Seven Predictions for 2021

Here comes another year. But it can’t get much worse than 2020. Can it?

Every November, after all the leftover turkey has been eaten, a group of Wall Street analysts gathers at a secret location to mete out predictions for the upcoming year. Trends are analyzed, forecasts are made and charts are backtested. Then, when everything is finally ready, they print out the results on a single Excel spreadsheet and light it on fire. White smoke billows from their all-male athletic club, signaling that next year’s forecast has been made.

One of the most legendary analyst prognosticators, 87-year-old Blackstone Advisory Partners Vice Chairman Byron Wein, has largely faded from public view. But he resurfaces from time to time, and his annual list of 10 Surprises always makes headlines. Much like Punxsutawney Phil, or a liver spot on an old person, Wein’s sporadic appearances are always geared to surprise and shock. “Every year, I take $1 million of my own money and invest it in the 10 Surprises because I want my money to be where my mouth is,” Wein said in an interview posted on Money & Markets. In 2019, Wein’s wieners (he should really start calling them that) netted a 28% profit. Not bad for five minutes of work. Too bad he doesn’t have an OnlyFans.com account.

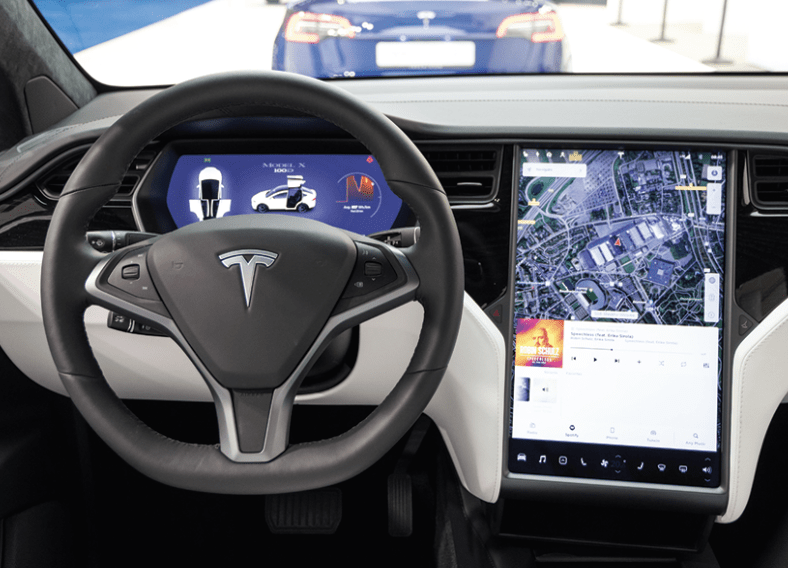

But in a year rocked by the pandemic, the market made moves no one saw coming. So, a lot of his 2020 forecast seems delightfully antiquated, like human-to-human contact. Wein thought FAANG stocks would struggle in 2020 (Narrator: They did not), that Boeing would fix its problems (um…), and that Brexit would be a solidified deal (wrong-o, chum). He also thought self-driving cars would be crashing left and right, but Tesla has reached the stratosphere, and Elon Musk is wondering how to colonize Mars.

So, for this prediction issue, Luckbox asked this writer to come up with my own 2021 predictions, even though I am not an analyst, I don’t believe in fundamentals and I am pretty sure Jerome Powell has a restraining order against me.

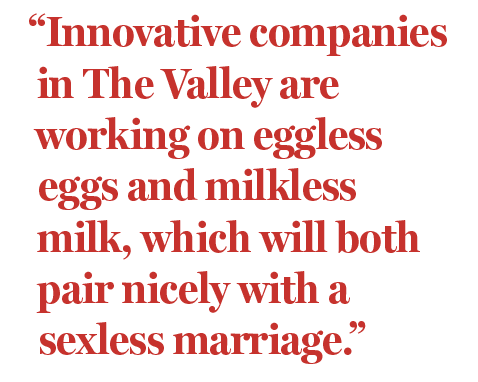

Meatless everything

Look for 2021 to go down as the year of fake meat. Beyond Meat (BYND) benefitted from the at-home cooking trend, and its stock hit new highs. Private companies, such as Impossible Foods and Incogmeato (this straight-up wins for best name), also gained market share. Innovative companies in The Valley are also working on eggless eggs and milkless milk, which will both pair nicely with sexless marriage.

