mandate a 50% deposit of the asset’s value, so gaining exposure is still expensive.

Commodity futures invented decades ago provide an abundance of benefits to investors. They carry more value per dollar than stocks, mutual funds or ETFs, and they offer fantastic diversification. That’s why futures contracts will provide the next iteration of product innovation.

While mutual funds enable individual investors to stretch their $2,500 into a portfolio of multiple stocks, and ETFs provide access to all-day pricing, futures contracts afford pure exposure for a fraction of the cost.

If an ETF provides $100 of exposure for $50, futures can make that exposure possible for $5. That reduction in capital outlay frees investors to build a holistic portfolio of stocks, bonds, oil, gold and foreign exchange for less than the cost of a mutual fund or ETF.

Now, the Small Exchange (smallexchange.com), a new futures exchange, is offering smaller futures contracts appropriate for investors of all sizes for risk management, short-term speculation and long-term investment. The Smalls conform to a common set of contract specifications and tick just like a stock or ETF, without the high cost.