Diesel Prices Plunge as Slowing Economy Weighs on Energy Markets

Diesel prices are down roughly 33% in the last year as cooling inflation and a slowdown in the global economy weigh on global energy markets

The Federal Reserve isn’t done fighting inflation, but there are signs that inflation may finally be cooling in the U.S. economy.

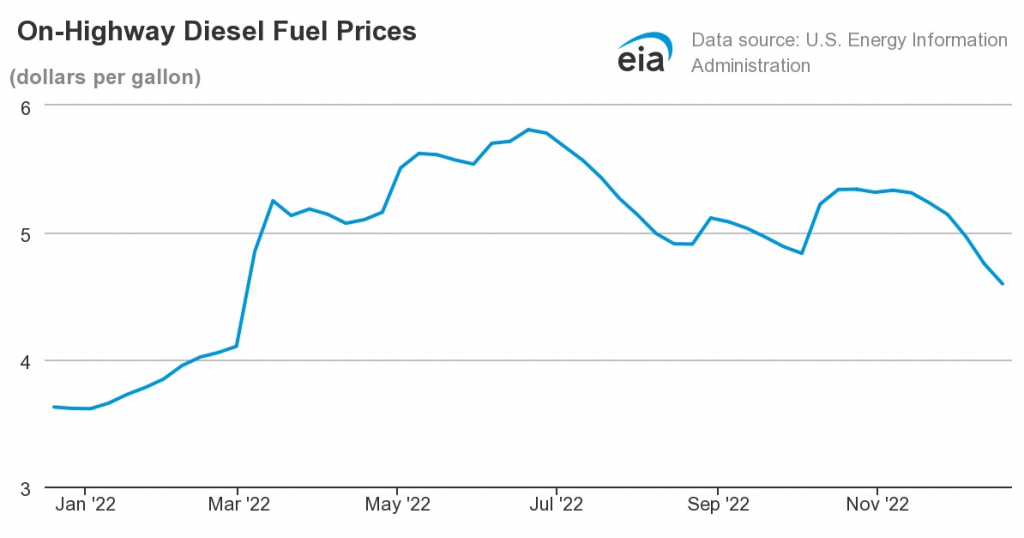

The price of diesel fuel—which hit a record high in 2022—has plunged in recent months, and is now trading 33% lower than it was a year ago.

Today a gallon of diesel costs $3.76, compared to about $5.65/gallon at this time last year. The current price represents an 18-month low.

That’s certainly good news for big consumers of diesel like the shipping, construction, farming and military sectors. And based on some projections, the downward trend could persist for a while longer.

Last summer, the record spike in diesel prices was partially attributed to supply-side shortages. However, those supply issues still remain an issue today, which means prices are now retreating due to weakening demand.

From that perspective, the recent decline in diesel prices is likely indicative of a slowdown in the U.S. economy. The Federal Reserve indicated earlier this year that it expects the U.S. economy to fall into a mild recession during the second half of 2023.

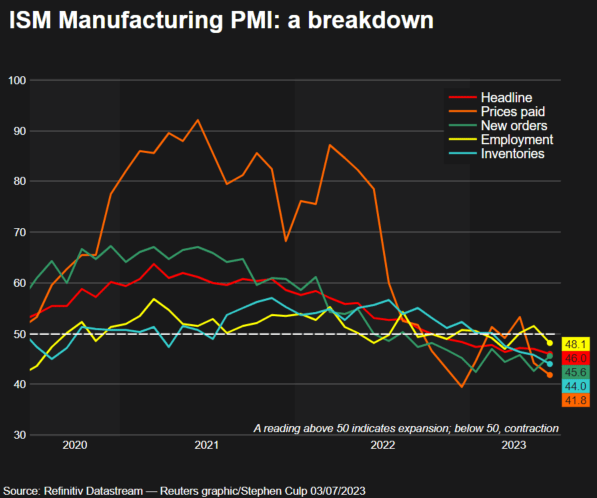

Based on surveys conducted by regional Federal Reserve banks in Dallas, Kansas City, New York and Richmond, Virginia, manufacturing activity in the U.S. is also contracting, which appears to fit with the recession narrative.

In June, the RSM U.S. Manufacturing Outlook Index was 1.7 standard deviations below normal, which represented the 14th straight month of contracting activity.

Moreover, recent data collected by the Institute for Supply Management (ISM) confirms those findings. On July 3, the ISM reported that its widely-followed Purchasing Managers’ Index (PMI) had dropped from 49 in May, down to 46 in June.

Any PMI reading below 50 indicates that manufacturing activity is contracting. And ISM’s PMI has now clocked in below 50 for eight months, which is the longest stretch since the Great Recession.

Timothy R. Fiore, the chairperson for the ISM, provided further context on the recent PMI report and said, “The June composite index reading reflects companies continuing to manage outputs down as softness continues and optimism about the second half of 2023 weakens.”

As highlighted in the chart below, diesel prices peaked last summer, and have moved steadily lower in the interim, virtually in lockstep with the slowdown in manufacturing activity.

Source: MercuryGate.com

Going forward, diesel prices will almost certainly continue to mirror ongoing expectations for the U.S. economy. If a recession does materialize in H2 2023, some market analysts have projected that diesel prices could even fall further in the summer and fall.

The ongoing correction in oil prices has also been a big factor in the 2023 diesel market, and any further deterioration in the global economy could push oil prices below $65/barrel. That development would almost certainly weigh on diesel prices, and potentially push them below $3.50/gallon.

Crude oil prices peaked last summer above $120 per barrel, but have since slid down to roughly $71/barrel as of early July.

To learn more about trading the global energy markets, check out this installment of Futures Measures on the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.