Venomous FAANGs

A VETERAN TRADER TACKLES TECHNICALS

For decades, conservative politicians have courted votes by promising to reduce federal regulation. After all, many of their constituents are convinced that removing red tape and curbing nettlesome bureaucrats can nurture capitalism. So government intervention has, on the surface at least, been in retreat.

Until the 1970s, for example, the federal government tightly controlled commercial airlines. Many of today’s travelers may find it difficult to believe that in those days every ticket from point A to point B was identical in price (for the same cabin class, at least). So airlines had to compete on service, cleanliness, safety and other non-financial characteristics.

But the feds have unchained airlines, banking and a host of other industries from some aspects of government oversight and allowed them to compete on whatever terms they choose.

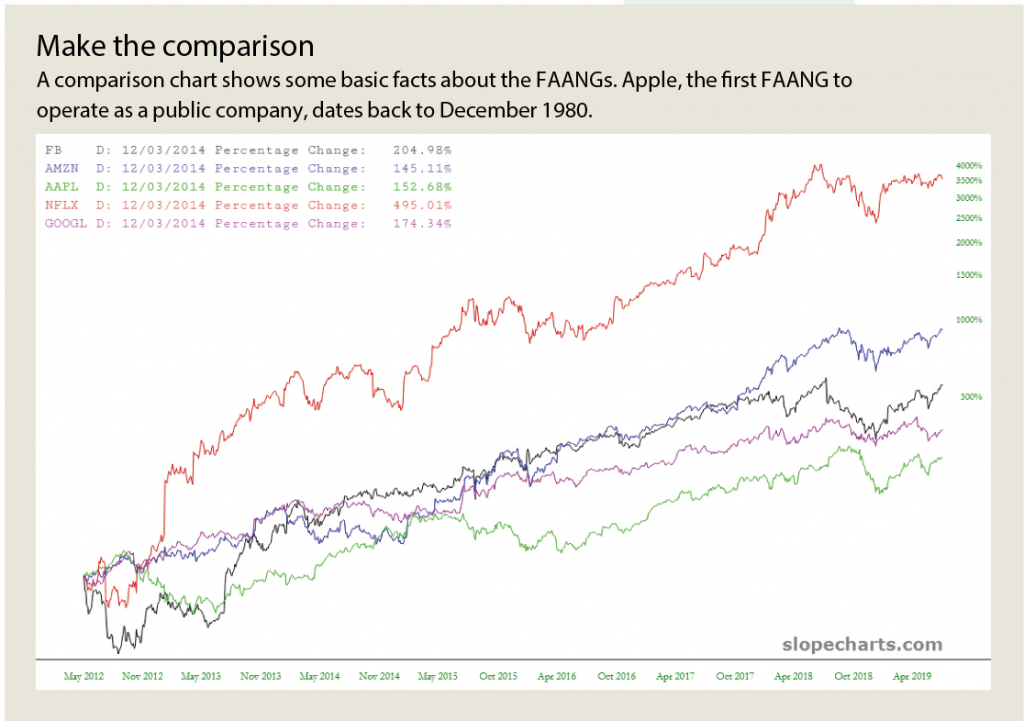

Today’s high-tech companies, particularly the megacaps colloquially known as the FAANGs, didn’t exist during those days of tighter regulation. The FAANGs—comprised of Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google, otherwise known as Alphabet (GOOGL)—were all born in the current relatively laissez-faire period with its comparatively low taxes and somewhat relaxed bureaucratic oversight.

However, the political environment is changing and could bring an end to the less-strict circumstances that helped the FAANGs thrive. Europe seems eager to tax the largest digital corporations. In the United States, concerns about privacy, monopolization and transparency may foster a new era of regulation, complete with rules targeting the specific companies in question.

A comparison chart shows some basic facts about the FAANGs. Apple, the first FAANG to operate as a public company, dates back to December 1980. For a valid comparison, however, the graph begins when Facebook went public about seven years ago. The stocks more or less move in the same direction over the long run, with Netflix having the most substantial gain at about 3500% and Apple having the least at about one-tenth that amount. (See “Make the comparison,” below.)

Off the hook

The five companies, all of them large technology enterprises, vary in reputation, products and services, and government scrutiny. In the present political climate, which some would describe as unusual, some of the companies get more of President Trump’s attention than others.

