Fed Tapering Could Push Market Volatility Higher

When the Federal Reserve steps back its accommodative support for the economy, that “tapering” process has at times catalyzed a pop in market volatility.

With prices rising sharply for goods and services in the U.S. economy, the inflation story has captivated Wall Street in recent months.

But going forward, that story may have to share the limelight with another developing economic story—namely the tapering of the Federal Reserve’s assistance to the U.S. economy.

While the two stories are undoubtedly linked, their respective impact on the financial markets isn’t easy to predict, and could be substantial.

As most are well aware, the United States Federal Reserve—the nation’s de facto central bank—acted swiftly last year to assist the American economy during the onset of the COVID-19 pandemic.

Using its full complement of tools (i.e. the Fed bazooka), the nation’s top bankers sought to facilitate growth and confidence during a period of economic shock. And as with the 2008-2009 Financial Crisis, a couple of the most important moves by the Fed involved a quick reduction in benchmark interest rates (i.e. federal funds rate), as well as the deployment of a program known as quantitative easing (aka QE).

Also known as large scale asset purchases, quantitative easing occurs when the Fed purchases securities (typically Treasures and mortgage-backed bonds) to signal their support for the economy to improve liquidity in the system, and to help facilitate the reduction of longer-term interest rates.

The achievement of those goals is viewed as complementary to the reduction of short-term interest rates, which the Fed can achieve by simply cutting the federal funds rate. As illustrated in the chart below, the U.S. federal funds rate was cut to near-zero for the first time ever during the 2008-2009 Financial Crisis, and again during the onset of the corona crisis.

A big question, of course, is when to remove that assistance to the economy—the precise issue that the Fed is grappling with at this time.

Leaving these programs in place for too long can cause the economy to overheat due to excessive inflation. A scenario that’s already come to pass during 2021. But the Fed also has to beware of removing its accommodative measures too early, especially considering that the pandemic isn’t yet “over.”

That’s where the term tapering comes into play.

In order to test the strength of the economic rebound, the Fed can signal its intention to reduce some accommodation, and step back slowly over a long period of time. That way, if there are any setbacks to the rebound, the Fed can quickly reverse course.

In terms of short-term interest rates (i.e. the federal funds rate), the Federal Reserve has already indicated that it won’t start increasing benchmark rates from near-zero until 2023, at the earliest.

The Fed’s intentions for QE tapering are less clear at this time. However, recent public statements by members of the Fed suggest that guidance on the tapering could be forthcoming.

Traditionally, the Fed has lobbed softballs, when it comes to tapering, to help avoid shocks to the system. This time around has been no different, with the Fed starting to sprinkle potential tapering plans around like grass seed on a patchy lawn.

Most recently, the President of the Federal Reserve bank in Dallas—Robert Kaplan—said of the tapering plan, “It would be my view that if the economy unfolds between now and our September meeting … if it unfolds the way I expect, I would be in favor of announcing a plan at the September meeting and beginning tapering in October.”

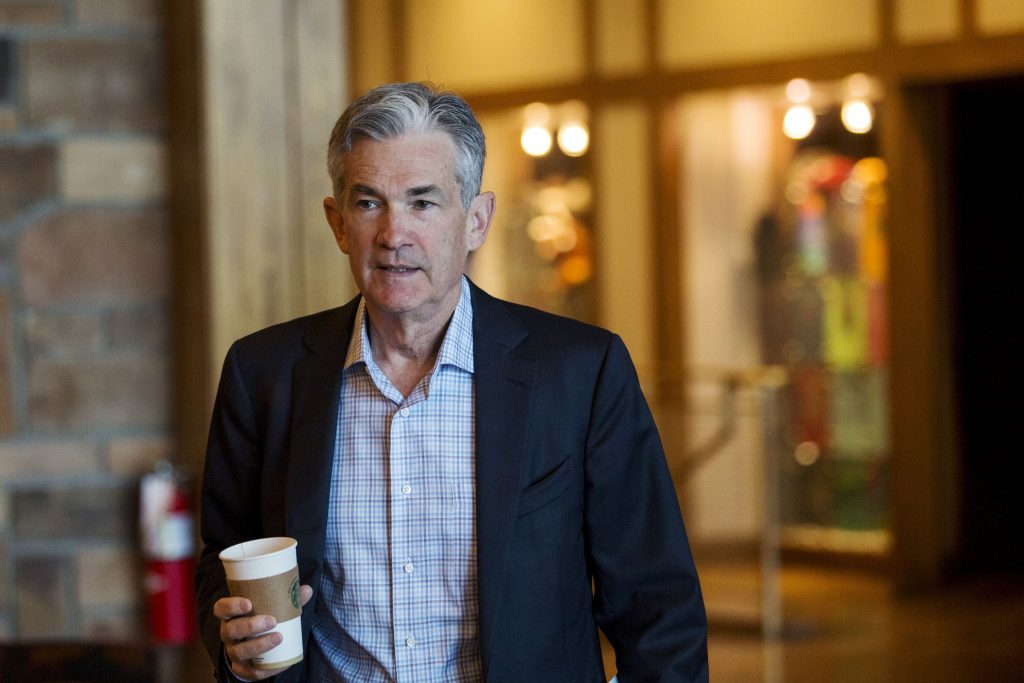

However, that’s only one perspective, and broad consensus across the entirety of the Federal Open Market Committee (FOMC) will be required—not to mention the support of Federal Reserve Chair Jerome Powell—before any official plan is unveiled to the public.

Tapering is considered an important and sensitive topic due to its potential impact on the financial markets.

Since July of last year, the Fed has been buying $80 billion of Treasury securities and $40 billion of agency mortgage-backed securities (MBS) every month as part of its QE program. Tapering would involve a slow, steady reduction in those purchases, ending ideally with a complete QE step-back by the Fed.

Of course, there’s no perfect way for the Fed to exit such a massive accommodation—especially with new variants of COVID-19 currently complicating global efforts to eradicate the virus through mass vaccination programs.

The pandemic’s exacerbation of the global wealth gap is another big consideration that can’t be overlooked by the Fed. Research suggests that the wealthy have mostly seen their situations improve since the onset of the pandemic, while many others in the U.S. and abroad have seen their lives and livelihoods devastated by the pandemic.

That bifurcated economic reality doesn’t make the Fed’s decision any easier.

Considering the multitude of factors in play, a bout of market volatility wouldn’t be unexpected during the initial stages of tapering, once they are made public. In the wake of three rounds of tapering from 2008 to 2012, the global financial markets experienced a sharp rise in volatility during the summer and fall of 2013 when tapering plans for the Great Recession were first unveiled.

While that period is known as the “taper tantrum,” the impact on the markets was more minimal in hindsight, as market valuations ultimately turned higher. In the wake of the previous crisis, the Fed started tapering in December of 2013, and officially ended QE in October of 2014—nearly six years after the stock market bottomed.

This time around, it appears that tapering will occur much earlier in the cycle.

With broad market indices currently at all-time highs, it wouldn’t be shocking to see market volatility pick back up at some point during the tapering process, especially given that other market indicators—such as the Buffet Indicator—are currently flashing red.

Readers seeking to learn more about those indicators are encouraged to review a new installment of Options Jive on the tastytrade financial network.

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.