What You Need to Know About Trading Around Midterm Elections

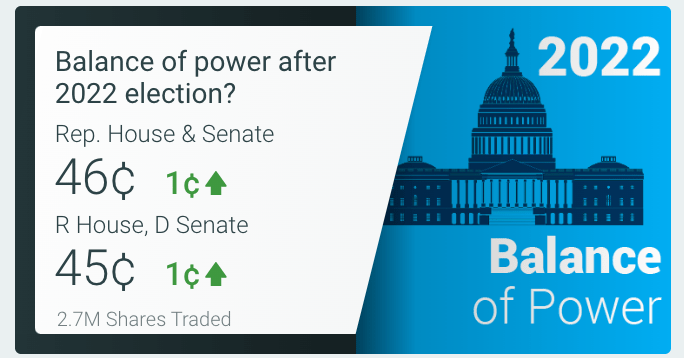

Prediction markets currently expect Republicans to regain control of the House of Representatives this November, while the race for the Senate is now leaning in favor of Democratic control. Here is what that means for active traders.

The global financial markets have been highly volatile in 2022, and based on historical data, it’s likely to continue—at least until early November.

Traditionally, the summer months tend to be among the least volatile on the calendar, while September and October often exhibit the highest degree of volatility, according to research conducted by tastytrade.

Moreover, investors and traders may want to circle Nov. 9 on the calendar, as it’s the day after the midterm elections in the United States. In the past, the stock market has steadied in the wake of midterm elections, and on average has also tended to move higher.

According to historical data, the rally at the end of a midterm election year can sometimes even materialize before November—during the first part of October—as illustrated in the chart below.

Source: MarketWatch

While there’s certainly no guarantee that history will repeat itself during 2022, the fact that midterm election years have historically been tumultuous may provide bullish investors and traders with some degree of comfort, because that suggests that this trading year has been “normal”—at least in terms of elevated volatility.

Moreover, historical data suggests that bullish activity in the markets could extend beyond 2022. That’s because the third year of a president’s term has often been the best-performing when it comes to returns in the stock market.

Since 1896, the third year of a given presidential term tended to be the highest performing in the stock market (on average). This is somewhat logical, considering that midterm elections occur during the second year of the term, while the subsequent presidential election occurs in year four—elections that no doubt contribute to increased uncertainty.

Taken together, the aforementioned data suggests that bullish sentiment could take hold in the stock market at some point this fall, and possibly extend into 2023.

What do prediction markets expect from the 2022 midterms?

One of the reasons that midterm elections are so important to the financial markets is because changes to the political landscape can in turn have a major effect on the corporate sector.

For example, if Republicans gain control of Congress this fall, it’s likely that the legislative agenda in Washington D.C. will change. That could provide a lift to some sectors of the economy, and create a headwind for others.

The upcoming elections will therefore be closely followed by investors and traders, both inside and outside of the U.S. For this reason, it’s worthwhile to check in on the current state of political prediction markets.

You can legally trade futures on political outcomes. To learn from expert prediction market traders watch The Prediction Trade podcast on the tastytrade YouTube channel.

A prediction market (a.k.a. betting market) is an exchange-traded market where individuals can bet on the outcome of a variety of events with an unknown future. They are created for the purpose of trading the outcome of specific events.

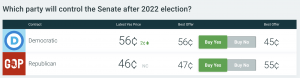

Currently, two-sided action in the prediction markets at PredictIt.org suggest that control of the U.S. Senate for the next term is a toss-up. The market is currently locked at roughly 51%-49%, with bets on a Republican-controlled Senate only slightly outpacing the bets cast for a Democrat-controlled Senate.

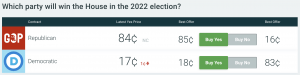

However, when it comes to the U.S. House of Representatives, the PredictIt market is a lot more definitive. At this time, a strong majority expects Republicans to take control of the House during the 2022 midterms. Both markets are highlighted in the graphics below.

The above suggests that control of Congress could be split when the dust settles on Nov. 9. And it’s even possible that Republicans could control both chambers of Congress. Either way, the result will likely be “gridlock.”

In the political realm, gridlock is a situation in which the government is unable to pass new legislation because the presidency and Congress are controlled by different political parties.

However, gridlock may not be the worst outcome for the financial markets.

Historical data shows that when Congress is gridlocked the stock market has outperformed—especially when there’s a Democrat in office. The same goes for instances in which a Democrat holds the White House alongside a “split” Congress.

Data from 1928 to present, shows that these are the two preferred scenarios when it comes to market returns, as highlighted below.

The best returns with a Republican in the White House were also accompanied by a gridlocked Congress.

Of course, past results are no guarantee of future returns. However, this data certainly has to be encouraging for fatigued market bulls in 2022.

To learn more about trading the markets during election years, review this previous installment of Options Jive on the tastytrade financial network. To follow the political prediction markets throughout the election season, tune in to the Luckbox podcast, The Prediction Trade.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.