Gas Pump Arbitrage

Futures enable active investors to hedge against higher fuel prices

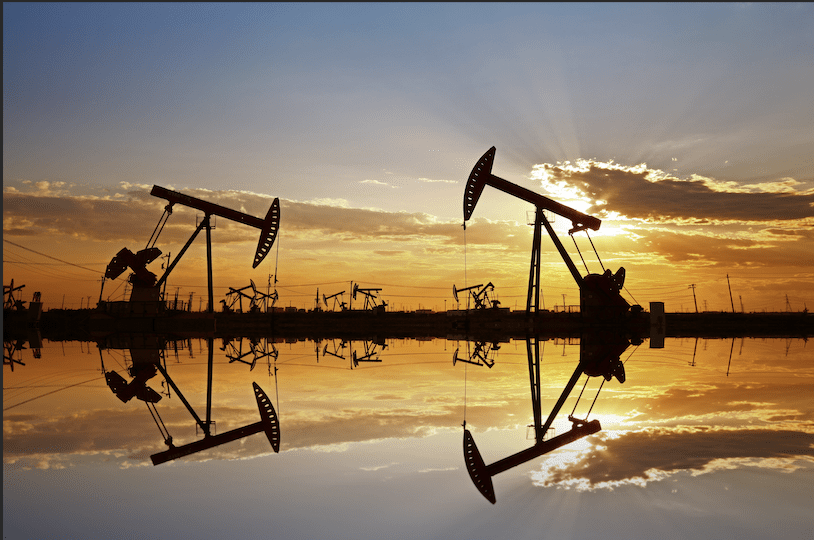

Americans take to the highways more often in the summer than at any other time of year, but it’s no bargain with gasoline prices exceeding $5 per gallon.

Let’s do the math for an entire summer driving season: Assume the family van or SUV averages 22 mpg, and daily drives and road trips add up to 6,000 miles. At $5 per gallon, the national average at press time, that costs a grand total of $1,360.

So, a question arises. Is there any way to use the financial markets to hedge summer gasoline purchases?

Yes. There’s a misconception that hedging is just for large institutions, but that’s not the case. Access to the futures options market and micro futures markets enables individual investors to trade products that have a direct relationship to gasoline prices.

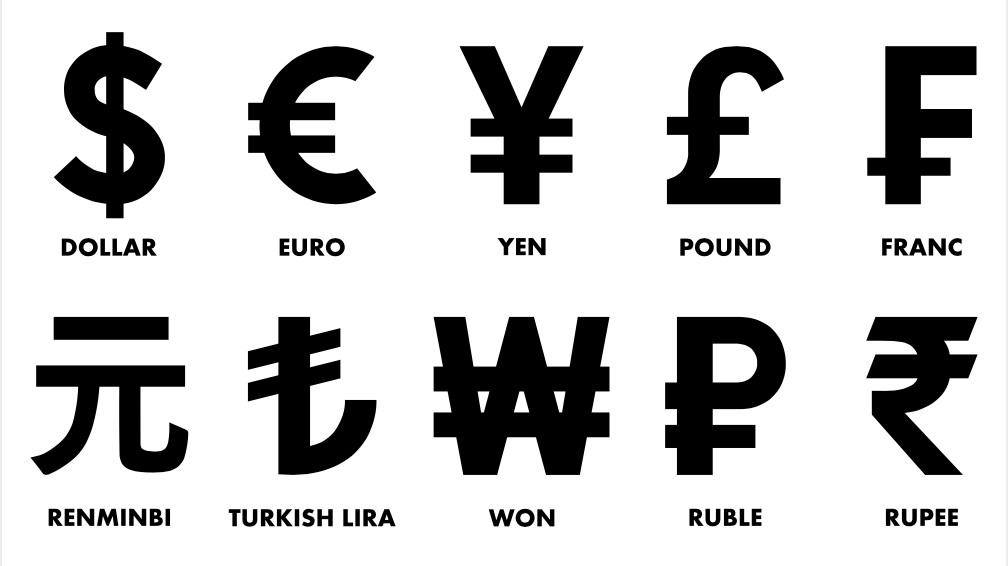

Gasoline futures are available but have limited options liquidity, and at more than $150,000, they’re too large in notional value for many retail investors.

