Cryptocurrencies: Gambling or Investing?

Most people can’t help wanting to parlay a small investment into a windfall. So they buy real estate, procure precious metals, execute options trades or bet on horse races.

At one extreme, they make reasoned, logical, fact-based investments. At the other extreme, they risk their bankrolls on reckless wagers with a good chance of failure and a small chance of an outsized return.

What distinguishes an “investment” from a “gamble” comes down to a personal judgment based on experience, values and even religious upbringing.

Most visitors to Las Vegas are clearly gambling and, on the whole, losing money. That’s because multi-billion-dollar corporations haven’t set up shop in the desert out of the goodness of their collective hearts. They’re there to make money.

Yet with sufficient knowledge of games of chance and enough experience, some players could be considered investment professionals.

At the same time, straitlaced puritanical critics view the simple act of purchasing common stock with the intent of holding it for years as “gambling.” They even utter the word with contempt.

Gambling or investment?

In the world of investment, observers don’t think of a decision as “gambling” if it’s backed with knowledge, has an appropriate risk/reward ratio and there’s a commitment to longevity.

“Gambling” can even have a positive connotation if it means the execution of a relatively short-term, well-reasoned decision based on probabilistic outcomes.

And one of the most appealing new vehicles to do just that is cryptocurrencies. Investors don’t need to understand the technical details of how crypto works to succeed, but it helps to have a basic grasp of these financial instruments.

Good as gold? Better!

When crypto burst upon the scene a few years ago, some viewed it as a digital form of precious metals. They lauded it as a hedge against inflation, a refuge from the frailties of fiat and a seething rebuke to the authority of central bankers.

But crypto’s even better than that. As an investment, it has some tremendous advantages over the physical world of precious metals.

Specifically:

1.Extremely tight bid/ask spreads. For crypto, these are virtually non-existent, whereas the bid/ask with physical gold feels as though it’s a mile wide. Traders who stroll into a precious metals shop or execute an order with a large retailer instantly lose between 5% and 15%. That’s the difference between what a buyer pays a shop and what a shop pays a seller—in other words, retail versus wholesale.

2. Around-the-clock access. What if it’s Saturday morning and someone suddenly feels a desperate need to sell a stockpile of gold bullion? Well, tough. They’ll have to sweat it out for 48 hours until a dealer opens on Monday and then sell it for whatever the price happens to be by the time opening rolls around. They could sell crypto anytime the mood strikes, day or night, 365 days a year.

3. Size of movement. Crypto has moved hundreds, thousands or even tens of thousands of percentage points over the years, whereas precious metals have, relatively speaking, hardly budged. That’s exciting when it goes up, but it can fall much more swiftly than more standard investments, as multiple instances of 50% plunges have illustrated. However, crypto has proven vastly superior to most investment vehicles in its capacity for larger returns, even without leverage.

An insular world

So what does crypto have to do with a large alkaline body of water in the West? Well, airline passengers flying above the state of Utah often glance out the window to see the Great Salt Lake.

It’s huge and impressive, but it’s a mere remnant of Lake Bonneville, which once covered what is now the massive Bonneville Salt Flats.

Cryptocurrencies have some tremendous advantages over the physical world of precious metals.

This Utah “sea-change” can serve as a metaphor for crypto. The money flowing into crypto pretty much goes in one direction. The reason is simple: It’s an enormous task to make it flow in the other direction.

Yes, some services permit relatively easy conversion of crypto into fiat. But most fiat that’s been turned into crypto simply remains in crypto-land, either locked away in digital wallets or being converted from coin to coin. It constitutes a veritable financial sea unto itself.

Changing crypto into green cash to spend at Whole Foods requires a whole series of steps. It takes effort, it takes time and, generally speaking, it’s a hassle that most people would prefer not to endure.

So, not many people make deposits into crypto accounts with the idea of hopping between spendable fiat and crypto. The money goes in and does the only thing it’s capable of doing easily, which is being converted from one coin to another.

Thus, the gigantic Lake Bonneville represents the $6 trillion that the Federal Reserve Bank created and has found its way into all manner of assets.

The fraction that remains—symbolized by the much smaller Great Salt Lake—is the $2 trillion of various cryptocurrencies out there.

The rest of the “water” has retreated elsewhere for other more traditional purposes, such as buying houses, cars, groceries, gasoline, vacations and equities.

But the isolated body of water surrounded by hostile desert isn’t going anywhere. Think of it as an island made of water, so to speak, conjured from the largesse of the Fed. Because otherwise, it simply would not exist.

Another crypto metaphor

Here’s a way of thinking about crypto as a tool for successful gambling. Imagine a hodgepodge of lakes—hundreds of them. Let’s call a huge one Lake Bitcoin. Some are smaller but still substantial, including Lake Ethereum, Lake Cardano and Lake Litecoin. Some seem like tiny puddles at risk of evaporating in the midday sun.

