Lighting up Cannabis Futures

Bullish or bearish, most traders have an opinion on pot stocks, and those opinions have manifested themselves in the volatility of the prices. Tilray Inc. (TLRY), for example, has seen prices as low as $2.50 and as high as $215 in its short three-year lifetime on public markets. It’s currently trading for roughly $15.

While it’s anybody’s guess where the stock prices go from here, day traders, investors and short-sellers alike can agree this sector is bursting with opportunity.

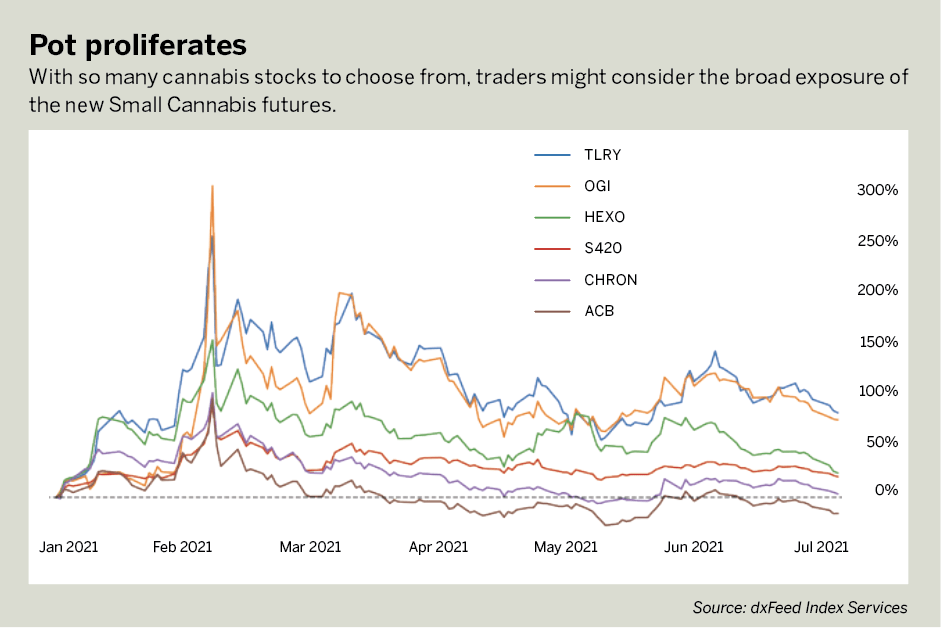

But with so many cannabis stocks to choose from, how might one decide which is the right product? Look at the wide range of performances of some of the most popular names in “Pot proliferates,” below.

For more holistic exposure, consider the new Small Cannabis Equity Index (S420), which tracks the performance of 21 liquid, large-cap cannabis industry companies listed on the New York Stock Exchange and Nasdaq. Besides Tilray, stocks comprising the underlying index include Aurora Cannabis Inc. (ACB), Canopy Growth Corp. (CGC) and Cronos Group Inc. (CRON), to name a few.

There’s also exposure to blue-chip tobacco companies, such as Altria Group Inc. (MO) and Philip Morris International Inc. (PM), that are attempting to break into the cannabis sector. For a full list of the components of the Small Cannabis Equity Index, check out indexit.dxfeed.com.

Pound for pound, cannabis futures are immensely more capital-efficient than single pot stocks or exchange-traded funds.

While exchange-traded funds (ETFs), like the Alternative Harvest MJ, track a similar basket, Small Cannabis futures offer several benefits that ETFs don’t have, including efficient margining, less stringent day-trading requirements and more favorable

tax treatment.

Pound for pound, futures are immensely more capital-efficient than single pot stocks or ETFs. While stocks and ETFs are margined at 50% to 100% of their notional exposure, Small Cannabis futures exposure can be achieved for roughly 15% their notional size.

That means investors need roughly $200 in margin to buy or sell one contract of Small Cannabis, which provides nearly $1,200 worth of cannabis stock exposure. Whether investing or trading, they can use those savings to increase exposure, diversify a portfolio or hedge.

Besides being capital-efficient, futures are flexible for day trading. Investors can sell futures contracts just as easily as they bought them and with the same margin requirement. Short-sale restrictions or unduly, hard-to-borrow costs never prevent capitalizing on market activity.

Plus, for small-account traders, futures contracts are not subject to the FINRA (Financial Industry Regulatory Authority) Pattern Day Trading Rule. So, with a roughly $200 margin and an average historic daily move of just $35, Small Cannabis futures were neatly designed for accounts of all sizes.

As a bonus, the IRS views futures as 1256 investment products and taxes them differently from stock, options and ETF trades. Unlike stocks and ETFs, which are taxed at either a short- or long-term rate, depending upon the duration of the holding period, futures gains are taxed at a blended 60% long-term rate and a 40% short-term rate, regardless of the holding period. That can potentially net a profitable trader thousands of dollars in savings over time.

Regardless of one’s opinion of cannabis, investors would do well to take a look at Small Cannabis futures for a novel way to invest or day-trade 21 of the most actively traded and liquid pot stocks with more efficient margining, flexible day-trading capabilities and more-effective tax rates.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.