Influencers: The New Pump & Dump Cons

When 50 wealthy parents from eight states were indicted for allegedly using a Brinks truck full of bribes to get their shockingly average spawn into the nation’s elite universities (and the University of San Diego), the Twittersphere was awash in jokes. “Aunt Becky’s going to jail,” some online comedians wrote. “Man, these housewives sure are desperate,” wrote others. What got lost in the shuffle, however, was how federal authorities caught on to the biggest college-admissions scam ever.

According to the Wall Street Journal, “Morrie Tobin, a Los Angeles financial executive who was being investigated in….an alleged pump and- dump investment scheme… offered a tip to federal authorities in an effort to obtain leniency.”

Ah, pump-and-dump. It could be the tagline of dating apps like Tinder and Bumble, but it’s a scam as old as time: boy meets stock, boy “hypes stock” by endorsing it and getting others to invest, boy sells stock at higher price, boy never calls stock again. It’s essentially a financial ghosting.

It seems Tobin didn’t like being the object of a shakedown by a Yale women’s soccer coach, so he sang like a canary to the Feds. (Tobin’s no financial savant, by the way, having tried to sell pharma stock by not registering it.) Anyway, the admissions scandal has once again focused the financial spotlight on pump-and dump schemes. And there’s no better topic for luckbox fake financial news than an oldie but goodie scam.

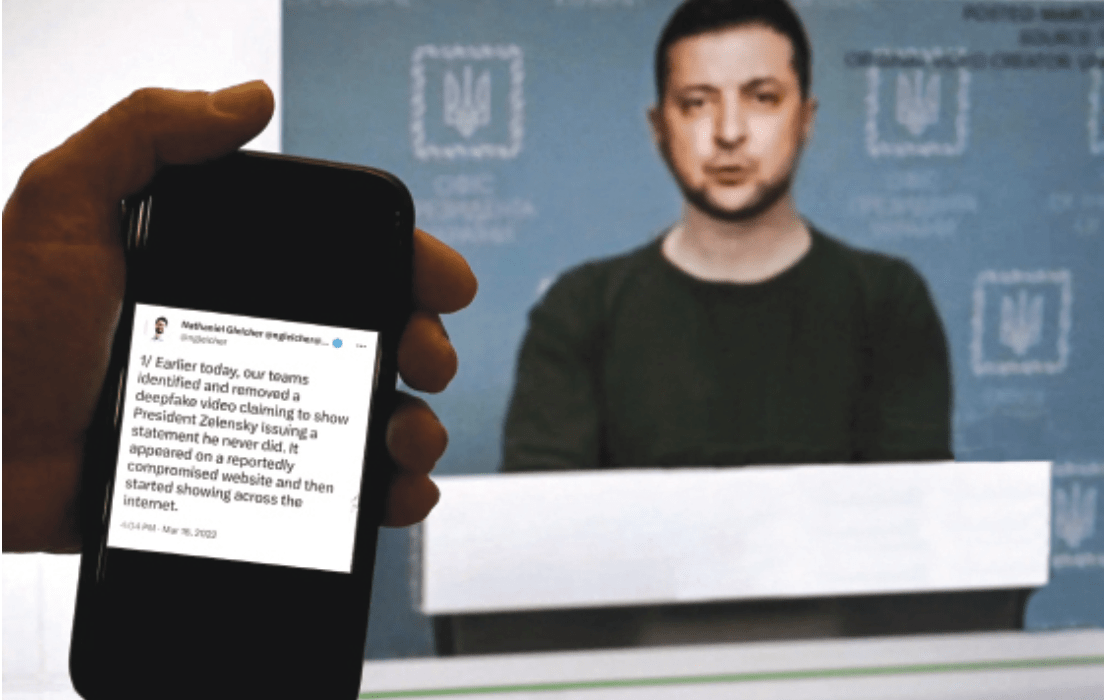

Con game goes digital

Today, a pump-and-dump scheme reaches victims through an Instagram feed instead of in the leather-ensconced locker room of the Good Ol’ Boys Club.

Gone are the days of charlatans, confidence men and traveling purveyors of snake-oil. Welcome to the era of the influencer. A blonde in a teeny bikini posting #fitspiration advice while hawking #flatbellytea quickly makes more money than most people see in a lifetime. Imagine her commanding her manservant, Timba, to read an article like this aloud whilst spraying her with sunless tanner.

