El Nino Threatens Coffee Crops, Prices Trading Near Record Highs

After a strong rally in 2022, coffee prices have climbed further in 2023 due to the increased threat posed by El Nino weather conditions, which could ravage coffee crops in South America and Asia.

Somewhere north of 2 billion cups of coffee are consumed globally on a daily basis, making coffee one of the most popular commodities on earth.

Coffee’s key role in the global economy has likely never been more apparent than in 2023—prices have chugged to fresh record highs this year, despite the purported cooling of record inflation.

But, prices aside, another big concern in the coffee industry is the return of El Nino. On June 8, the National Oceanic and Atmospheric Administration (NOAA) announced that El Nino had returned and that it was expected to strengthen in the coming months.

El Nino typically emerges when warmer-than-average temperatures are observed on the surface of the Pacific Ocean. The impact of El Nino can vary by region, but from the perspective of the coffee industry, this often results in either the increased potential for drought or the increased potential for destructive storms—both of which can devastate coffee crops.

Later in 2023, Brazil is consequently expected to battle an intense drought, with overall harvests now expected to be worse than previously forecasted. Those same issues are also expected to hit coffee-growing areas in southeast Asia.

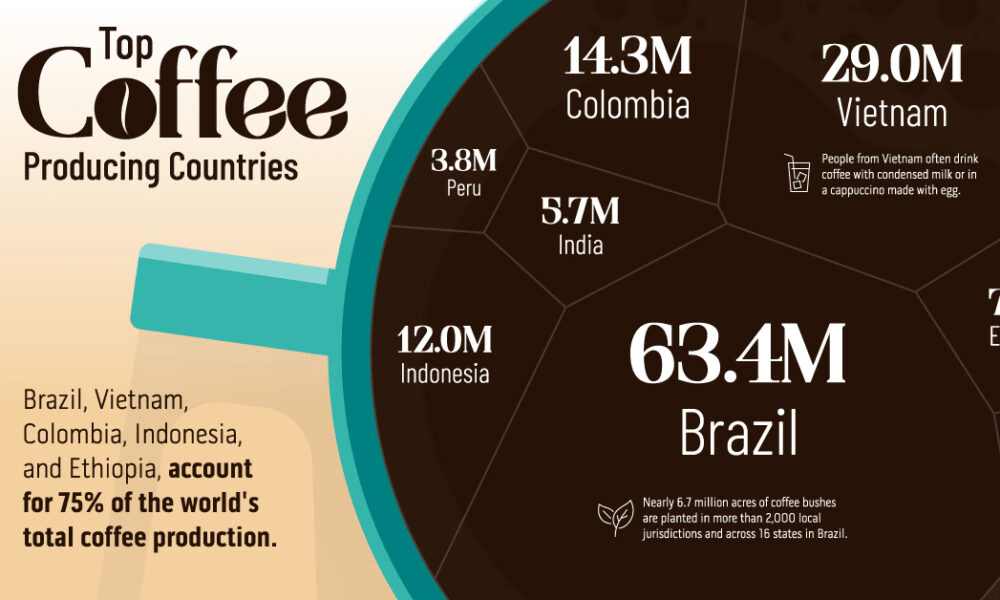

So, coffee harvests in four of the top coffee exporting countries—Brazil, Colombia, Indonesia and Vietnam—could see a material impact from El Nino in 2023 and 2024.

Source: visualcapitalist.com

The headwinds facing the coffee industry in 2023 were recently underscored by Fitch’s BMI unit, which said of the current situation, “The now widely expected transition to El Nino conditions in the third quarter of 2023 has fueled fears of reduced production in Vietnam and Indonesia, both major Robusta coffee producers.”

The report further highlighted that rainfall in Vietnam could pull back by 25%-50% in the latter half of 2023 and early 2024, which will undoubtedly impact its coffee harvest. In 2022, Vietnam exported roughly 1.7 million tons of coffee, bringing in nearly $4 billion in export revenue.

Moreover, the impact of El Nino is likely to extend beyond just the coffee market. On June 14, Citibank raised its price forecasts for both sugar and cocoa in 2023, citing weather risks as one of the primary risks to the supply side of those markets.

That means global coffee drinkers probably won’t see relief at the cash register anytime soon. However, record prices could serve as an opportunity for producers, as well as for investors and traders active in this niche of the financial markets.

