The Low Bar to Trading High-Action Currencies

Think of foreign exchange, or FX, as the “cult classic” of asset classes. Compared with investors in mainstream markets—like stocks and commodities—FX traders are fewer in number but certainly more passionate. Whether volatility runs high or low, foreign exchange trading groups buzz with talk of currency crosses and interest rate comparisons.

But traders don’t need to jump in head first to reap the benefits of an active market that offers a unique opportunity relative to equities. Plenty of people enjoy the Grateful Dead without feeling the need to abandon their lives to follow Bob Weir and John Mayer around the country.

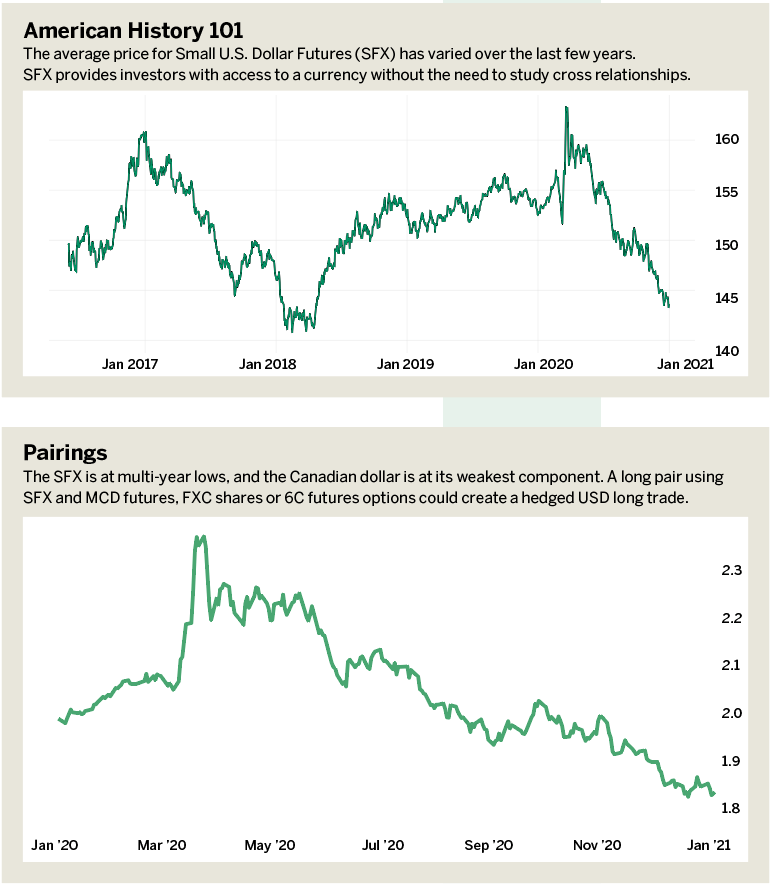

The U.S. dollar provides a solid place to start, and Small U.S. Dollar Futures (SFX) offer direct access to this singular currency without having to research several cross relationships. The U.S. dollar is at multi-year lows, and it’s nearing territory travelled less than 10% of days going back to 2016. Buying SFX here would bank on a reversion to historically normal levels. Small U.S. dollar futures move about +/- 0.50 ($50) per day, and their margin is only around $200, depending on the broker. Maybe it’s a bit overboard to dress like the Big Lebowski every Halloween, but traders should at least see what all the fuss is about.

Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the flagship programming slot called Splash Into Futures.