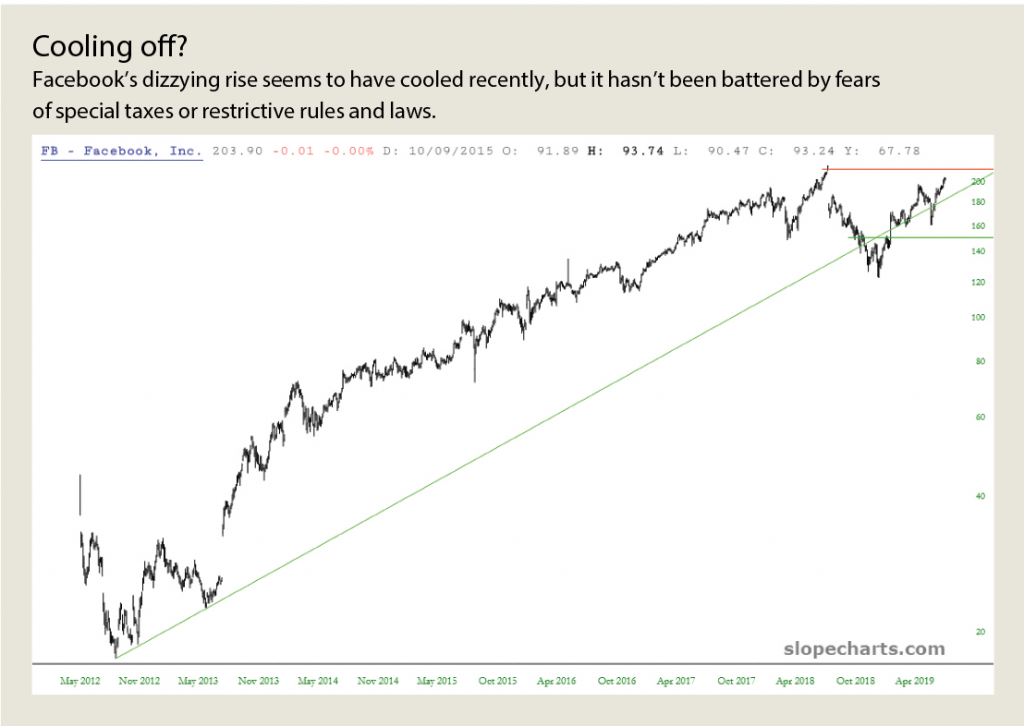

Netflix, for example, isn’t a target in Washington. Its stock performance has been extraordinary. The company’s dizzying rise seems to have cooled recently, but it hasn’t been battered by fears of special taxes or restrictive rules and laws. It’s learned to stop committing internal fumbles and transform itself into a moneymaking machine for itself and its shareholders.

Facebook presents a different story, but at least some of its foibles have been short-lived. The company endured an embarrassing privacy scandal that landed Mark Zuckerberg, its co-founder, chairman and CEO, in front of a sometimes hostile joint session of Senate committees and shrank its public equity by nearly half. It has since recovered most of those losses, and it hasn’t been a target of the current administration. Instead, it seems to have been beleaguered by a “one-off” incident that temporarily seemed devastating to shareholders but looks less relevant after some time to heal. (See “Cooling off?” below.)

