NFT Trading Activity Drops Sharply Amidst ‘Crypto Winter’

Trading activity in non-fungible tokens (NFTs) has slumped sharply in recent months, as the downturn in the cryptocurrency sector has spread to other digital assets.

With the financial markets reeling, value investors are no doubt scouring the stock market for attractive entry points amid the current price slide.

The same is likely true of cryptocurrency enthusiasts, as opportunities have likewise multiplied in 2022 during what many are calling a “crypto winter.”

For long-term bulls of non-fungible tokens (NFTs), the opportunity to purchase a long-coveted digital asset may have finally arrived. The decline in trading activity—and associated valuations—in this niche of the financial markets has been especially profound in recent months.

According to Dune Analytics, monthly NFT trading activity dropped from roughly $17 billion in January 2022, all the way down to $466 million in September 2022—indicating a 97% drop over those nine months.

Data from OpenSea—one of the world’s largest NFT marketplaces—mirrors that trend closely. At OpenSea, NFT trading activity declined by nearly 98% from May 2022 through late August 2022. To wit, on May 1, OpenSea processed a record $2.7 billion in NFT transactions. But by Aug. 29, that figure had dropped to only $9.3 million.

That period also saw a drop in the number of OpenSea users. At the end of summer 2022, roughly 24,000 individuals were actively trading on OpenSea—about two-thirds the number of users active on the platform during the spring.

Ethereum and bitcoin are both down in 2022, which has undoubtedly played a role in the cooling of the NFT market. Since the start of the year, bitcoin has shed roughly 60% of its value, whereas ethereum has lost about 64% of its value. Today, a single bitcoin trades for around $19,000/coin, while ethereum is changing hands at the $1,300 level.

Looking at total monthly NFT transactions, recent figures also reflect a decline in trading activity. According to CryptoSlam, total NFT transactions dipped below 1 million in August, down to 988,433. That was the lowest monthly total since March 2022.

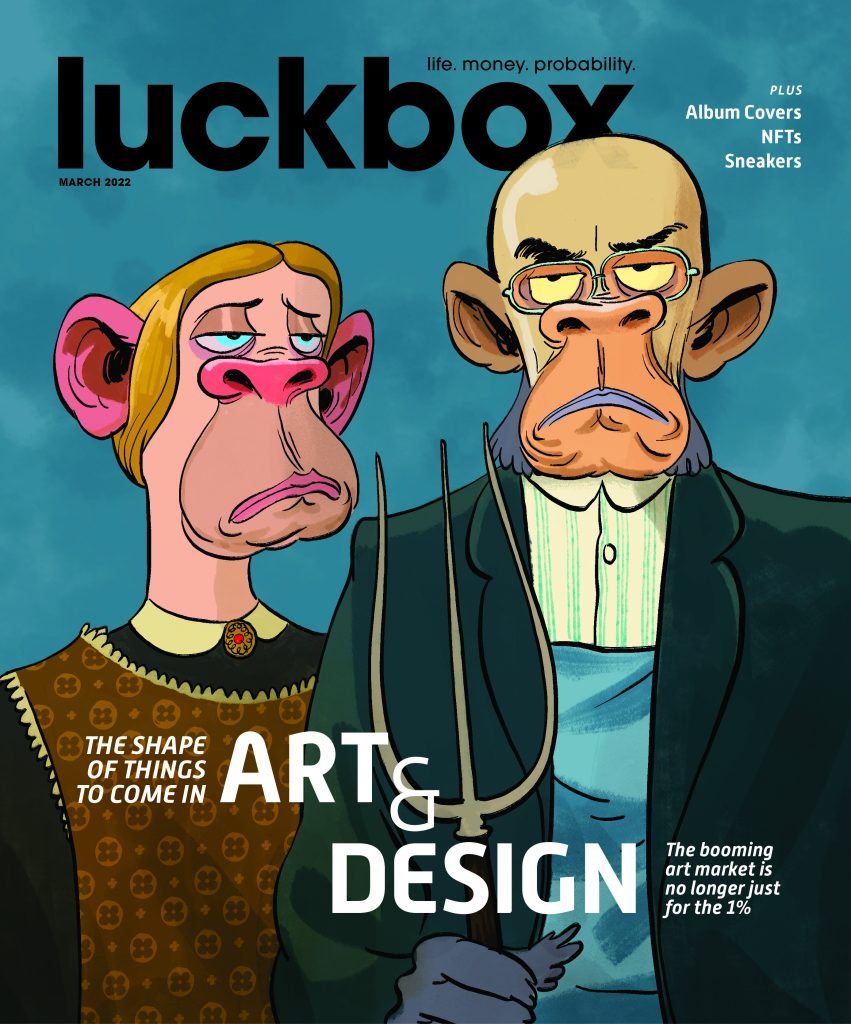

With the current “crypto winter,” even some of the most popular NFT collections have experienced a downdraft in valuation.

In late August, trading activity indicated that the popular “Bored Ape Yacht Club” NFT collection had dropped by as much as 50%. The well-known “CryptoPunks” collection was down only 19% from its July 2022 peak.

Much like the trend observed in art-focused NFTs, valuations of so-called “virtual plots of land” have also declined in recent months. Virtual land (aka virtual spaces) is also typically packaged as an NFT, ensuring that the “deeds” to these digital assets are recorded on the blockchain.

Much like the broader NFT sector, virtual land sales are estimated to have shrunk by roughly 98% from November of 2021 through mid-September 2022.

Some of the biggest players in the virtual land sector include Decentraland, Otherside and the Sandbox.

The Otherside platform was introduced in May 2022 by Yuga Labs—the same group that created the Bored Ape Yacht Club. During the recent downturn, all three platforms have seen the average plot of virtual land drop in price. Some estimates indicate that virtual land valuations have dropped by as much as 80%, on average.

Depending on one’s unique outlook on the future of digital assets, the current pullback in the NFT market might be viewed as an opportunity. However, like any investment opportunity, further downside risk could also be in store for this emerging market.

Going forward, it seems likely that NFT valuations will hinge on the fate of the broader cryptocurrency sector. If sentiment shifts, and the crypto sector surges, one would think that the NFT universe would also rebound in value.

For more background on the close link between the NFT market and the digital coin ethereum, check out this installment of Market Measures on the tastytrade financial network.

To follow the latest developments in the crypto sector, tune into tastytrade’s Crypto Concepts series and the Crypto Currently column in each issue of Luckbox.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.