Failing Chinese Property Developer Spooks Global Financial Markets

Corporate debt has ballooned in China, and financial mismanagement at one of its largest property developers raised the profile of this latent risk to the global financial system.

Volatility came back to the markets in a big way on Sept. 20, with the CBOE Volatility Index (VIX) jumping 25% in a single session as broad market indexes such as the S&P 500 lost nearly 2%.

A key catalyst behind Monday’s pullback was purportedly the Evergrande Group—one of the largest property developers in China. Evergrande has amassed nearly $300 billion in total debt and due to financial mismanagement may need a bailout by the Chinese government to avoid bankruptcy.

Monday’s selloff in the United States, which followed earlier losses in other parts of the world, was said to be a precautionary “risk-off” reaction to the potential domino effect of an Evergrande implosion.

However, it’s entirely possible that the stock market simply buckled under the weight of the current “wall of worry” on Wall Street, and that Evergrande was simply the straw that broke the camel’s back.

Aside from the Evergrande calamity, investors and traders are also grappling with a bevy of other concerns, including:

- Potential tapering of monetary stimulus by the Federal Reserve

- Continuing inflation concerns

- Commercial supply-chain shortages which could ultimately impact 2021 earnings and beyond

- Rising caseloads of COVID-19, both domestically and abroad

- Uncertainty in Washington, D.C., as negotiations continue over a potential increase in the federal debt ceiling

In addition to the above, the S&P 500 also closed below its 50-day moving average on Monday, suggesting technicals in the market are also weak. At one point on the 20th, the S&P 500 was down 5% from its record high on Sept. 2 (intraday). It closed trading on the 20th down about 4.1% from its recent all-time high.

As one might expect, other asset classes also got swept up in the volatility, with crude oil dropping 2% and bitcoin seeing 10% of its value washed away. The 10-year Treasury yield also dropped to 1.31% as investors and traders piled into government bonds.

Not surprisingly, trading volumes also surged across the board.

On Monday, roughly 5.3 million put contracts traded hands in the SPDR S&P 500 ETF (SPY), which was the most for a single trading day since June of last year. Activity in SPY call contracts was also robust, with the 3.9 million call contracts trading on Monday representing more than double the daily average observed in recent months.

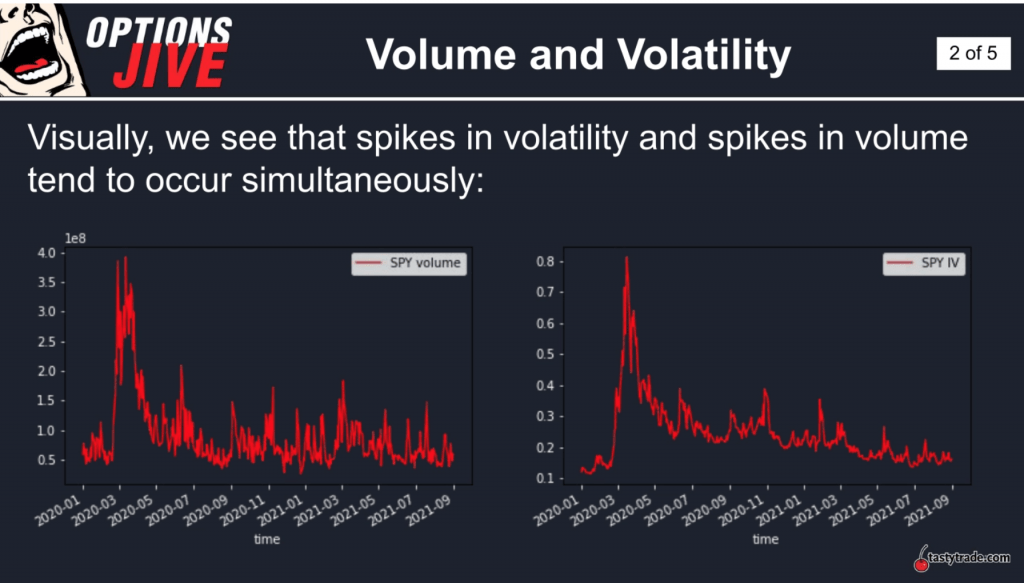

Traditionally, spiking implied volatility tends to correspond with increased volume, as detailed recently by the tastytrade financial network.

Getting back to Evergrande, investors and traders may want to circle Thursday Sept. 23, 2021 on their calendars, as that’s the day an $83 million interest payment comes due for the embattled company.

Global markets will undoubtedly be watching closely to see whether that payment is made or missed, and whether the Chinese government steps in to assist Evergrande in the case of the latter scenario.

As previously highlighted by Luckbox, ballooning corporate debt levels in China have been a red flag in recent years.

In the last quarter of 2019, the Institute of International Finance (IIF) estimated that the public debt-to-GDP in China was 302%. And by May of 2020, that figure had risen to an estimated 318%.

The public debt-to-GDP ratio measures a country’s total debt (government, corporate and consumer) relative to its gross domestic product (GDP). The metric is commonly used to evaluate a country’s financial health, and more specifically its ability to make good on its debts.

For context, the debt-to-GDP ratio for the United States is roughly 98%, calculated by taking the estimated net public debt ($20.3 trillion) divided by the estimated GDP ($20.6 trillion).

The World Bank has conducted extensive research on the debt-to-GDP ratio and concluded that any reading above 77% is suboptimal—thus increasing the risk that a country’s economic potential could be hamstrung by excessively high debt service requirements.

In the case of China, it’s already been well-established that the country’s economy is littered with a boatload of bad debts, particularly of the corporate variety (see graphic below).

The difference in China is that the country’s national savings rate is also among the highest in the world—meaning Chinese banks are theoretically better capitalized and potentially better positioned to absorb a big shock to the system.

Few are eager to see that theory put to the test, as evidenced by recent tensions involving Evergrande.

Volatility in the markets tends to heat up during the fall season, and as evidenced by recent moves, 2021 is no exception.

To follow everything moving the markets, including Evergrande, readers are encouraged to tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Get Luckbox! Subscribe to receive 10-issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.