Recent Volatile ETFs and 2021’s Current Winning and Losing Stocks

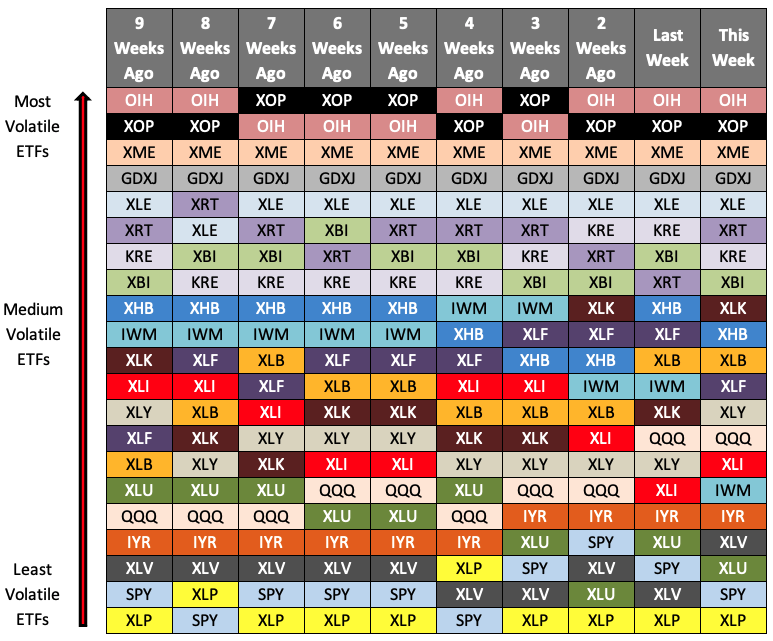

Most and Least Volatile Equity ETFs

Below we sorted the sector and index ETFs from high to low for each week. Oil ETFs (not surprisingly) are consistently, week after week, the most volatile. Healthcare, the S&P 500, and Staples are the least volatile. For several weeks, the Nasdaq (QQQ) were less volatile than Utilities (XLU)—but not anymore. How can you use this information? If you are risk adverse, and not looking for much volatility, perhaps look at the symbols at the bottom of the list—short options strategies as well. Looking for more risk? Look at the ETFs OIH, XOP and XME and perhaps individual stock components as well.

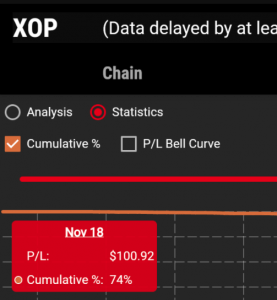

Probability of making $100 in XOP Strangle?

Check out tastytrade’s free backtesting (https://lookback.tastytrade.com/). Click under “Chain” and cue up a 88/125 strangle. Click “Analysis” and then check out the “Statistics” button. Move the scroll bar to the right (all the way to expiration). Now move your mouse along the curve until you get to your desired P/L. For example, the theoretical probability of making slightly over $100 is 74% by Nov. 18.

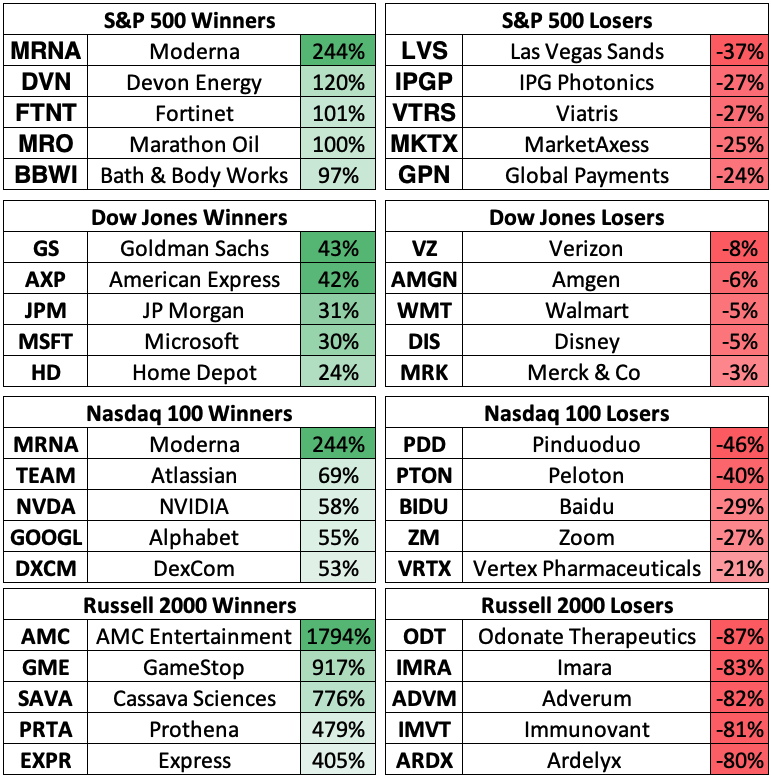

2021: The Home Stretch

The first three quarters of 2021 are in the books. Here are the biggest winners and losers in each of the four indices:

The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique insights from the geekiest of geeks. Conquer the market with confidence … get Cherry Picks today!

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Research and Development at tastytrade; and James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade.