The Past as Prologue

History holds the key to predicting the future—just not the way you would expect

Luckbox has been publishing an annual forecasting issue for four years. That’s why I was running out of ideas for yet another column on the subject when I spied a seemingly innocuous message on FinTwit.

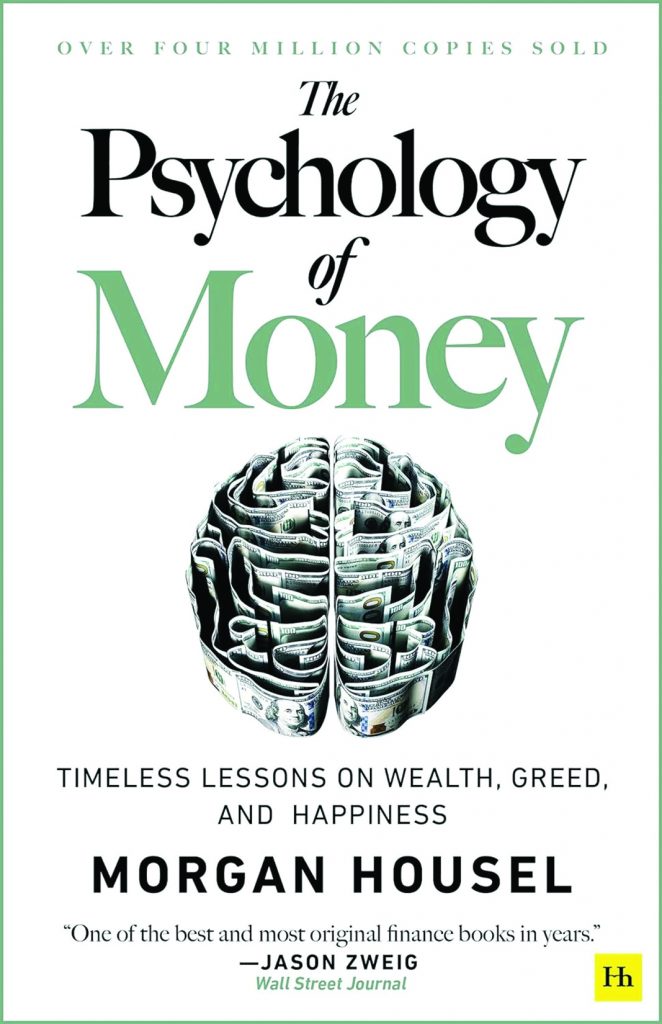

It was about a new book by Morgan Housel called Same as Ever: A Guide to What Never Changes. Perfect, I thought, I’ll just skim this woo-woo financial book, crank out some prose and be on my way.

Let me tell you I wasn’t prepared for how this book contorted my brain in such a good way. A book about what never changes can change your life.

Not the only constant

I wasn’t familiar with Housel, but his previous book, The Psychology of Money, has sold more than 4 million copies. My Jerome Powell/Janet Yellen fanfic, Rising Rates, Rising Passion, has sold only four copies, so points there to Housel.

On the exact day Same as Ever was published, Spotify (SPOT) announced a new benefit for premium subscribers—15 hours of audiobooks a month. I hit play and was immediately drawn in.

Housel divides his book into short, themed sections providing historical context to buoy the premise. He writes that “change captures our attention because it’s surprising and exciting, but the behaviors that never change are history’s most powerful lessons because they preview what to expect in the future.”

It’s not that old chestnut about ‘those who fail to remember history are doomed to repeat it.’’ Instead, his thesis is that while we know where we’ve been, we can’t predict where we’re going because what may seem like inconsequential decisions can lead to either magic or mayhem.

Risky business

No one knows what the world will look like in 50 years, Housel writes, but he feels it’s a safe bet people will still respond to greed, fear, opportunity, exploitation, risk, uncertainty, tribal affiliations and social persuasion.

Events—whether they’re social, political or relational—compound like money. Every event spawns offspring, which makes prediction exceedingly difficult. One chapter is titled Risk Is What You Don’t See.

“We’re very good at predicting the future, except for the surprises which tend to be all that matter,” Housel cautions. “If you’re only preparing for the risks you can envision, you’ll be unprepared for the risks you can’t see.”

A desire for wealth and a penchant for certainty

A favorite chapter describes how we’ve become good at showing off wealth and haven’t stopped coveting what we don’t have. He cautions readers to manage expectations in relation to circumstances.

“Money buys happiness in the same way drugs bring pleasure,” Housel writes. “Incredible if done right, dangerous if used to mask a weakness and disastrous when no amount is enough.”

