ETF Roundup: Top-Performers From the First Half of 2023

Top-performing ETFs so far include the technology, communications and consumer discretionary sectors, as well as thematic ETFs focused on artificial intelligence, cryptocurrencies and electric vehicles

All trading years are unique, but 2023 has been especially interesting because the winners have been screaming higher, while the rest of the stock market has been trading only marginally higher, sideways, or even down on the year.

That’s much different than 2020-2021, when the stock market as a whole rallied into the stratosphere, and 2022, when most stocks traded mostly in negative territory.

The emergence of ChatGPT, and the ensuing artificial intelligence (AI) craze has also been a big factor so far in 2023.

Looking at the major sector ETFs in the S&P 500, the Technology Select Sector SPDR Fund (XLK) has been the best performer in 2023, posting a 43% return year-to-date.

Traditionally, the XLK shares a strong positive correlation with the communications sector, which helps explain why the Communications Services Select Sector SPDR Fund (XLC) has also outperformed in 2023. The XLC is up roughly 40% year-to-date, just behind the XLK.

Another big winner has been the Consumer Discretionary Select Sector SPDR Fund (XLY), which has risen by 36% year-to-date. The rally in XLY has been especially notable, because the consumer discretionary sector doesn’t typically perform that well when the economy is slowing, but it has bucked that trend this time around.

Outside of those three sector ETFs, year-to-date performance in the other major sector ETFs has been fairly benign in 2023, as highlighted in the list below:

- Technology (XLK), +43%

- Communications Services (XLC), +40%

- Consumer Discretionary (XLY), +36%

- Industrials (XLI), +11%

- Materials (XLB), +8%

- Real Estate (XLRE), +4%

- Consumer Staples (XLP), 0%

- Financials (XLF), 0%

- Energy (XLE), 0%

- Healthcare (XLV), -4%

- Utilities (XLU), -5%

Considering the energy sector was the best performer in 2022, it’s no great surprise that the XLE has slowed down in recent months.

However, the underperformance in the utilities sector is another head-scratcher, because utilities have historically performed well when confidence drops in the underlying economy. From that perspective, both the XLU and the XLY appear to be bucking their historical patterns.

That could indicate that investors and traders believe that fears of a recession are overblown. But if a recession does eventually materialize, that would almost certainly weigh on XLY, and potentially provide support to XLU.

The elephant in the room is of course the financial sector. The U.S. financial system was under pressure earlier this year as a result of the regional banking crisis. Year-to-date, the Financial Select Sector SPDR Fund (XLF) is trading flat on the year, but that’s mostly because it’s composed of larger financial institutions.

In contrast, the SPDR S&P 500 Regional Banking ETF (KRE) is down 25% so far this year. That said, KRE has rebounded by about 16% since early May.

Whether or not the XLF and KRE can rally from here will depend heavily on whether the banking crisis is truly over—which could hinge on whether or not a second crisis develops in the commercial real estate sector.

Top-performing ETFs From H1 2023

Looking beyond the sector ETFs, there were plenty of big winners from the broader ETF universe during the first half of 2023.

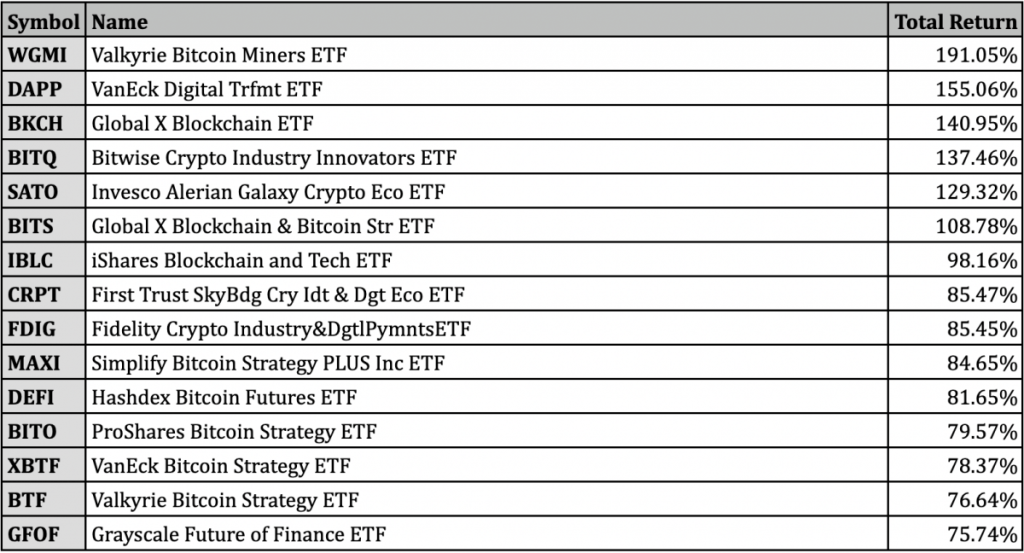

But due to the 80%+ year-to-date rally in bitcoin, most of the top-performing ETFs in H1 2023 were bitcoin or crypto-focused.

Source: TheStreet.com

For investors and traders bullish on bitcoin, it’s undoubtedly been a great year. But as evidenced by sky-high returns in stocks such as Nvidia (NVDA) and Tesla (TSLA), bitcoin hasn’t been the only big winner this year.

The list below highlights some of the other top-performing ETFs in 2023, outside of the crypto sector:

- ARK Next Generation Internet ETF (ARKW), +77%

- ARK Fintech Innovation ETF (ARKF), +68%

- ARK Innovation ETF (ARKK), +63%

- Simplify Volt RoboCar Disruption and Tech ETF (VCAR), +60%

- AXS Esoterica NextG Economy ETF (WUGI), +57%

- VanEck Semiconductor ETF (SMH), +57%

- SoFi Social 50 ETF (SFYF), +54%

- iShares Semiconductor ETF (SOXX), +52%

- AOT Growth and Innovation ETF (AOTG), +52%

- Invesco PHLX Semiconductor ETF (SOXQ), +52%

- iShares US Technology ETF (IYW), +50%

- Fidelity Blue Chip Growth ETF (FBCG), +47%

- Pacer Data and Digital Revolution ETF (TRFK), +47%

- First Trust S-Network Future Vehicles & Technology ETF (CARZ), +45%

The above list hammers home just how popular innovation and technology have been in the financial markets this year. That’s underscored by the strong rebound in Cathie Wood’s family of “ARK Invest” ETFs, which are heavily focused on disruptive innovation.

The Fidelity Blue Chip Growth ETF (FBCG) also fits like a glove with that theme, because it counts most of the stock market’s best 2023 performers among its ranks, including Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA).

This group of stocks was recently dubbed the “Magnificent Seven” by CNBC’s Jim Cramer, which was seemingly a nod to the well-known Western movie of the same name.

In addition to bitcoin and AI, another key niche attracting investor attention in 2023 has been electric vehicles (EVs). Two of the outperformers highlighted above focus on this segment of the broader technology sector, including CARZ and VCAR.

The SoFi Social 50 ETF (SFYF) is also notable in 2023 due to its rather unique investment approach. The SFYF is composed of the companies that are most widely held by members of the SoFi Active Invest community. The SFYF therefore contains the Top 50 U.S. companies as measured by the number of accounts that invest in that stock.

Based on the 50%+ return in SFYF so far this year, it appears that “following the crowd” has been a successful approach of late, alluding to the rising power of social media in the trading and investment industry.

To learn more about actively trading ETFs, check out this installment of Options Jive on the tastylive financial network. To follow everything moving the markets this summer, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.