Crude Oil Volatility Hits All-Time High

Statistics and numbers are some of the closest friends of investors and traders.

While many normal people like to go out for dinner or a drink on weekend nights, investors and traders are often found parked in front of their trading screens during these times, reviewing important figures from the most recent week of trading.

And when stuff starts going haywire, as it has in recent weeks, stats and numbers can become even more important, comforting traders like a life preserver in a violent storm. This can be especially true when it starts to feel like fundamentals have been thrown out the window, because embracing the numbers can be a way of bringing order to the chaos.

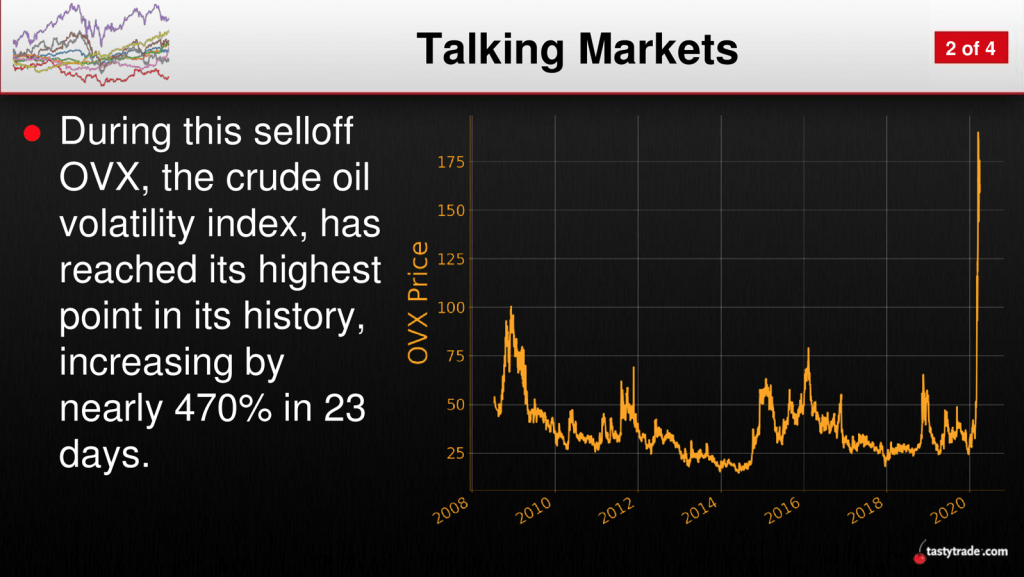

Volatility in crude oil has officially blown through the roof in 2020.

The OVX (CBOE Crude Oil Volatility Index), which measures volatility in the crude market much like VIX does in the S&P 500, notched a new all-time closing high on March 20 of 190.08.

And while the VIX may have also notched a new all-time closing high this year, it only did so by a small margin—a couple of points higher than the previous pinnacle reached during the 2008-2009 Financial Crisis.

In March of 2020, crude oil volatility blew the lid off its previous record high, as shown in the chart below:

Interestingly, the above chart looks quite similar to the one released recently documenting historical unemployment claims. The number of unemployment claims made during the weeks of March 23 and March 30 dwarfed any on the previous historical records.

Certainly, that fact alone would represent a strong indicator that demand for crude oil is currently downward sloping. However, it’s not just the demand side of the energy market that’s been pressuring oil prices.

The bigger story is the supply side, which has been dominating headlines in recent days.

As many are well aware, the Organization of Petroleum Exporting Countries (OPEC) had partnered with Russia recently to “artificially” boost oil prices by reducing production through coordinated cuts. OPEC’s goal was to limit the amount of oil reaching the market in order to provide a floor for prices—a floor of their choosing.

Intriguingly, agreement among the group, widely known as OPEC+ (OPEC plus Russia), experienced a breakdown in the wake of the spreading coronavirus crisis. While the details of that breakdown aren’t exactly clear (lots of “he said, she said”), the main takeaway is that the OPEC+ production cuts were essentially discarded on March 8.

After the group failed to come to a new agreement during early March, Saudi Arabia decided to take matters into its own hands and announced it would open the oil taps across the country to maximum capacity—jumping from their throttled level of about nine million barrels per day to their perceived maximum of 12 million.

That meant at least another three million barrels of oil were suddenly available to the global market during a period in which demand was crashing. Not exactly a recipe for higher prices.

In response to Saudi Arabia’s full throttle production announcement, crude oil futures lost 25% of their value on March 9 and another 24% on March 18. These are the two biggest percentage declines in West Texas Intermediate (WTI) futures since 1999. Overall, crude oil prices are down about 50% on the year.

As if all that wasn’t enough, global lockdowns associated with the coronavirus were also being instituted around the same time as the OPEC flare-up, meaning that expectations for crude oil demand were also plummeting. In the crude oil market, it was almost like the collision of two black swans.

Fast forwarding to the present, a meeting of OPEC+ was originally scheduled to be held on Monday, April 6. This news catalyzed a sharp spike in crude oil prices on April 3, based on widespread belief that OPEC+ would reinstitute their previously agreed production cuts.

However, during the weekend, news broke that Monday’s upcoming OPEC+ meeting was being delayed, possibly until April 9, due to an ongoing war of words between Saudi Arabia and Russia.

The situation in crude oil markets is therefore fluid and could change at any time, based on further updates regarding the timing and tone of that potential meeting.

The one thing that seems certain is that volatility in crude oil pricing isn’t going away anytime soon, even if one of the two black swans were to float out of the picture.

To learn more about the current crude oil trading landscape, readers may want to review a new episode of Forward Slash on the tastytrade financial network. Another episode to consider is a recent installment of Futures Measures, which involves a deeper dive on trading oil volatility and the OVX.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.