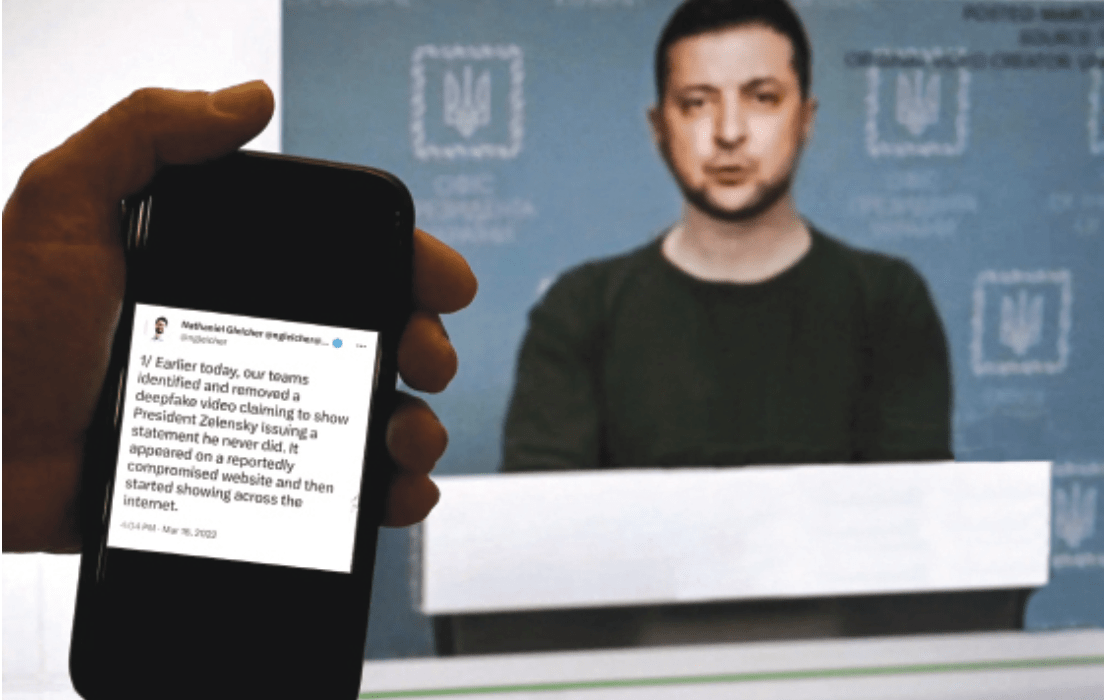

The psychological twistiness continues a few lessons later. “People don’t want accuracy—they want certainty,” he notes. We reject the painful reality of not knowing what will happen next.

Housel quotes forecasting guru Philip Tetlock, writing: “We need to believe we live in a predictable, controllable world, so we turn to authoritative sounding people who promise to satisfy that need. Certainty is so valuable that we’ll never give up the quest for it.”

Who does your PR?

Another theme is the power of good storytelling. “What do I believe is true but is actually just good marketing?” Housel asks, adding that it’s not the best idea or even the rational idea that wins—it’s whoever tells the best story.

“The valuation of every company is simply a number from today multiplied by a story about tomorrow,” he writes. Lehman Brothers was bad at telling its story, but GameStop (GME) crafted a phenomenal narrative.

Moreover, you shouldn’t base every decision on reason, rationality or fundamentals, Housel advises. “If you relied on data and logic alone to make sense of the economy, you’d have been confused for 100 years straight.” The economy is rooted in emotions—the one quality you can’t predict, measure or model on a spreadsheet.

Cultivating craziness

Calm plants the seeds of crazy, another chapter says. The financial instability hypothesis posits that things are most dangerous when people perceive them to be safest. The only way to test the limits of what’s possible is to venture beyond those limits.

You can find the top only by experiencing a decline on the backside. “Are stocks overvalued? What is Bitcoin worth? How high can Tesla go? You can’t answer these with a formula,” Housel insists. “They’re driven by whatever someone else is willing to pay for them.”

Pack it up, everyone. Nobody knows anything.

Housel also urges caution for investors who want mo’ money but without mo’ problems. I laughed out loud when he quoted Warren Buffett, who said “you can’t make a baby in one month by getting nine women pregnant.” Um, has anyone told Nick Cannon that?

“The question everyone asks is ‘how can I make the highest returns?’ not ‘what are the best returns I can sustain for the longest period of time?’” Housel notes.

He contends that imperfection has its advantages because honing one skill can come at the expense of another. “Cash is an inefficient drag during bull markets and is as valuable as oxygen during bear markets,” he writes.

“Leverage is the most efficient way to maximize your balance sheet and the easiest way to lose everything,” he continues. “Concentration is the best way to maximize returns, but diversification increases the odds of owning a company capable of delivering returns. A little inefficiency is the best spot to be in.”

Same as ever

Housel’s writing never comes off as smug or condescending. He understands the logical fallacies that plague us and how dogmatic financial literature can be. “Nothing is more persuasive than what you have experienced first-hand,” he insists.

But unexpected hardship makes people do the unexpected. “In investing, saying I will be greedy when others are fearful is easier said than done because people underestimate how much their views and goals can change when markets break,” he notes.

Housel urges readers to gut-check their personal time horizons. When are you being patient and when are you just being stubborn?

“Long-term thinking can be a crutch for people who are wrong but don’t want to change their mind,” he contends “I’m just early,” he says we tell ourselves. “Everyone else is crazy.”

Housel advises reframing our view of the mythical long term as a series of short terms. Instead of creating a 10-year plan, we should ask: “How can I endure a never-ending parade of nonsense,” or what I like to call our weekly marketing meeting.

Housel is adamant that his lessons apply to more than investing. It’s what we are taught to believe vs. what we experience.

Here’s one final insight: “The typical attempt to clear up an uncertain future is to gaze further and swing harder to forecast with more precision, more data and more intelligence,” he writes.

“Far more effective, is to do the opposite,” Housel contends. “Look backward and be broad. Rather than attempting to figure out little ways the future might change, study the big things the past has never avoided.”

Vonetta Logan, a writer and comedian, appears daily on the tastylive network. @vonettalogan