Global Fintech Stocks Correct Sharply on European Slowdown

Global fintech stocks have been under pressure in Q3 after disappointing earnings announcements out of Worldline (WRDLY) and Paycom (PAYC)

- Global fintech stocks are in focus after two European companies from this sector posted disappointing Q3 earnings results.

- Over the last two weeks, shares in both Worldline (WRDLY) and Paycom (PAYC) corrected sharply in the wake of earnings.

- So far, American fintechs such as Block (SQ) and PayPal (PYPL) have fared slightly better, but that could change if the U.S. economy falls into recession.

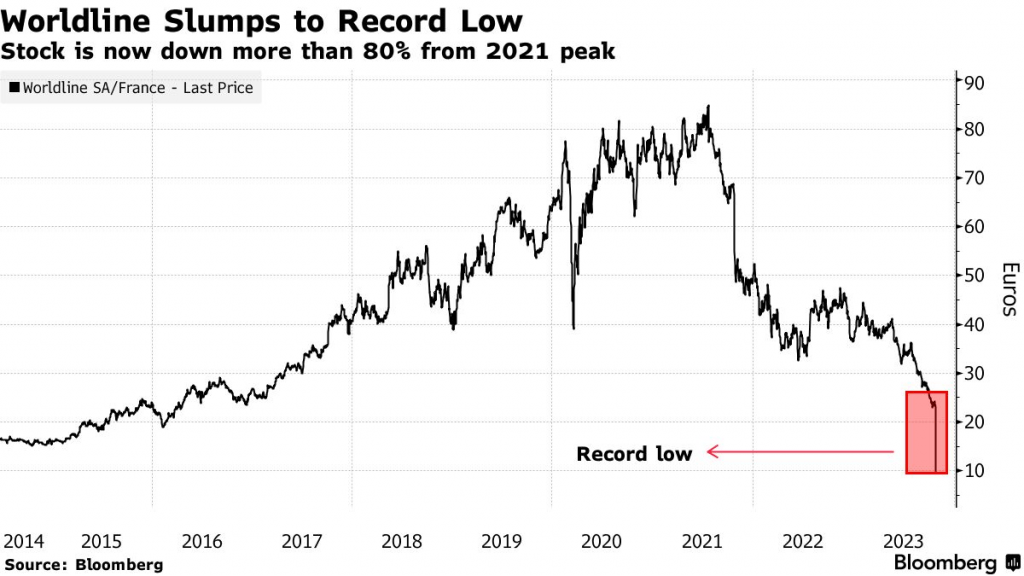

Already under pressure the last couple of years, the fintech sector sprung another leak on Oct. 25, when Worldline (WRDLY) reported disappointing Q3 earnings results.

Aside from guiding down its full-year earnings forecast, Worldline revealed that its operating margins were falling, contradicting the company’s previous guidance. Moreover, Worldline signaled that organic sales growth would be lower than expected for the foreseeable future.

Worldline attributed weaker-than-expected earnings guidance to slowing economic conditions in Europe.

Reactions in the marketplace were immediate and decisive, with shares of WRDLY correcting by about 60% in the wake of earnings. During the last 52 weeks, Worldline stock has now dropped by just under 80%, falling from $21.50/share all the way down to $7.30/share.

With the financial sector already on fragile footing due to the ongoing regional banking crisis, it wasn’t surprising to see investors and traders flood the Worldline exit doors. Year-to-date, the well-known regional banking ETF—the SPDR S&P Regional Banking ETF (KRE)—is down more than 25%.

Worldline is headquartered in France, so payments companies with concentrated exposure to Europe saw the biggest declines on Oct. 25. For example, shares of Nexi SpA (NEXI)—a payments company based in Italy—were down 13% on Oct. 25, and are down nearly 32% over the last 52 weeks.

