What You Need to Know About the Recent Shift in the Yield Curve

A look at the gauge that suggests a 2024 recession would be mild

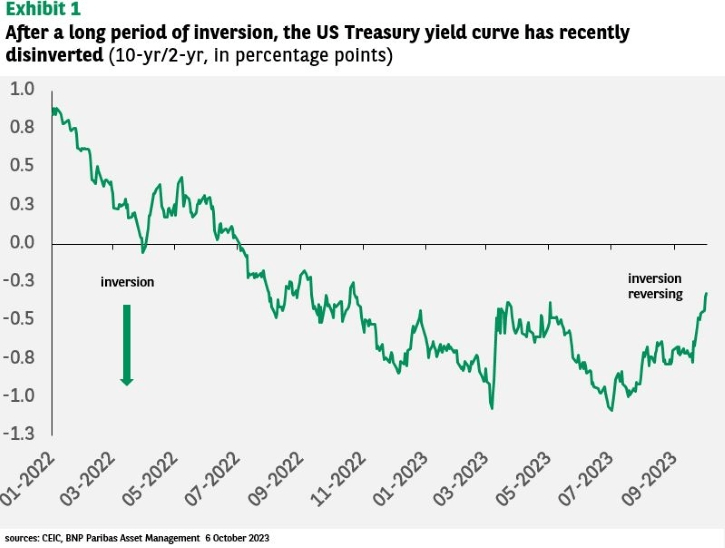

- The U.S. yield curve has been inverted since July 2022.

- In the past, yield curve inversions have often preceded economic recessions and depressions.

- Recently, the yield curve has become less inverted, with the inversion between the 2-year Treasury yield and the 10-year Treasury yield shrinking from over 100 basis points, back down to about 30 basis points.

A recession remains on the horizon, but a key gauge on Wall Street now projects it could be a mild contraction in the economy, as opposed to a sharp one.

That’s according to a recent shift in the U.S. yield curve, which is a key resource that investors and traders use to monitor interest rates. The yield curve shows how interest rates vary across different maturities in time.

Changes in the yield curve are often used like tea leaves to project potential implications for the underlying economy. And as many investors and traders are probably aware, inversions in the yield curve—when long-term interest rates slump below short-term interest rates—have traditionally preceded recessions/depressions.

