Down with the Dow

Investors who still track and favor the Dow can trade the value of the index

Headline writers love describing the daily movement of the Dow Jones Industrial Average in melodramatic terms. Classics like “Dow surges 600 Points” and “Dow tumbles more than 1,000” dominate newspaper financial pages, scroll across the screen on cable news or arrive as a push notification from a financial outlet.

The higher the Dow has rallied over the past decades, the more sensational the numbers naturally became. The 1,000-point quote has only been a recent phenomenon because the Dow fell more than that for the first time in February 2018, dropping 1,175 points or 4.6%.

The largest point drop in the recession of 2008 was only 777.68, though that was a drop of 7% on Sept. 29 of that year. Two weeks later, the index dropped 7.87% but at lower price levels that was a decline of only 733 points.

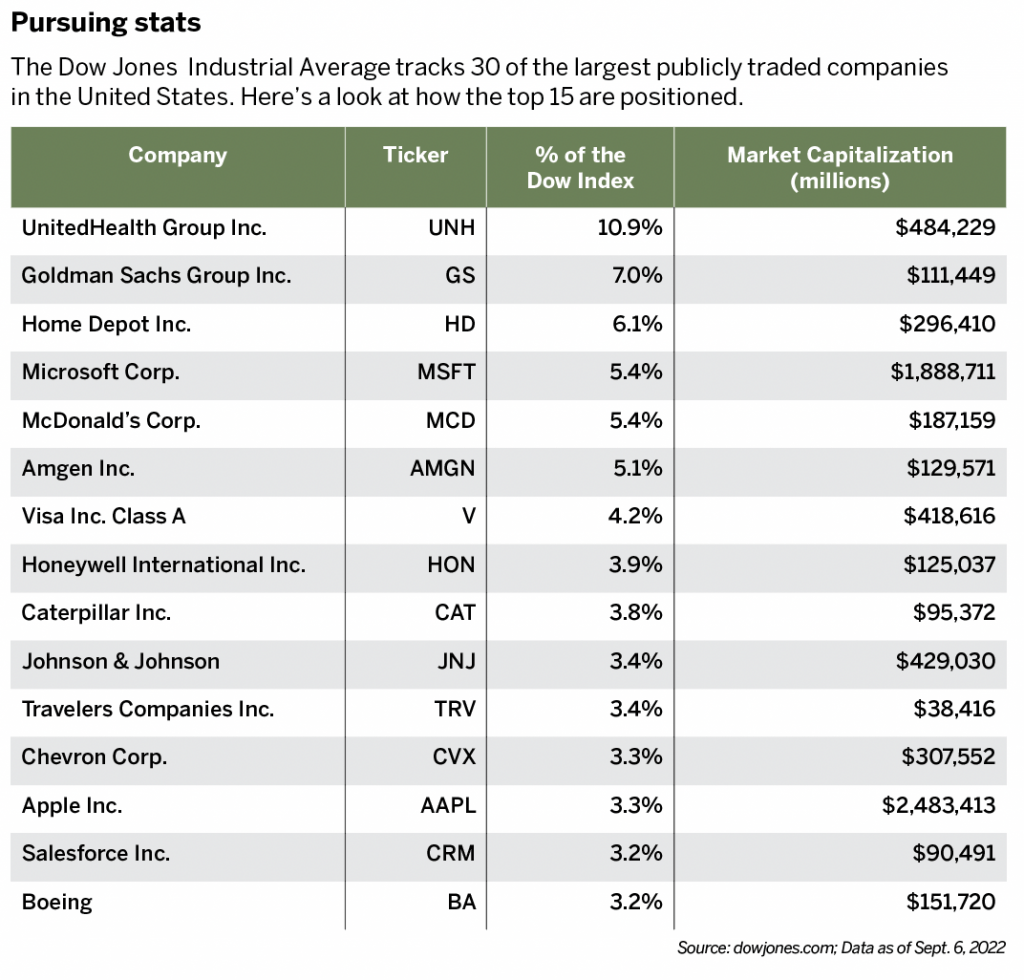

But let’s take a step back from the sensationalism: What even is the Dow Jones Industrial Average? It’s a stock market index that tracks 30 of the largest publicly traded companies in the United States.