Instead, active investors might choose the micro-crude oil futures (/MCL), which control 100 barrels of crude oil and have a notional value of $10,000 (when crude oil is $100). While gasoline and crude oil can have a love-hate correlation relationship, they do track one another’s movements in reasonable fashion. As the price of oil goes up, so does the price of gasoline—same with downward moves.

Investors who are worried oil and gasoline prices might jump through the summer months can buy a micro-crude contract and make $100 for each $1 increase in the price of crude oil. Just remember, contracts for crude oil expire monthly, and the current market is in backwardation, meaning later-dated contracts trade below the price of the current month. The October future, for example, is trading more than $4 lower than the August contract.

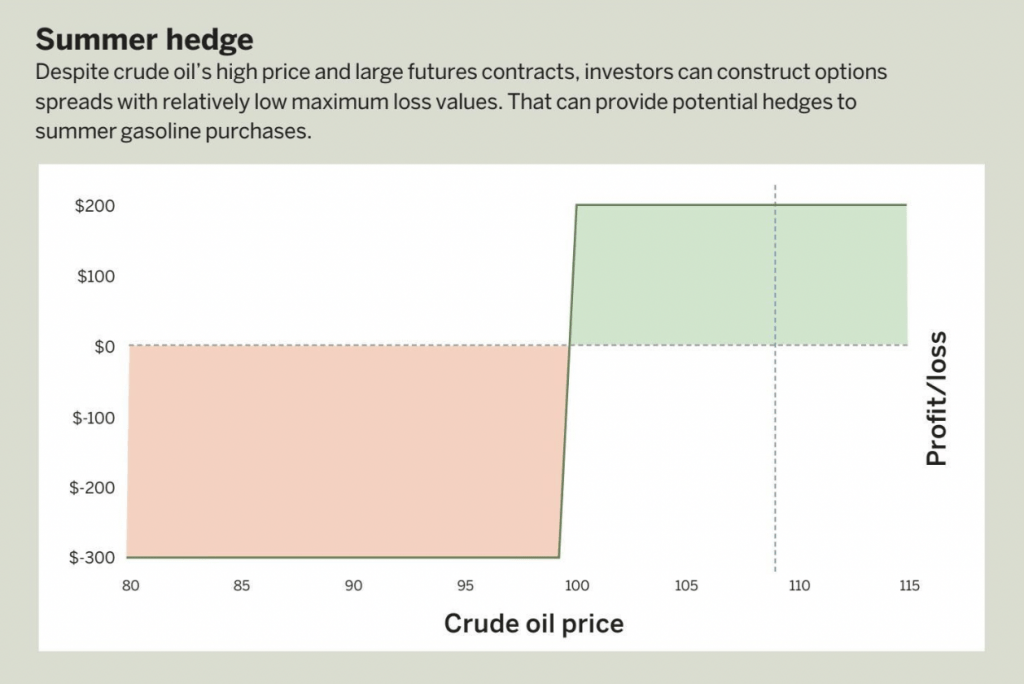

More savvy investors might want to put the probabilities on their side, using the options on the larger crude oil futures (/CL). Even though this is a higher notional value contract, controlling 1,000 barrels, investors can use the options to create relatively small spread trades. Strikes for the options are listed in $0.50 increments. So, the maximum value of any spread is $500 ($0.50 x 1000 barrels).

Traders who want to hedge their gasoline price with a high probability trade could look to sell put spreads. For example, with the October futures trading at $108.50, the 99.5 put option can be sold and the 99 put option can be purchased to create a spread that collects $190 in premium.

If the price of crude oil stays above $99.50 (60% probability) by October expiration, the investor keeps all $190. If the price of oil is below $99 at expiration, the loss on the spread is $310. But, if crude oil is trading back around $99, as it was in mid April, then gasoline would likely be closer to $3.90 per barrel again, with some serious savings at the pump.

This isn’t a no-risk trade, but it offers active investors an opportunity to use the futures market for some personal expense hedging.

Pete Mulmat, tastytrade chief futures strategist, hosts Splash Into Futures on the tastytrade network. @traderpetem