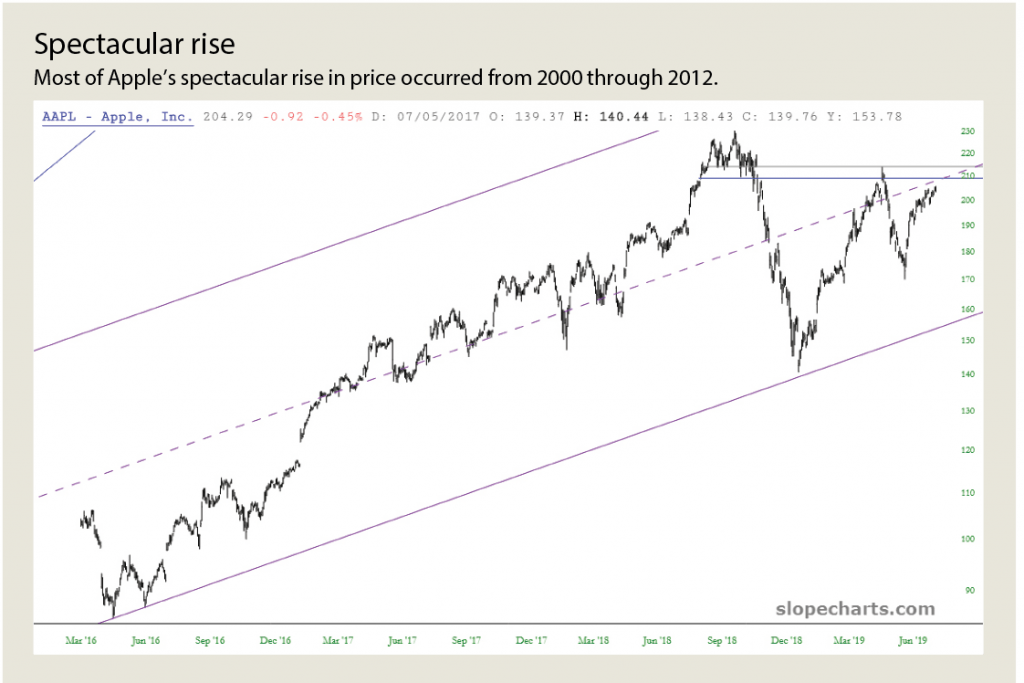

Apple, too, has been spared the administration’s attention. In fact, President Trump erroneously addressed its CEO, in person, as “Tim Apple.” How’s that for lack of attention? Most of the company’s spectacular rise in price occurred from about 2000 through 2012. Although the stock has climbed higher now, in percentage terms, its move has been more placid. Recent ups and downs have had more to do with projections about iPhone sales than about meddling from D.C.

After removing three of the five FAANG companies from this examination, let’s take a look at the remaining two.

Target acquired

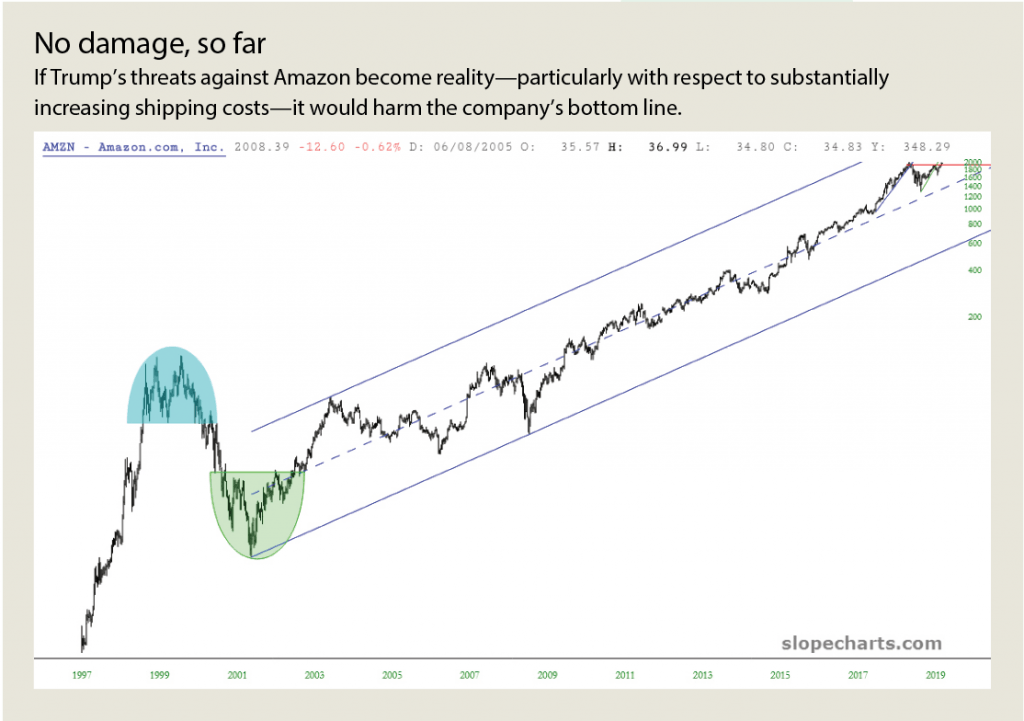

At Amazon, the world’s largest online retailer, founder Jeff Bezos serves as chairman, CEO and president, and he’s also the largest shareholder. But Bezos also happens to own the Washington Post, a newspaper often harshly critical of Trump and his administration. The situation has led Trump to threaten Amazon, particularly with respect to substantially increasing shipping costs, which would harm the company’s bottom line.

