Retail Interest in 0DTE Options Continues to Surge

Estimates suggest that the total options trading volume in 2023 will likely set a new record, and could climb as high as 11.4b contracts this year, which would represent a 14% pop from 2022.

- Total options trading volumes are expected to set another record in 2023, with an estimated 11.4 billion contracts traded on the year.

- Daily options trading volumes have consistently clocked in above 40 million in 2023, which also represents a new record.

- Options with five or fewer days until expiration, which includes so-called “0DTE” options, now account for nearly half of the total volume in the options market.

Interest in the financial markets surged during the heart of the COVID-19 pandemic, as remote workers and others with extra time funneled their disposable income into cryptocurrencies, stocks, options and other financial instruments.

However, things haven’t reverted back to “normal” in the wake of the pandemic, instead, trading volumes continue to surge. One of the biggest beneficiaries has been the domestic options market.

Last year, total options trading volume in the U.S. climbed above 10 billion contracts for the first time in history. That’s more than double the figure observed in 2019, when annual volumes were closer to 5 billion contracts.

Moreover, estimates suggest that the total options trading volume in 2023 will likely set a new record, and could climb as high as 11.4 billion contracts this year, which would represent a 14% pop from 2022.

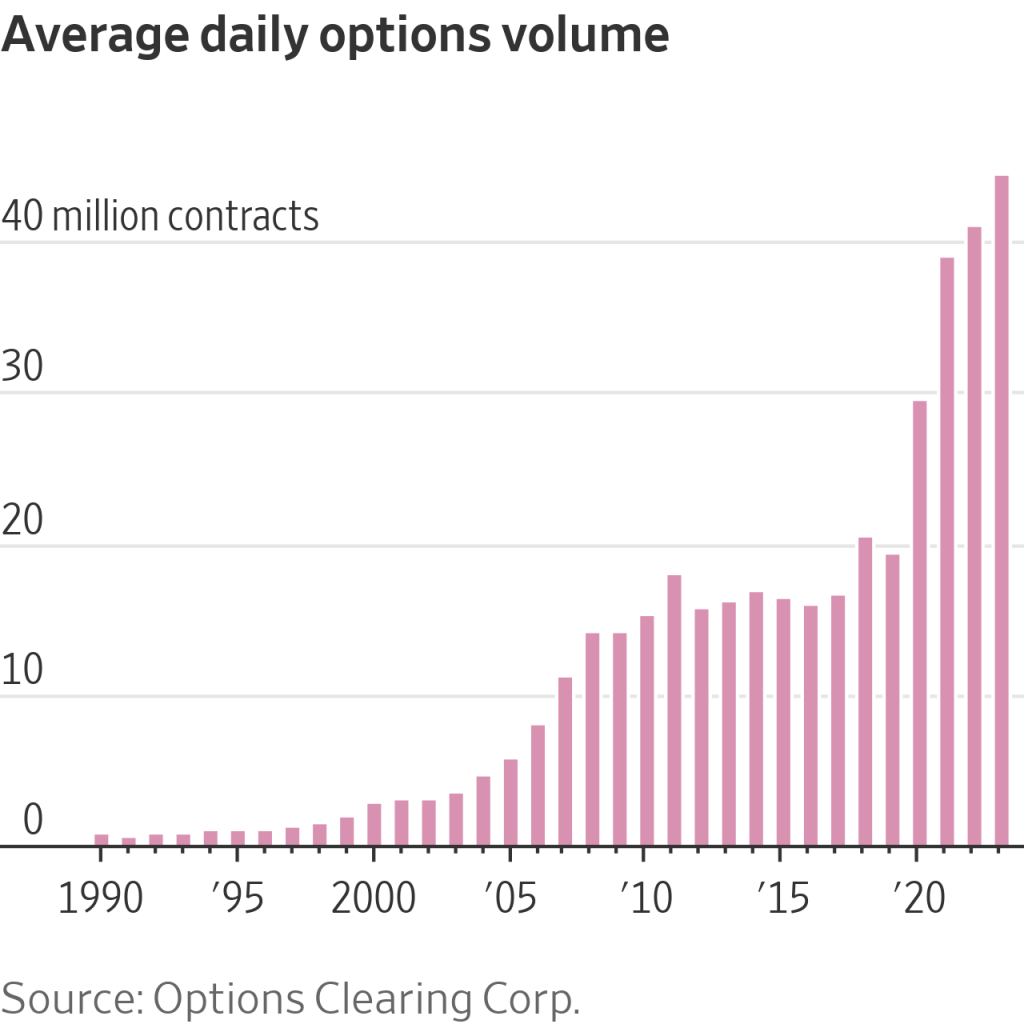

As illustrated below, average daily option volumes have pushed well above 40 million in 2023, and are poised to set a fresh record in this category, as well.