In the United States, well-known payments companies such as Block (SQ) and PayPal (PYPL) also took a hit. Shares of SQ were down roughly 7% on Oct. 25, while shares in PYPL were down about 4.5%. Unfortunately, the problems at Worldline appear to be only the tip of the iceberg.

On the evening of Oct. 31, another payments provider—Paycom (PAYC)—also released disappointing Q3 results. The next day, shares in PAYC were down 40%, slumping all the way from $245/share to $150/share.

Revenue growth at Paycom clocked in at a healthy 21% in Q3, but much like Worldline, the company’s forward guidance was worse than expected, triggering further downside in the broader fintech sector.

One of Paycom’s comparables—Paylocity (PCTY)—has dropped by about 20% since Paycom reported earnings on Oct. 31. And the fintech-focused ARK Fintech Innovation ETF (ARKF) is down about 17% since peaking above $24/share at the end of July.

2023 performance in the broader fintech sector:

- Affirm (AFRM), +146%

- Upstart (UPST), +135%

- SoFi (SOFI), +78%

- Futu (FUTU), +55%

- UP Fintech (TIGR), +49%

- Ark Fintech Innovation ETF (ARKF), +42%

- Flywire (FLYW), +19%

- nCino (NCNO), +12%

- Payoneer Global (PAYO), +5%

- Global X FinTech ETF (FINX), +3%

- Toast (TOST), 0%

- Shift4 Payments (FOUR), -8%

- Marqeta (MQ), -10%

- Green Dot (GDOT), -23%

- Fidelity National (FIS), -24%

- Paylocity (PCTY), -25%

- PayPal (PYPL), -25%

- Lending Tree (TREE), -25%

- Block (SQ), -25%

- Adyen (ADYEY), -45%

- Paycom (PAYC), -48%

- Worldline (WRDLY), -63%

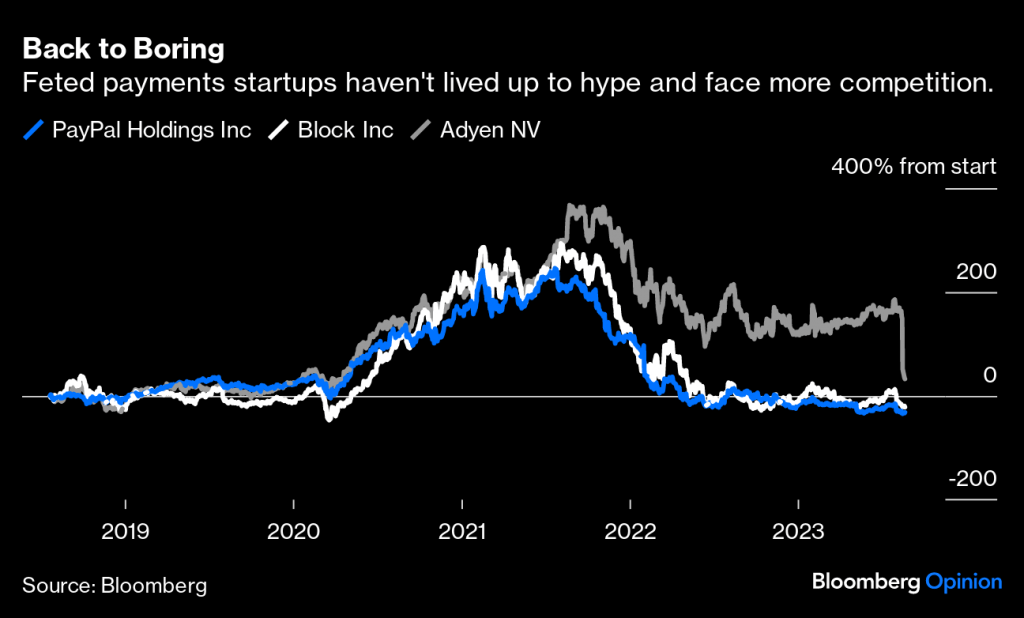

The Correction in Payment-Focused Fintechs Started Back in 2021

Q3 earnings haven’t been good for payments-focused fintechs, but the pullback in this sector started well before 2023.