Amazon’s share price hasn’t suffered unduly from those threats, which seem more bluster than reality. Indeed, as of this writing, the share price is close to its October 2018 peak. Its only recent weakness came in the last quarter of 2018, which was a three-month period of extraordinary weakness for almost all equities—particularly richly valued tech sector stocks. That weakness, which the stocks have since shaken off, seems unrelated to political machinations.

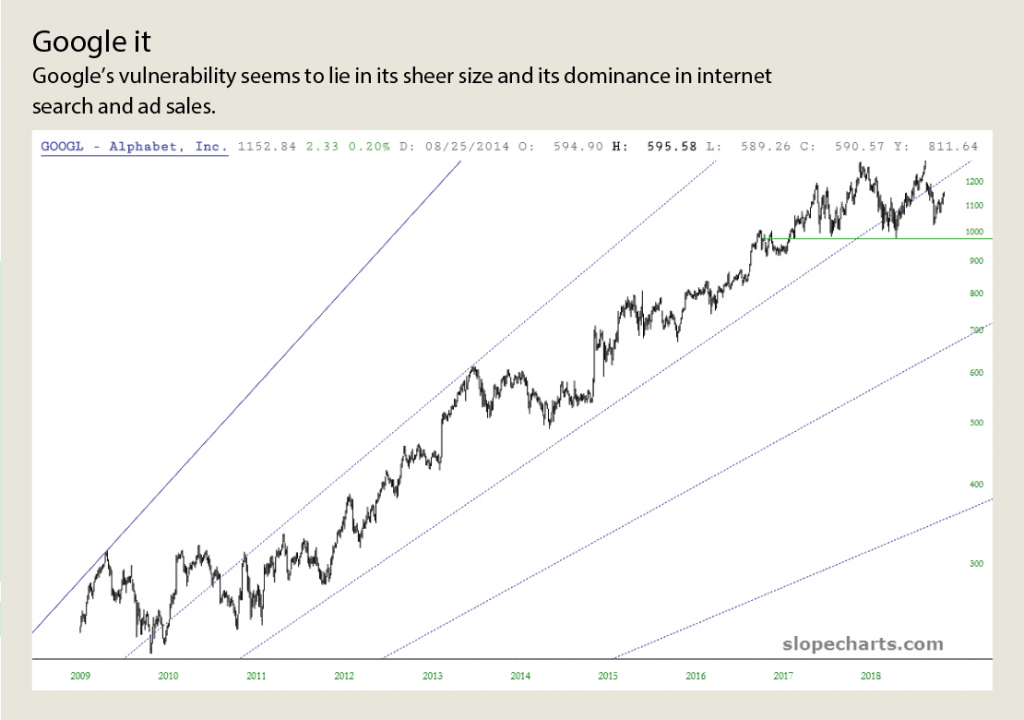

The final company among the FAANGs, Alphabet (aka Google), appears most prone to diminished value because of the attentions of the government. This seems paradoxical because the giant search engine hasn’t been involved in the political firestorms surrounding companies like Twitter (TWTR) or the election-interference accusations aimed at Facebook.

Instead, Google’s vulnerability seems to lie in its sheer size and its dominance in internet search and advertising sales. And there are rumblings about antitrust action related to Google’s important YouTube subsidiary. Enforcement action, both real and prospective, seem to weigh on the stock price. The price peaked in April, and the price chart in “Google it,” below, is augmented with Fibonacci fanlines denoting key support and resistance levels.

From 2008 through 2018, Google’s price steadily climbed above the fanline shown. Starting late last year, however, and continuing this year, prices began to fall beneath the surface of that important level. As of this writing, the stock has the same price it had

18 months before.

The failure of the fanline could represent just the beginning. Should the stock break below approximately $975, that would suggest the slip under the fanline was not an aberration and Google could be ripe for a new era of diminishing price or at least stagnation. Washington is eying Google more closely than its FAANG brethren, and the equity price will reflect that — particularly between now and the 2020 election.

Tim Knight has been using technical analysis to trade the markets for 30 years. He hosts Trading the Close daily on the tastytrade network and offers free access to his charting platform at slopecharts.com.