Meanwhile, people scurry around on dry land, pitchers in hand, ready to scoop water out of one lake and into another. Some don’t bother and simply leave the water where it is. Others move water actively.

But the size of each lake changes constantly, growing larger or becoming smaller. Sometimes the entire region benefits from a huge rainstorm of fresh fiat. Other times, a scorchingly hot day diminishes the bodies of water, much the way the entire crypto market shrinks when China threatens to ban crypto for the umpteenth time.

Those who choose to “gamble” in this metaphorical universe most likely will prosper if they figure out which lakes will become larger and which will grow smaller. It’s all because Fed Chair Jerome Powell opened the heavens and dumped a diluvial cataclysm.

Chart-friendly crypto

One vitally important characteristic of crypto trading that aids good judgment and discourages of wild guesses is this: It’s chart friendly.

What that means in this context is that, simply stated, cryptocurrencies appear to “obey” classic lessons and methods of technical analysis far better than any other markets. The reason, almost undoubtedly, is that cryptocurrencies operate in a classic, organic market. Indeed, there is probably no market more purely classical than crypto.

Think of the stock market since the year 1987. Only a fool would believe that the federal government hasn’t had a tremendous influence over equities during the past third of a century.

Between the trillions of dollars the government has spent on quantitative easing, the “Plunge Protection Team” created following the 1987 crash, the endless speeches, programs and tax regulations directly in support of creating a “wealth effect,” it has reached the point—as it did years ago in Japan— that the government has vastly more influence over the ups and downs (but mostly ups) of the market than the general public does.

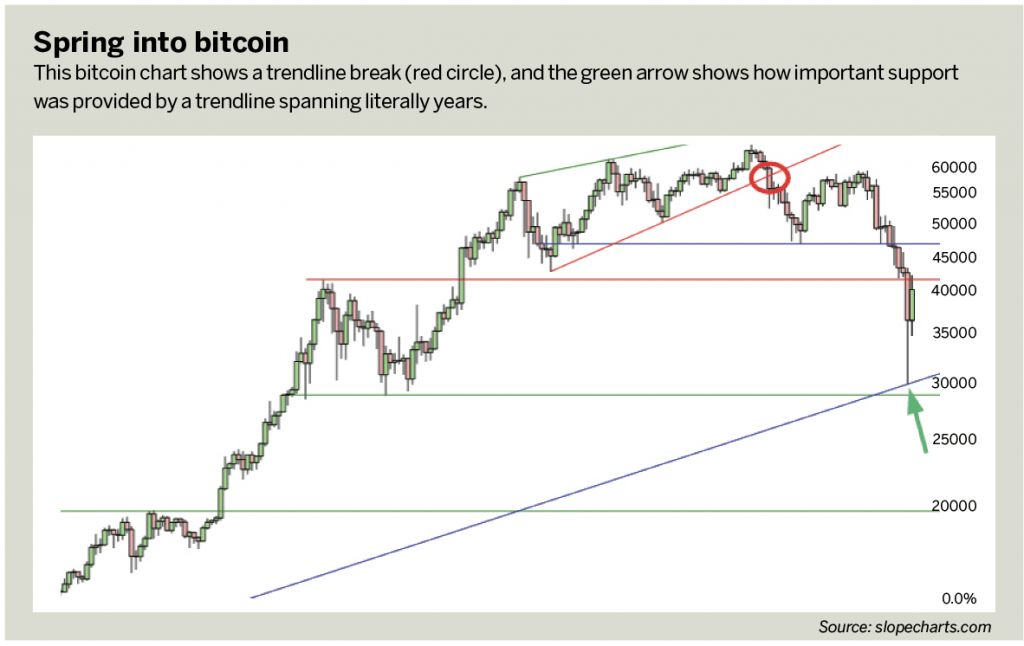

Crypto, on the other hand, is a classic market of buyers and sellers, supply and demand, booms and busts—all without the meddling of an exogenous governing force which is “just trying to help.” Take note of the two crystal clear examples in Spring into bitcoin, below.

First, the red circle shows a trendline break, which warned of an immediate drop in price of literally 50% in a matter of weeks. The second, marked with the green arrow, shows how important support was provided by a trendline spanning several years. Simply stated, when it comes to crypto, technical analysis works.

Post-diluvian attitude

Set aside the futurists who point to crypto as the basis for a new economy. Eschew the political missives that declare crypto a libertarian dreamscape made possible by blockchain ledgers. What matters to a profit-seeking decision-maker is interpreting the possibilities of crypto as something similar to the more familiar turf of equities and options.

With that viewpoint, seize the opportunity to focus on which metaphorical lakes provide the best chance of a successful gamble. The next issue of Luckbox will provide methods for that analysis.

Tim Knight has been using technical analysis to trade the markets for 30 years. He’s the host of Trading the Close on the tastytrade network and offers free access to his charting platform at slopecharts.com.

@slopeofhope