For example, Block (SQ) has seen its shares decline by 34% in 2023, but since August of 2021, shares in Block have slumped by a jaw-dropping 82%. Interestingly, however, Block released its own Q3 earnings report on Nov. 2, and appeared to buck the broader trend.

Somewhat unexpectedly, Block reported better-than-expected revenues and earnings during its most recent quarter. And in contrast to Worldline and Paycom, Block actually raised its full-year guidance, suggesting the company may be in the midst of a subtle turnaround.

Shares of Block have been under pressure since the company acquired Afterpay in 2021 for $29 billion. The integration of Afterpay has been bumpy, with many pundits suggesting that Block paid way too much for an acquisition that’s actually added an outsized degree of credit risk to the combined enterprise.

In the first half of this year, Block reported roughly $310 million in consumer loan losses, up from $69 million during the first half of 2022.

As if all that wasn’t enough, Hindenburg Research released a short report on Block earlier this year which alleged rampant misuse of the company’s Cash App, which Hindenburg argued was attributable to inadequate oversight at Block. Moreover, Hindenburg alleged that Block had “overstated its genuine user counts and has understated its customer acquisition costs.”

Considering all of the aforementioned negatives, it’s a bit easier to understand why Block shares are trading near multi-year lows.

Interestingly, PayPal (PYPL) also reported better-than-expected earnings on Nov. 2. Revenues at Paypal rose by about 8% as compared to the year prior. On top of that, total payment volumes also increased by 15%.

Better than expected Q3 earnings at Block and PayPal likely stem from continuing strength in the U.S. economy, which grew by 4.9% in Q3. In contrast, the Euro region registered flat growth of 0% in Q3, which probably helps explain why American payment providers outperformed their European counterparts.

It should be noted, however, that despite the recent earnings beat, shares in PayPal are down more than 80% since July of 2021, mirroring the returns in Block over that same period.

One of the main complications for PayPal was the decision by Ebay (EBAY) to replace PayPal with Adyen (ADYEY) as its preferred payments provider. An especially surprising turn of events given that Ebay is the former parent company of PayPal.

That said, shares in Adyen haven’t fared much better than Block and PayPal, especially of late. So far in 2023, shares in Adyen have declined by about 45%, as highlighted below.

The Onset of a Recession in 2024 Could Weigh on American Fintechs

For longterm holders of Block and PayPal, the recent Q3 earnings reports were no doubt welcome surprises.

However, with the Euro economy already softening, and the U.S. economy expected to follow suit, it seems likely that American payment providers will experience a drop-off in business activity at some point in late 2023, or early 2024.

Underscoring those risks is the fact that PayPal’s forward guidance was lighter than expected, despite the company’s Q3 earnings beat. In Q4, analysts were expecting earnings of about $1.40/share, but PayPal recently guided those down to about $1.36/share.

Block painted a slightly rosier picture for ongoing revenue and earnings in Q4, but if the U.S. economy does indeed slow down in H1 2024, it’s difficult to imagine a scenario where PayPal’s business is negatively impacted and Block’s isn’t.

Shares in both companies are down significantly since the middle of 2021, but that doesn’t mean they offer significant value at this juncture. With the risk of a U.S. recession looming, it’s probably better to wait and see at this time, as opposed to establishing new long positions in Block or PayPal.

Right now, buying shares in either company feels similar to trying to catch a falling knife. Especially considering the recent corrections in shares of Worldline and Paycom.

Even if the U.S. economy avoids recession in H1 2024, GDP growth probably won’t be robust, which means the risks in the fintech sector probably outweigh the potential rewards at this time.

However, if the share prices do correct further, and the economic outlook for the U.S. economy improves, it might be worth revisiting potential share purchases in Block and PayPal.

To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.