Catfish Are Biting in Love and in Money

Separate fact from fiction to reveal the traps set by bogus online daters and fake financial marketers

Imagine that you’re using a dating app and swipe right on a comely lass or rugged fella. You “match” and then the witty banter ensues. A few flirty emojis, some well-placed innuendos, and your heart starts beating fast. Your mind races to the possibilities, and you innocently ask for more information: When can we meet? Do you have any more pics? Is that REALLY you with Sting?

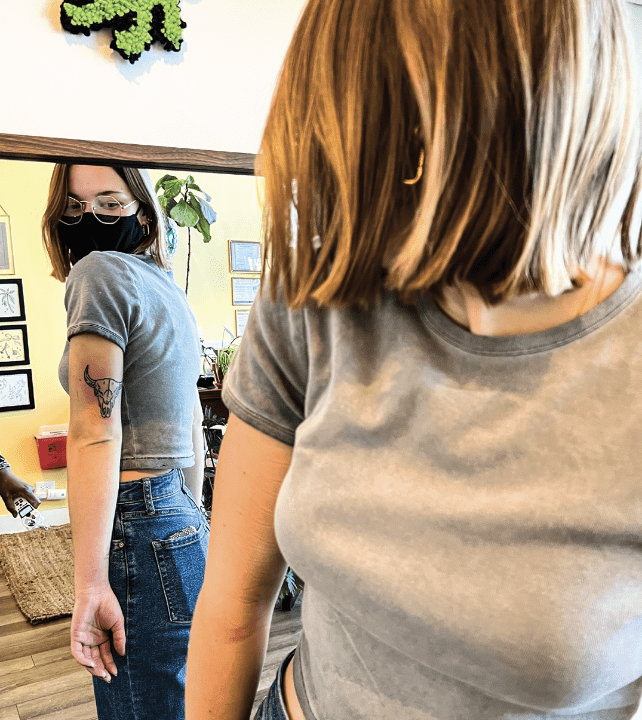

Then the wheels start to come off. Your dream date is nothing more than a catfish, a person using someone else’s identity to lure people into an amorous trap. Your Instagram-ready bikini beauty is really a bored Nebraska housewife, or your rugged beau with the intricate tattoos and sweet chopper is really a 12-year-old kid and you’re now looking at a jail sentence.

Misrepresentation is common in the tech-based dating scene,

but it’s also common in the financial news sector. Retail investors

are getting financially catfished every day. Here’s an accounting

of some of the worst.

Less than zero

Who could forget the seemingly unanimous decision by broker-dealers to reduce commission rates on stock and exchange-traded fund (ETF) trades to zero? The move was hailed as “gamechanging” and “revolutionary” but left many wondering how firms could do it. There’s no such thing as a free lunch, right?

“Commissions have ratcheted down in fits and starts for years,” according to a recent Bankrate article, “but for some brokers, commissions are not the largest part of their business. While they’d prefer not to cut commissions, they have other ways to make up the revenue.”

Charles Schwab, which recently announced its intent to acquire competitor TD Ameritrade, saw revenue generated from trading fall from 15% in 2014 to just 8% in 2018. Most of Schwab’s revenue comes from income on client funds and from asset management. They probably derive revenue from selling clubbed baby seals, but we can neither confirm nor deny that.

So what does “zero commissions” really mean for retail investors?

Catfish revealed:

- Firms have reduced commissions on stocks and ETFs to zero but are still charging for options trades.

- Many brokers are still using legacy technology platforms that are as bloated and slow as you feel after an all-you-can-eat buffet.

- Most brokers have a wide array of “asset management” services. They want to manage you out of your assets. They’re selling your information so they can upsell you later.

- Only 54% of Americans own stocks. Most new investors are reluctant to jump into stocks because equities are at an all-time high and the capital commitment is huge.

Analyze This!

Buy. Sell. Hold. Even if you don’t actively trade, you’re probably familiar with the triumvirate of analysts ratings. Chris Reining, a millennial investor who retired at the age of 37, explains on his site that “countless studies have shown that stock recommendations and the opinions of analysts are of little value to ordinary investors.”

Reining provides details on the intricate dance of patronage. “Institutional investors (hedge funds or mutual funds) need to decide which firm they want to buy their stock research from,” he says, “and they highly value if the firm and analysts have direct access to the management of the companies they cover.” And how do analysts maintain that access? By sucking up to management and making positive remarks and recommendations, even if their “numbers” don’t support it.

Luckbox readers, this reporter is a newly minted trader and recently felt the sting of analyst stupidity. Selling an iron condor, with $5 wide strikes in Roku, was a delta neutral position that followed good tastytrading mechanics. Then, on a day that will live in infamy, Morgan Stanley rated sweet Roku at “underweight” and the stock tumbled 16% in a single day. Roku hadn’t murdered anyone, and as far as we know, Roku doesn’t cause cancer, nor is Roku clubbing baby seals, but an analyst changed the game with a tweet. So how can you protect your sweet, baby trades?

Catfish revealed:

- Analysts are street walkers selling their goods to anyone who wants a taste. Analysts are compensated generously for building relationships with institutional investors, and they maintain those relationships with favorable reviews of companies.

- Analysts aren’t traders! Read any financial site the day after a company beats earnings and watch as all the “upgrades” roll in. Imagine being able to bet on your football team AFTER they win a big game.

- No one knows anything! Probabilities and good mechanics will outperform biased ratings any day of the week valuable Lessons

Valuable Lessons

Get active!

So as we roll into a new year, dear trader, what have we learned? Why should you take a proactive approach to trading and investing?

- Trading makes you a better decision maker in all facets of life.

- People love intellectual challenges and trading provides strategic engagement to those challenges.

- You’ll learn how to use probabilities to assess risk (this one is fun at parties).

- You’ll appreciate finance!

Step away from the herd

And what does active investing do for your portfolio?

- You can craft a portfolio that generates returns independent of market performance.

- You will see volatility as an opportunity instead of a harbinger of uncertainty.

- You can finally experience true, multi-level diversification and not just some half-stock, half-bond charade.

- You can have definitive ranges for probability of profit and manage expectations on order entry instead of worrying that your entire fortune will go down the tubes on a tweet.

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network and hosts the Connect the Dots podcast. @vonettalogan