The cost of a cup of Joe

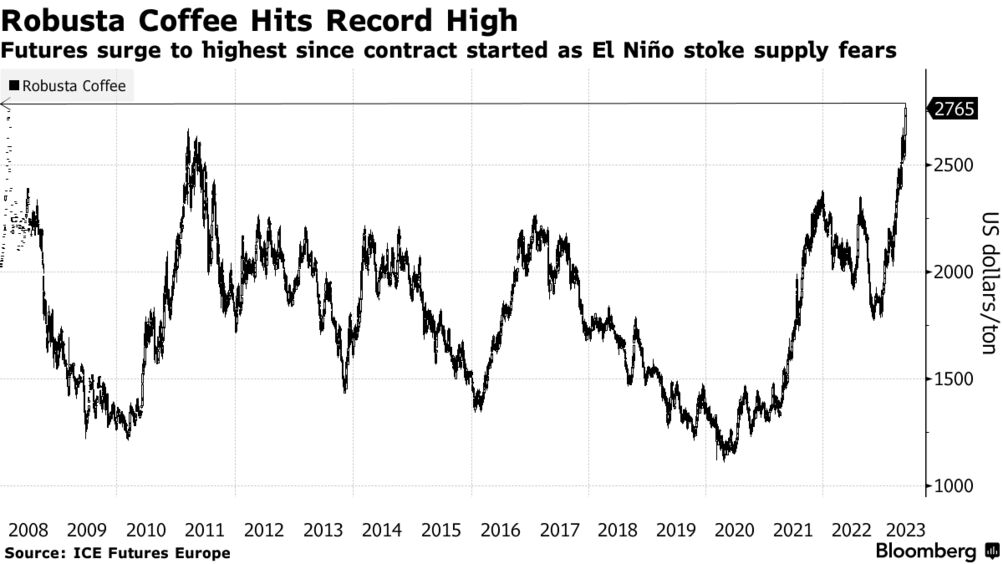

So far in 2023, the average price of Robusta coffee has risen by roughly 30%, and isn’t expected to pull back anytime soon.

In the coffee world, Robusta beans are the most widely grown, and known for their high levels of caffeine. Arabica, on the other hand, is known to be more aromatic, with less caffeine, and more limited in supply.

For these reasons, Arabica beans have traditionally traded at a considerable premium to Robusta beans. For example, at some points in this 21st century, Arabica has traded for more than twice the price of Robusta.

However, as Arabica has gotten increasingly expensive, more and more coffee roasters have been mixing a higher percentage of robusta beans into their grounds. This is a strategy that’s intended to minimize expenses in order to protect profit margins—roasting has long been one of the most profitable parts of the overall coffee supply chain.

As a result, demand for Robusta has actually grown at a faster rate than Arabica as of recently, and that trend has translated directly to global commodities markets. These days, Robusta is trading for roughly $2.70/kilogram, which is up from $2.11/kilogram at the start of 2023.

In comparison, the same kilogram of Robusta was trading for $1.42/kilogram back in June 2020. That means Robusta prices are up nearly 30% year-to-date, and up some 90% since June 2020.

Considering that level of explosive price growth, it shouldn’t come as much of a surprise to hear that some retailers have likewise been forced to raise prices, and also add anti-theft measures to retail coffee products.

In the UK, for example, Pret A Manger recently raised the prices of lattes, cappuccinos and flat whites from £2.95 to £3.30, or by 12%. Moreover, some retailers have even started outfitting their coffee products with anti-theft tags.

Shortages contribute to rising coffee prices

In addition to the rising demand for Robusta coffee beans, there have been several key supply-side issues that have also contributed to higher prices.

For example, in 2021, many growers in Brazil saw lower-than-expected harvests due to a widespread drought. Brazil produces nearly a third of the world’s total annual Robusta crop, so that development rippled through the global supply chain. By early 2022, global coffee reserves had dwindled to the lowest levels observed in 20 years.

Supply shortages like this are often bullish for the market, and it’s been no different in the coffee industry. With less inventory in the market, coffee buyers have been frantically bidding up prices, which is why Robusta futures prices reportedly touched an all-time record in early June.

On June 9, the Robusta contract on the ICE Europe Futures exchange traded for $2,785/metric ton, which is the highest price on record. That was attributable not only to low inventories, but also because forecasts for the 2023 and 2024 harvests have been moving lower.

To track and trade the coffee industry, readers can add the following tickers to their watchlists: Black Rifle Coffee Company (BRCC), Dutch Bros (BROS), Farmer Bros (FARM), Keurig Dr Pepper (KDP) and Starbucks (SBUX).

To learn more about trading coffee futures, check out this installment of Futures Measures on the tastylive financial network. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.