The digital age is perfect for digital manipulation. On average, at least two pump-and-dump schemes occur every day, generating $7 million in daily trading volume, according to a study at Imperial College London of 236 pump-and-dump schemes in the crypto space. Bloomberg News cited another study, “The Economics of Cryptocurrency Pump and Dump Schemes,” by researchers at the University of Tulsa, University of New Mexico, and Tel Aviv University, that “identified 4,818 so-called pump-and-dump attempts between January and July.” Researchers called the fraud “widespread and often quite profitable,” Bloomberg said.

Trading on fame

How about a legendary boxer and a DJ known for pumping up the jams becoming embroiled in a tussle with the Securities and Exchange Commission over an Initial Coin Offering (ICO) pump-and-dump imbroglio? In November 2018, Deeeeee JAAAAAAY Khaled (sorry there’s no way to write that without having his voice in your head), and retired professional pugilist Floyd Mayweather settled out of court with the SEC but racked up a combined $767,520 in fines for failing to disclose the payments they received for promoting ICOs on their social media channels. The case centered on a cryptocurrency platform called Centra. According to Forbes magazine, “Centra promised investors that funds raised in the ICO would be used to build…a debit card backed by Visa and Mastercard that would enable users to convert thinly traded cryptocurrencies into U.S. dollars.” The card was a scam, but Mayweather and Khaled weren’t charged with fraud. They were accused of “failing to disclose the fact that they were paid to promote Centra’s ICO.” So two multimillionaires get a slap on the wrist and then go about their day while investors get fleeced.

Even more ludicrous, stock shenanigans are now working in reverse on the new digital pump-and dump frontier. Yes, child, let luckbox introduce you to an epic pump-and dump scheme. Kylie Jenner, the world’s youngest self-made billionaire is known for inflating her lips while deflating stock prices.

In February 2018, Jenner tweeted, “Sooo does anyone else not open Snapchat anymore? Or is it just me….ugh this is so sad.” Then, faster than the Kardashian clan can flock to a camera, Snapchat’s stock (SNAP) lost $1.3 billion in market value. From there, it continued to decline. Jenner tried to ameliorate the situation by tweeting, “Still love you tho snap….my first love.” A year later, Snap shares were still down 50% from BK…before Kylie. For more on Jenner, click here.

The celeb puffery doesn’t end there. In 2015, billionaire media mogul and boss of housewives everywhere, Oprah Winfrey, joined the board of Weight Watchers (WTW) and took a 10% stake in the company, causing the stock price to double in a single day. Subscribers got Winfrey’s cauliflower pizza! Her ability to recruit subscribers powered Weight Watcher’s stock to a record high of more than $100 per share in July 2018.

But since those magical days, Winfrey hasn’t been, ahem, pulling her weight. WTW is down about 80%, and Winfrey unloaded some of her shares before the stock started to trim the fat.

On average, at least two pump-and-dump schemes occur every day, generating $7 million in daily trading volume.

The power of influence

In this day and age, influence is its own currency and it’s trading at all-time highs. According to an article in Wired magazine, “becoming a social media star is the fourth most popular career aspiration for Gen Z, ranking well above actor or pop star.” Mama don’t let your kids grow up to be cowboys….er, YouTubers.

The American lexicon now includes the words “influencers,” “micro-influencers” and “pet-influencers.” People are taking notice everywhere, from college campuses to local juice bars. Nothing happens by accident anymore, and nothing’s organic. A December article in Fast Company says, “The Casper mattress. The Allbirds sneaker. Birchbox, Prose, Snowe, and Keeps… each of these brands’ Instagram feeds were designed by the same company – the New York-based studio Red Antler.”

If that’s not enough to blow your mind, the Fast Company writer continues, “Red Antler partners with companies in their earliest days of forming their business and frequently takes equity in those businesses.” Put your hands together for the new digital pimp, ladies and gents!

luckbox asserts that speculative assets like crypto, cannabis or ICOs – while heady with roller coaster price movements and celebrity endorsements – are no place for active and engaged investors. Trading mechanically in viable, listed, liquid underlyings provides the true path to wealth, no matter what a blonde in a teeny bikini tries to tell you.

“On (messaging apps) Telegram and Discord, 10% of the pumps increased the price by more than 18% and 12% respectively in just five minutes. Given that trading volume and crypto prices were falling during the January-July 2018 period, even modest percentage increases were considered ‘an achievement for the pump.’” – The Economics of Cryptocurrency Pump and Dump Schemes (2018)

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network and hosts the Connect the Dots podcast. @vonettalogan