Dollar Peaks Against Yuan As Chinese Economic Slowdown Weighs on USD/CNY Exchange Rate

The post-COVID economic recovery in China weakened in Q2 and a new stimulus package has weighed on the yuan, tilting the USD/CNY exchange rate further in favor of the dollar.

Rising interest rates haven’t exactly been a godsend for the U.S. economy.

Since the Fed started aggressively raising interest rates in 2022, the U.S. economy has suffered a sharp slowdown in the property market, a banking crisis, and the ever-present threat of a recession.

But the effects of the Fed’s recent rate hikes have also spilled over into the global financial system, as evidenced by the recent collapse of the Chinese yuan against the U.S. dollar.

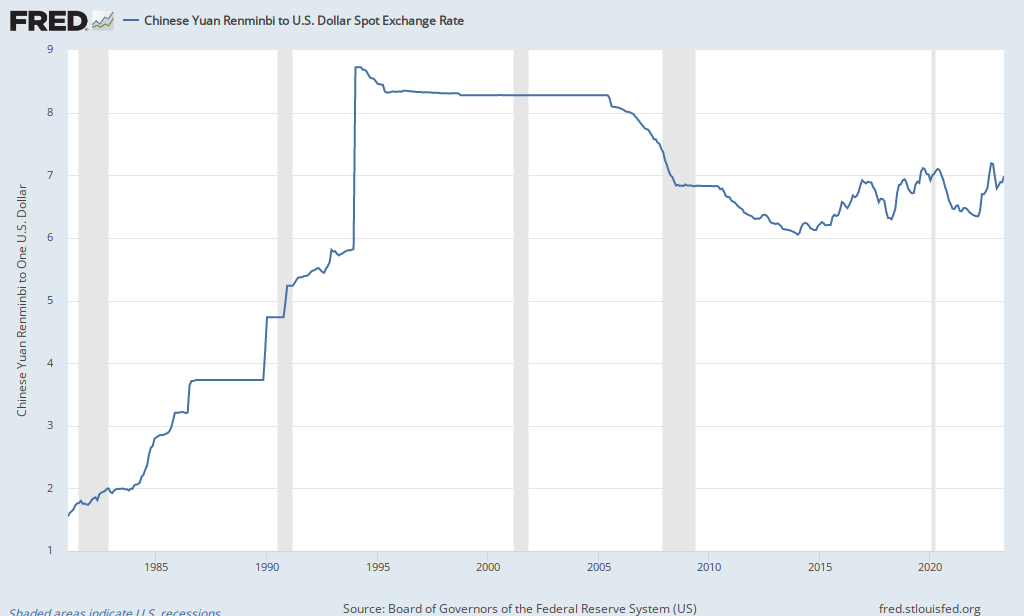

Since early 2022, the Chinese yuan has depreciated by about 13% against the U.S. dollar, which has pushed the dollar/yuan exchange rate to a historical extreme.

At this time, one dollar buys roughly 7.16 yuan, which is considerably more than at the start of 2022, when one dollar bought 6.35 yuan.

As a reminder, exchange rates are typically quoted using the format “ABC/DEF,” and are interpreted to mean that the first currency listed is a single unit, while the exchange rate itself represents the amount of the second currency that is required to purchase a single unit of the first currency.

The dollar/yuan (USD/CNY) exchange rate has ranged between roughly 6.0 and 7.3 since the end of the Great Recession, which means the current exchange rate is closing in on the best levels (for the dollar) observed in the last 15 years.

This trend ties back to the diverging prospects for American and Chinese economies, or at least the perceived potential of each economy.

Two economies move in opposite directions

Despite the harsh realities of sky-high interest rates, the U.S. economy has remained relatively resilient in 2023.

One of the key indicators of this resilience has been continued strength in the U.S. labor market. Data from May 2023 once again demonstrated that hiring remains robust in the U.S., and that the country’s overall unemployment rate remains historically low.

Moreover, the U.S. stock market has performed extremely well so far in 2023, with the S&P 500 up about 15% year-to-date, and the Nasdaq Composite up an astounding 32%.

In China, however, the situation is quite different.

At the start of 2023, hopes abounded that China’s economy would kick into high gear after the country scrapped most of its draconian COVID-19 measures in late 2022. And for a time, that proved true.

In the first quarter of 2023, the Chinese economy grew at a healthy clip of around 4.5%. In the second quarter, however, economic data indicated that the recovery was weakening—dashing hopes for a strong follow-through from Q1.

That reality was underscored recently by Zhu Tian—a professor of economics at the China Europe International Business School in Shanghai—who recently told the Financial Times, “We thought that after the opening of the COVID situation, things would get much better, and now it’s not turning out that way.”

Last month, Chinese exports dropped by 7.5% as compared to the year prior. That drop meant that in absolute terms, Chinese export volumes were lower in May than at the start of 2023.

Moreover, Chinese industrial output also deteriorated in Q2. In April, analysts had projected that China’s industrial output would expand by nearly 11%, but the actual figure clocked in below 6%.

Then, in May, things took another turn for the worse when industrial production grew by less than 4%—another indication that the Chinese economy was slowing down, rather than expanding.

On top of all that, the euphoria that was observed in the Chinese stock market in late 2022 and early 2023 has also evaporated. From October 30 to January 30, the iShares China Large-Cap ETF (FXI) rallied by nearly 57%. But year-to-date, FXI is now down on the year.

Likewise, stock performance has also been weak in the major Chinese indices, such as the Shanghai Composite and the Hang Seng. The former is up around 4% in 2023, while the latter is down about 1%, and those figures look even worse when compared to some of the year’s top performers.

For example, Japan’s Nikkei 225 is up an astounding 30% so far in 2023, while Korea’s KOSPI is up 17%.

As a result of lagging growth and a lagging stock market, the Chinese government recently announced that it would enact measures to help stimulate the economy. On June 15, the Chinese central bank cut one of its key policy rates, known as the “medium-term lending rate,” from 2.75% to 2.65%.

And while that wasn’t a dramatic cut, the move sends a strong message that China’s leaders believe the underlying economy requires accommodation. Against the broader global backdrop, this is especially interesting because most of the world’s other large economies are raising rates, not cutting them.

Circling back to the USD/CNY exchange rate, there’s an important reason that China likely can’t cut rates further—such a move would be disastrous for the yuan. The yuan is already under pressure due to subpar Chinese economic performance, but any further rate cuts would undoubtedly make the yuan look even worse against other key global currencies.

Sovereign currencies usually don’t respond well to rate cuts because such moves are associated with economic weakness and lower investment returns. Lower rates also theoretically stimulate increased borrowing, which in turn increases the money supply. And as with most things, rising supply tends to weigh on prices/valuations.

With the dollar currently benefiting from the opposite environment, this helps explain why the USD/CNY exchange rate has recently tilted in favor of the dollar. If these trends continue, the dollar could benefit further, at least in relation to the Chinese yuan.

In addition to cutting key lending rates, it’s believed China will soon announce additional measures, including a potential $140+ billion infrastructure package to help shore up the labor market and stimulate new investment activity.

If these measures do help the Chinese economy get back on track, that could breathe new life into the yuan, and help it recapture some of its recent losses against the dollar. The yuan could also benefit if the U.S. economy falters and the Federal Reserve is forced to adopt a more dovish approach.

However, if the Chinese economy slows further and more aggressive stimulus measures are required, then the yuan could depreciate further, and trigger an even more dramatic move in the USD/CNY exchange rate than what’s already been observed.

For more background on trading the U.S. dollar, check out this installment of Options Live on the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.