As illustrated in the graphic above, the spike in options trading volumes isn’t new—the trend started back in 2020 and has continued through today.

However, the characteristics of the contracts being traded has changed, as investors and traders—particularly from the retail universe—have gravitated toward options with shorter and shorter lifespans.

In the industry, the lifespan of an option is often referred to as “days-to-expiration,” or DTE.

Options are unique because unlike stocks, they have specific expiration dates. And starting last year, options with the shortest expirations saw increased interest in the market.

As a result, options with “zero days-to-expiration” (aka 0DTE) have been in extremely high demand this year. Interest in 0DTE options has been so strong that the industry has even pivoted, and is now offering new products that are tailored toward market participants seeking exposure to options with shorter lifespans.

More Background on Trading 0DTE Options

Options with zero days until expiration only exist for a single trading session. Therefore, a 0DTE option could be a longer-term option that has reached the last day of its lifecycle, or it could be a specific option that’s listed only for a single day.

For example, monthly options for the October 2023 cycle expire as of 4:00 p.m. EST on October 20. That means that after the close of trading on October 19, those regular monthly options have essentially become 0DTE options. They exist for only a single trading session, on October 20.

The same is true of weekly options. For instance, a weekly option that starts trading on the morning of September 18 will expire at 4 p.m. EST on September 22. In effect, that means those weekly options transform into 0DTE options after the close of trading on September 21.

A 0DTE option can also be an option that’s specifically listed for only a single day. Meaning the entire length of the associated contract is a single trading session. For example, since April of last year, the SPDR S&P 500 ETF Trust(SPY) has offered 0DTE options for every single day of the trading year.

According to research compiled by the data firm SpotGamma, options with five or fewer days until expiration now account for nearly half of the total volume in the options market. That’s up considerably from three years ago, when such options comprised only about one-third of total options volume.

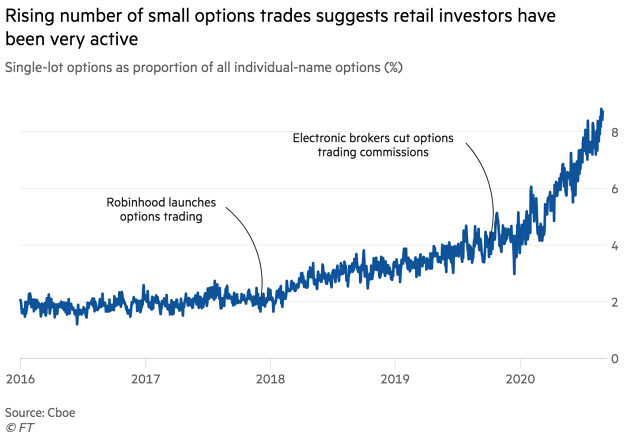

These days, increased demand for 0DTE options appears to be coming from retail investors and traders, at least in part. According to Bloomberg Intelligence, individual investors and traders accounted for 27% of all options trading volume as of June 2023, which is up 23% from the start of 2020.

The chart below highlights how smaller lot trades (<10 contracts per trade)—which are more indicative of retail trading activity—have also surged in volume since the start of 2020. This data further underscores the increased penetration of individual market participants in today’s options markets.

They cost less…

One of the reasons shorter duration options are attractive to retail market participants is likely because they cost less money, all else being equal. That’s because a portion of an option’s value is derived from the time until expiration.

As a result, individual investors and traders are likely drawn to options with shorter life spans because they require less capital.

That said, that doesn’t mean options with shorter lifespans represent higher probability bets. Whether buying or selling options, traders of short-term options theoretically have “less time to be right,” which means many 0DTE options are akin to throwaway lottery tickets.

Along those lines, a study conducted by the London Business School found that from 2019 to 2021 retail market participants lost upwards of $2 billion in options premium, much of which was concentrated in shorter-term options.

Those findings dovetail well with research conducted on 0DTE options by the tastylive financial network.

The aforementioned tastylive research revealed that the start-of-day implied volatility for 0DTE options can be twice as high as that of their monthly equivalents. That means options buyers in the 0DTE niche are paying a steep price for such options, in relative terms.

But that doesn’t necessarily mean that selling 0DTE is an advisable strategy, either.

According to the same tastylive research, the gamma risk associated with 0DTE options can be eight times higher than that of monthly options with 30-60 days until expiration. This is attributable to the risk of large, unexpected one-day moves in the market.

As always, investors and traders should conduct their own analysis on the overall value proposition offered by 0DTE options to assess whether they fit their unique market approach, outlook and risk profile.

Investors and traders looking to learn more about options trading approaches that possess a higher probabilities of profit, using a mechanical, systematic approach, can check out this installment of Options Jive on the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

To follow everything moving the markets this year, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.