Pairs Trading Futures

Futures traders have numerous products, tools and strategies to take advantage of price extremes and ranging markets, but pairs trading is something completely different. Pairs trading uses correlations and divergences between two markets to capture a potential profit. While it isn’t riskless, investors who understand how pairs trading works and know how to control risk and manage profits often find the strategy makes a great addition to a trading “toolbox” because it doesn’t depend on market direction.

In a pairs trade, traders identify two tradeable products (markets) that correlate in price. That means they have reason to believe that when one market goes up, the other will go down. To profit from that pair, traders open a long position on the market that they believe will go up and a short position on the market they suspect will go down. Typically, the long market is underperforming at the time the position is opened, and the short product position will be overperforming.

Pairs trading operates on the assumption of market neutrality. Essentially, this means that two markets that historically have moved in the same direction will continue to do so.

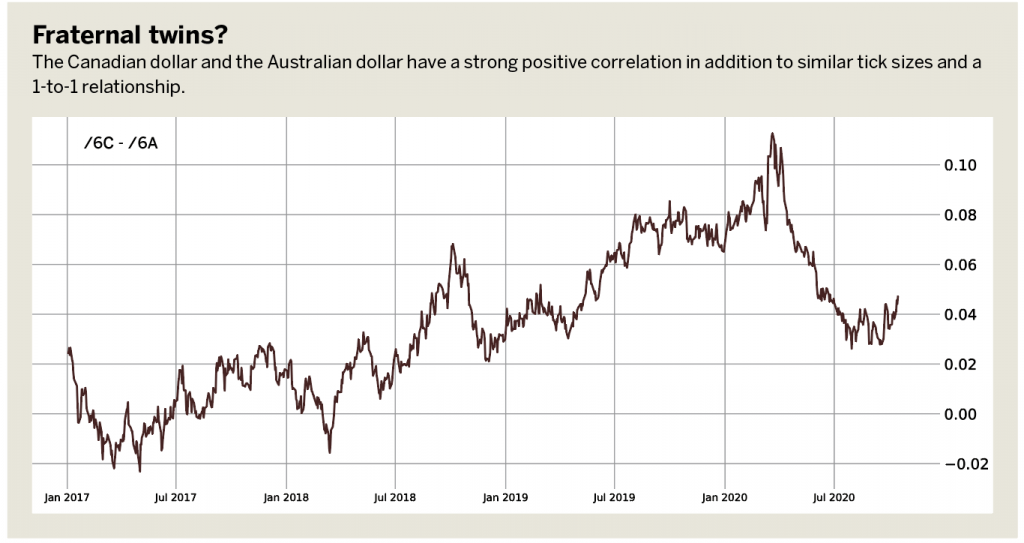

As an example, consider the relationship between two major currency trading markets: the Canadian dollar and the Australian dollar. Canadian and Aussie currency have a strong correlation, equivalent tick sizes in the futures world and a pair with a straightforward 1-to-1 relationship.

Pairs traders look for highly correlated markets—such as equity indexes, precious metals or, as in the example, the foreign exchange market—that begin to diverge in their price movements. Correlations at or above .75 make for the most interesting pairs trades.

Finding correlation

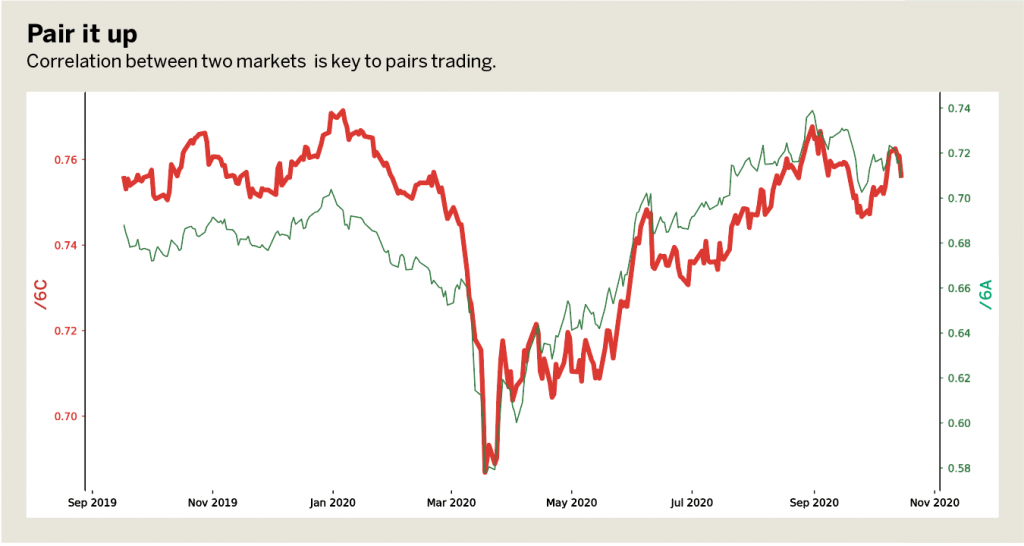

Correlation between two markets is key to pairs trading. Pairs are perfectly correlated (a correlation coefficient of 1.0) when they move exactly in sync. They are perfectly inversely correlated (a correlation coefficient of -1.0) when they move exactly in sync but in opposite directions. When two products have no correlation whatsoever, they have a correlation coefficient of 0. Since pairs traders are searching for markets that are correlated as closely as possible in the same direction, many traders use a correlation coefficient of 0.8 as a cutoff value.

These divergences can take place over a period of a few minutes intra-day, or over weeks or months in the longer term.

Under the assumption of market neutrality, pairs traders expect that the underperforming market (in this case the Canadian dollar) will eventually return to neutral performance, which means a price increase. Meanwhile, the same assumption for the overperforming pair (in this case the Aussie dollar) indicates a price decrease should occur.

Mitigating risk?

A major advantage of pairs trading is that if the assumption of market reversion is violated slightly, the positions can still be profitable. In an ideal scenario, traders will see the underperforming currency—which they are long—increase in price, while the overperforming currency—which they are short—decreases in price.

The trader would close out the positions when the historical correlated relationship between the two markets has reverted.

But traders can still profit even if only one currency moves. In the scenario in the example, even if the overperforming currency does not fall, as long as the price of the underperforming currency rises more than the price of the overperforming currency rises, the long position overtakes the short position to yield a net profit.

The last word

Pairs trading involves taking a long and short trade simultaneously in two typically highly correlated markets. A long position is taken when one product underperforms by a certain threshold, and a short trade is taken in the outperformer, with the intent that the markets will eventually revert to the historical norm, thus resulting in a profit. There is no certainty of pairs reversions to the norm, so traders must weigh which trades are worth the potential wait and risk and which are not.

Pete Mulmat, chief futures strategist at tastytrade, hosts a number of daily futures segments on the tastytrade network under the flagship programming slot called Splash Into Futures. @traderpetem