Risk and Reward Lessons in the Wake of GME

The retail trading frenzy has transformed the risk and reward dynamic on Wall Street, but for how long is anyone’s guess.

If the current market environment feels somewhat unique, there’s a reason for that: It is.

Since the onset of the coronavirus crisis, risks in the financial markets have grown significantly, as have potential rewards. The two always move together.

Several data points help illustrate how risk in the marketplace has transformed since February 2020.

First, the CBOE Volatility Index (VIX) hit a new all-time high in March. Second, the stock market experienced the fastest bear market 20% correction in history during 2020, at just 19 trading days.

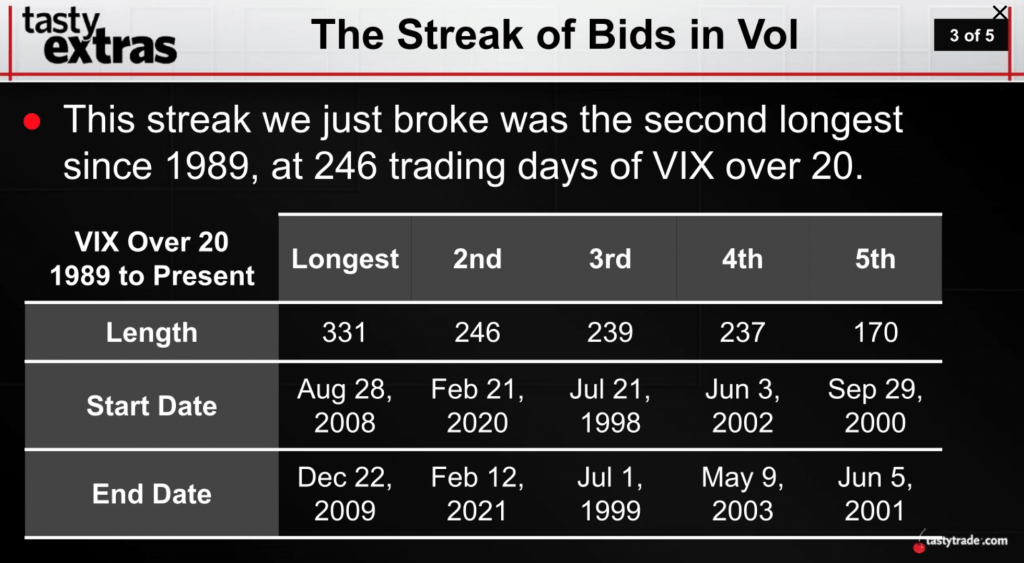

On top of that, the VIX recently set a record with its second-longest streak closing above 20. At 246 straight trading days, the streak is second only to the period from Aug. 28, 2008 to Dec. 22, 2009, when the VIX closed above 20 for 331 consecutive trading days.

And while the epic rally since last March has been a huge reprieve for many long-only investors, the intensity and speed of the rally have only served to reinforce the high-risk nature of the markets at this time.

That’s because high-volatility environments aren’t only characterized by corrections. Volatility also speaks to the speed of a given market. If stocks are making bigger-than-expected moves—whether to the downside or the upside—volatility tends to move higher, or at least remain elevated.

Speed in the current market is one reason the VIX has remained elevated for so long. Consider, for example, that the S&P experienced its largest-ever rebound in a 50-day period from April to June last year, when it rallied by over 37%.

And while short squeezes have existed for many years, the recent short-squeeze phenomenon—highlighted by GameStop (GME)—also provides strong evidence for the unique investing/trading risks presented by the current market environment.

While GME may have been unfairly shorted (that’s in the eye of the beholder), it’s hard to argue that a brick-and-mortar retail store deserved to rally from $40/share to more than $400/share in a matter of days, from a fundamental standpoint.

Regardless, one serious implication from that run-up is its impact on the pricing of risk in the marketplace. Consider, for example, the options market in GME. Most options traders weren’t likely prepared for GME to spike as much as it did in a matter of days. Many likely paid a heavy price for that miscalculation.

Going forward, that means plenty of options traders (both market makers and market takers) will be forced to price the “GME factor” into their ongoing risk calculations. And that adjustment won’t necessarily be limited to “heavily shorted” stocks like GME and AMC Entertainment Holdings (AMC).

As many market participants have observed in the wake of GME, there have been pockets of stocks making big moves almost daily since that story faded into the background. The risk of a retail-fueled rally materializing in any stock at any time has increased substantially.

And that risk will undoubtedly be reflected in the form of higher options prices. How long that lasts, however, is anyone’s guess.

Depending on one’s own unique risk appetite and market outlook, higher premiums could be perceived as an attractive opportunity.

But for others who aren’t comfortable with an elevated risk environment, the most prudent course forward might include portfolio adjustments that reduce risk exposure. This may involve trading options in exchange-traded funds (ETFs) as opposed to single stocks—among other adjustments.

Readers seeking to learn more about investing and trading in high-risk environments may want to review a recent episode of Options Jive on the tastytrade financial network. This show focuses on concrete factors that market participants can consider and adjust in highly volatile market environments.

For more information on the recent streak in VIX (246 consecutive trading days closing above 20), readers may also want to review this new installment of Tasty Extras. As always, daily market coverage is also available via TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. Central Time.

Subscribe to Luckbox in print and get a FREE Luckbox T-shirt! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.