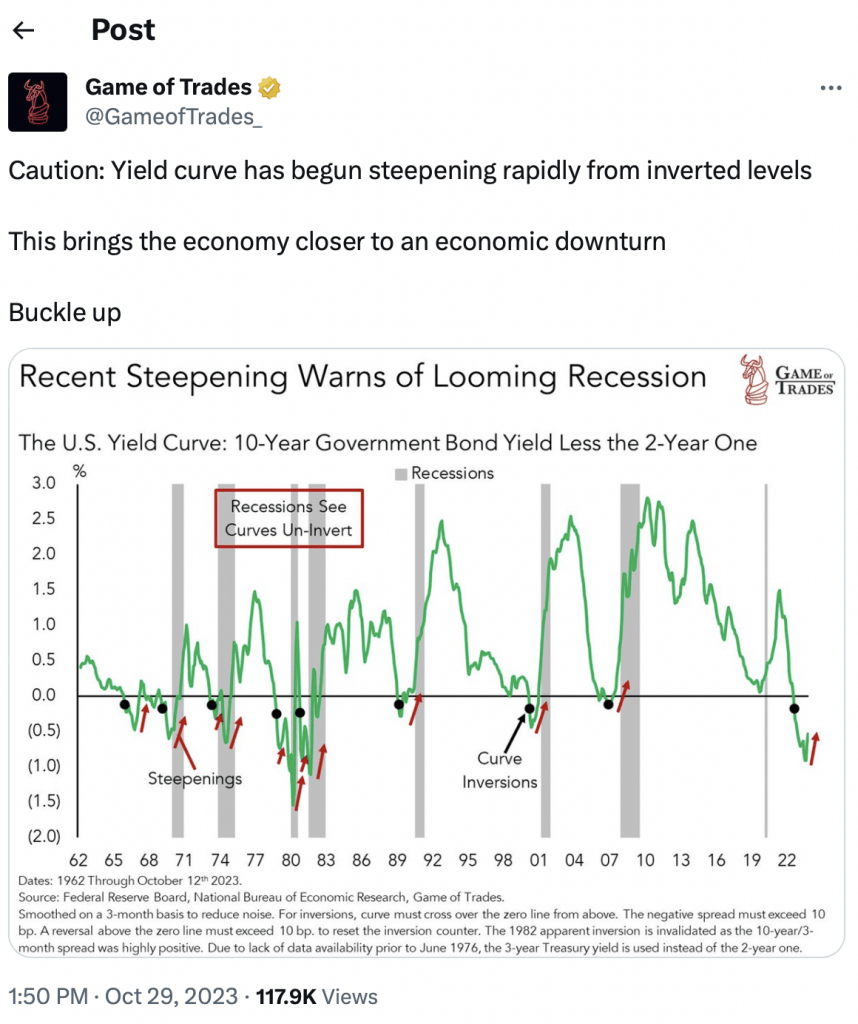

Last year, the yield curve began to invert in July, which appeared to signal that a recession was on the horizon. However, fast-forwarding to the present, that recession still hasn’t materialized. Current projections suggest it may finally materialize in H1 2024.

Hope for a Pullback

That said, there’s fresh hope that it could be a mild pullback, as opposed to a sharp one. That’s according to the aforementioned recent shift in the yield curve, which is known as a “bear steepener.”

In effect, this term describes a normalizing of the yield curve, eventually bringing long-term rates back above short-term rates. For context, a “normal” yield curve is characterized by higher long-term rates, relative to short-term rates, as illustrated below.

With the yield curve currently inverted, the steepening process typically marks the shift back toward a “normal” yield curve, and this commonly plays out in two different ways.

At times, the steepening manifests with short-term rates dropping more quickly than long-term rates (e.g. a “bull steepening”). And other times, the steepening plays out with long-term rates rising more quickly than short-term rates (e.g. a “bear steepening”).

Both patterns ultimately result in a steeper yield curve. However, it’s important to differentiate between the two, because each respective process can indicate something different about the economy.

In the case of bull steepeners, short-term rates often crash due to rising expectations that the U.S. central bank will imminently cut interest rates. And that usually occurs when the economy is under extreme duress. For this reason, bull steepeners are commonly associated with sharp pullbacks in the economy.

On the other hand, a so-called bear steepener—which is what’s been observed recently—occurs when long-term rates rise more quickly than short-term rates. Under this scenario, expectations for an imminent rate cut are reduced. Moreover, the rally in long-term rates can be indicative of an emerging expectation that the economy will hold up better than expected.

Why This Shift in the Yield Curve Suggests a Future Recession Could Be Mild

Another important consideration during a steepening of the yield curve is the severity of the shift.

Historically, extreme steepenings of the yield curve have preceded significant pullbacks in the economy. On the other hand, historical data suggests that moderate steepenings of the yield curve have resulted in milder recessions, or the avoidance of recession altogether.

According to historical data analyzed by Lord Abbett, bull steepeners tend to be more severe than bear steepeners. As such, bull steepeners have often resulted in recessions, whereas bear steepeners have not.

For context, bull steepenings in the yield curve (involving 2-year Treasury yields and 10-year Treasury yields) have averaged about 220 basis point, whereas bear steepeners have averaged only 75 basis points.

In recent weeks, the inversion between the 2-year Treasury and the 10-year Treasury has moderated by about 78 basis points—right on par with past bear steepeners. Today, the inversion between the two yields is about 30 basis points, which is far less than the steep inversion (more than 100 basis points) that was observed earlier in the year, as illustrated below.

The shift highlighted above may help explain why the S&P 500 rebounded recently, and has rallied by about 6% since Oct. 27. It’s possible that investors and traders have read the tea leaves, and are hoping that a potential 2024 recession—if one does materialize—will be garden variety in nature.

Obviously, past performance doesn’t guarantee future results. And the recent bear steepening of the yield curve is only one indicator—there’s no guarantee that the U.S. economy will avoid a sharp recession in 2024.

On the other hand, the current degree of steepening in the yield curve—which effectively represents a normalizing of the yield curve—does match up with previous instances in which the economy avoided sinking into severe recession.

Importantly, the yield curve is ever-changing, and could experience another seismic shift before the current cycle is complete. For this reason, investors and traders should closely monitor changes in the yield curve in the coming months, to stay abreast of ongoing expectations for the economy.

To learn more about interest rates and their role in the economy, readers can check out this recent installment of In This Economy on the tastylive financial network. And to follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Hungry for more? The next issue of Luckbox is food-focused looking at new growth opportunities and trading ideas in food, beverage, agricultural, hospitality and grocery stocks. Not a subscriber? Subscribe for free at getluckbox.com.