The Dow is a price-weighted index, meaning the impact of each stock on the overall value of the index is based on each stock’s price. Unlike newer indices like the S&P 500 or Nasdaq-100, which are capitalization-weighted, smaller companies have a larger weighting in the Dow, simply because they have a higher-priced stock.

Combined with following only the 30 stocks, this means that the highest-priced stocks can represent 5%-10% of the index. As it currently stands, UnitedHealth Group (UNH) is the top stock in the index, priced at over $500 per share (See “Pursuing stats,” below).

UnitedHealth is by no stretch of the imagination a small company. With a market capitalization—meaning its total value—of $484 billion, it would be worthy of a top spot in most indices. Plus, it’s the eighth largest company in the S&P 500.

However, because of the price-weighting of the Dow, the two largest S&P components Apple (AAPL) at $2.4 trillion and Microsoft (MSFT) at $1.8 trillion are relegated to the 13th and fourth spots in the Dow.

Luckily, for those who still track and (for whatever reason) favor the Dow, there are ways to trade the value of the index, placing a directional assumption as to whether the 30 stocks rise or fall.

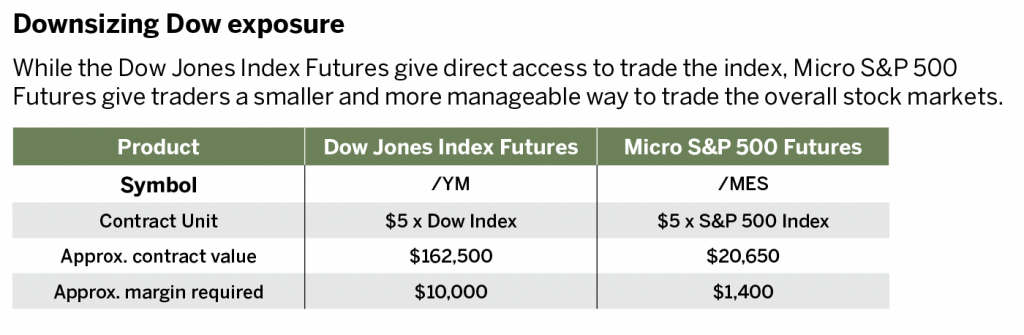

Enter the CME Dow Jones Index Futures (/YM). Buying or selling Dow futures enables active investors to post a fraction of the contract’s total value to open the trade.

Trading futures gives investors access to the overnight market, participating in news-driven swings that never happen during the stock market’s open session.

For example, during the 2016 election, the Dow futures closed their session at 4 p.m. Central time on Nov. 8 at 18,287. After the futures reopened at 5 p.m., the Dow contracts rallied up to 18,394 before dropping to 17,418 by 11 p.m.

By the time the stock market opened the next day at 8:30 a.m., the Dow futures had climbed all the way back to 18,121. Active investors only trading in the open market session completely missed any opportunity to trade the overnight, event-driven action.

However, the Dow futures are valued at $5 x index price. That means if the Dow is 30,000, the total contract value is $150,000. If the index moves 1,000 points, the profit or loss on one future is $5,000. The current margin to open a trade in the futures is approximately $10,000, which is likely too much for most investors to commit to a single position.

Those looking for a broad market futures product to trade events, such as elections, may be better-served looking to the CME Micro S&P 500 futures (/MES).

The Micro S&P futures, like the Dow futures, are worth $5 per index point. But the S&P 500 is a much lower numerical index value than the Dow Jones. With the S&P 500 trading at 4,000, the total value of each contract is $20,000.

Active investors can open a long or short position in the Micro futures for $1,400 per contract. That makes them far more accessible to a wider range of investors. At the index price of 4,000, a 1% move in the index of 40 points would be a $200 profit or loss on one /MES contract.

While the Dow is an interesting and historical barometer of the overall U.S. stock market, it may be time to relegate it to the history books, favoring capitalization-weighted indices like the S&P 500.

This is especially true with active investors considering a move into futures trading and looking for smaller, efficient trading products they can use to express market opinions, especially around elections where much of the action will go down while Wall Street sleeps.

Pete Mulmat, tastytrade chief futures strategist, serves as host for Splash Into Futures on the tastytrade network. @traderpetem