IPOs Aren’t For Real

IPOs (initial public offerings) are back, baby!

Here at luckbox, the editors are partying like it’s the dot com bubble of 1999. To borrow a line from the seminal film The Social Network, the story of Facebook (FB) evolving from dorm-room-based stalking site to global threat to democracy, co-creator of Napster (NAPS) Sean Parker supposedly tells a young Mark Zuckerburg, “A million dollars isn’t cool. You know what’s cool? A billion dollars!” Except in this current class of IPOs it’s more like, “Losing a million dollars isn’t cool. You know what’s cool? Losing a billion dollars, but then deciding to go public anyway.” OK, that’s not as catchy, but that’s what’s happening with the latest stable of unicorns—those private companies worth a billion dollars or more. Why can’t these pretty ponies hit their stride?

Grab any high school textbook … do high schools still use textbooks? Anyway, grab any tablet/e-reader/textbook and it will probably define IPOs as companies raising capital by offering their first shares of stock to mom-and-pop investors who are hungry for a real piece of some grade-A capitalist pie. “Tale as old as time, true as it can be, investors all get fleeeeeeced.”

No Beauty and the Beast fans?

Fake IPOs

Scrappy entrepreneurs taking their companies public to raise capital, and average investors getting in on the ground floor, hasn’t happened in many moons. But who wants to read about venture capital and private investment funds liquidating their shares and painting the top of the market? In a report published last year titled, “What is the point of the equity market?” Duncan Lamont, head of research and analytics for Schroders, explains that the number of U.S.-listed companies has, “shrunk by around half over the past 20 years.” And that, “financing needs can be met more cheaply and easily by other sources, without much of the baggage that comes with

Asking for a friend.

Ah sweet, free and easy cash flow. Remember, interest rates hovered near zero for a long time and a lot of large venture capital and private equity firms were making it rain like it was a Drake video. A guy just raised $1.6 million for water in a can called “Liquid Death.” What a time to be alive! Our public equity markets are priced to perfection, and individual investors are trading in the most liquid and efficient markets ever. Not only are the markets liquid, but they’re transparent, and the market doesn’t even bat an eye to mark down the price of a formerly high-flying unicorn. Y’all remember when Snapchat (SNAP) went public at $24 a share, then Kylie Jenner snapped her fingers like Thanos and now Snap is worth half that? Uber’s market cap is also now trading at half of what Morgan Stanley told accredited investors Uber was worth. Morgan Stanley collected $40 million in fees and was in a no-win situation if they had priced it lower, but don’t get mad when the devil lies to you.

Who can blame private companies for wanting to remain in the sweet embrace of the ample bosom that is the debt market? “You guys aren’t profitable yet? Sure, here’s a check for 10 times revenue…get outta here ya scamps!”

IPOs as ATMs

From Barron’s: “The IPO market … provides a way for private investors to monetize investments—that is to cash out their profits.” The shift has also meant that the IPO process produces a windfall for some employees who, “have been granted shares or options as compensation and want to cash out.” So, if you’re keeping score, it’s a win for private equity, it’s a win for the newly minted tech millionaires and it’s a big fat loss for regular retail investors. That was fun. Let’s play two!

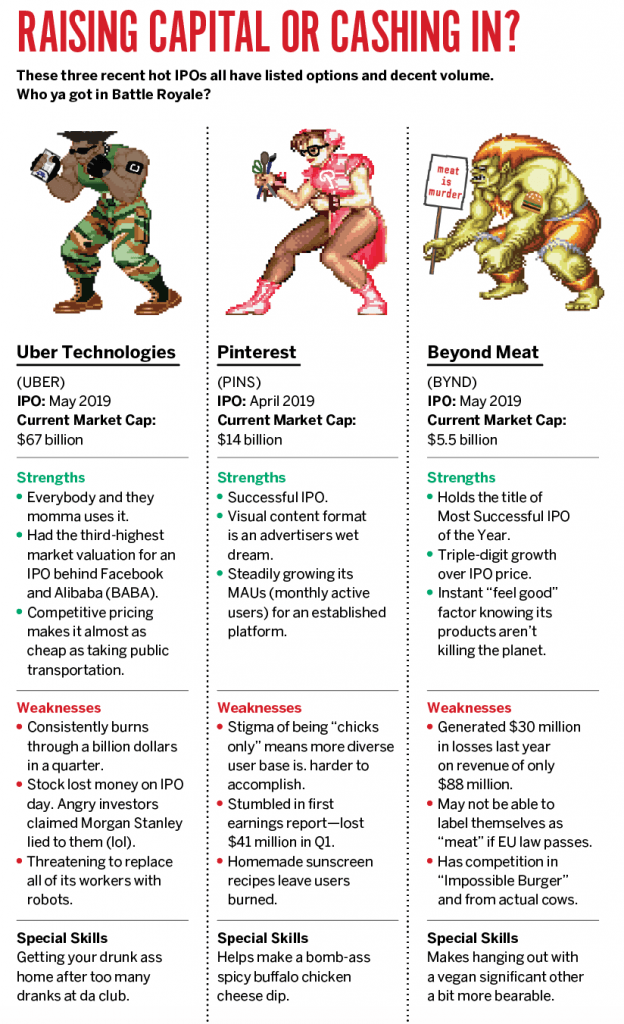

Lamont writes, “Given that growth is generally most rapid in those earlier years, it is highly likely that public market investors are missing out on returns as a result.” Well, this is sucky. luckbox wanted to party like it was 1999 … had Dr. Martens and a choker necklace picked out. Well, the good news is that a tighter timeline for the availability of listed options on publicly traded underlyings means even more opportunities for retail investors. This year has seen an increase in the number of companies coming to market, and that means more two-sided action for investors. So fitting in with the gaming theme of this month’s issue of luckbox, the editors invite readers to choose a fighter!

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network and hosts the Connect the Dots podcast. @vonettalogan