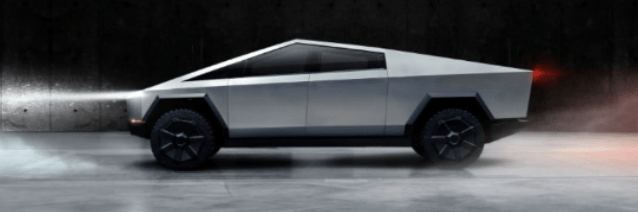

Rise of the electro-sexual

Expect the dawn of the hyper aggro-electric truck in 2021… TRUCK YEAH! General Motors (GM) unveiled its all-new Electric Hummer, with an astounding 1,000 horsepower and enough pound feet of torque to compensate for even the smallest of male members. The electric behemoth will set you back at least $112,000, and it’s not the only aggro-truck up for grabs. Nikola (NKLA) will continue to make headlines with its “will it, or won’t it exist” electric truck, and startup Rivian has the blessing of Jeff Bezsos of Amazon (AMZN), so you know it’s Illuminati approved! Plus, the truck that started it all, the blocky Tesla (TSLA) Cybertruck (opposite page), should start rolling off the assembly line. Not sure the dude bros know that electric trucks are quiet and that therefore no one can hear your masculinity when you bear down on them on the highway. But, alas, at least it’s good for the planet.

Peloton expands to more parts of life

The hit of the pandemic has definitely been Peloton (PTON). No forecasting could have predicted the elimination of Peloton’s main competition: actual gyms. Customers who wanted a safe way to exercise at home found wait times for the bespoke Peloton-connected fitness bikes and treadmills stretching into weeks. While Peloton’s margins on the bikes are slim, at 37%, users still have to plunk down money every month to use the bikes to their full potential. Those of us who can’t afford the bikes can still give Peloton our money to use their app while we piece together a bike from the discarded Peloton boxes of our wealthier neighbors. Now that we have a national mandate to wear yoga pants all the time, we see the fitness trend staying strong in 2021.

The all-encompassing drive-thru

We predict the end of chain restaurants—all of them replaced with a massive repaving of suburbia into an all-drive-thru zone. Still, national chains have pivoted quickly to mobile ordering, drive-thrus and contactless delivery. In fact, as we roll into yet another wave of COVID, it’s the traditional sit-down brick-and-mortar restaurants that are waving the white flag. It’s happening because after months of eating their own cooking for the first time, a lot of people decided to opt for takeout or drive-thru. Burger King (QSR), Wendy’s (WEN) and Chipotle (CMG) all announced design plans for drive-thru-only stores. We think the restaurant biz should take it one step further and also help our failing infrastructure by transforming toll lanes into fast food drive-thrus. Yes, we’re heading to Wisconsin, but can we also get a No. 6 with no tomato and a Diet Coke?

Netflix will feature Zoom cast reunions

One casualty of the pandemic that isn’t about to rebound anytime soon is the movie theater industry. AMC (AMC) theaters are offering a $50 million stock sale to stay afloat, and tentpole blockbusters with James Bond, Batman and Wonder Woman have all been pushed off until who knows when. Disney (DIS) decided to release several titles either for free or for a fee on its streaming service, Disney+. The Hamilton musical, slated for theatrical release next year, was a pleasant free surprise for the site. Disney’s Mulan, for $30, didn’t fare as well. Amazon has announced it’s releasing Coming 2 America in December for Prime customers, after they’ve paid $125 for the privilege. Christopher Nolan’s Tenet, the only real blockbuster that was released, has made $300 million globally, but most of that was from overseas and came from countries that had their anti-COVID act together. Netflix (NFLX) says its stable of content is strong and that it doesn’t anticipate production hiccups in the next year.

Joe Rogan 2024

In a move few could have anticipated, the guy who was on News Radio and made 24-year-olds eat Madagascar cockroaches on Fear Factor has become one of the highest-paid podcasters of the new decade. His $100 million deal with Spotify (SPOT) remains a revenue-generating point of contention as he continues to feature controversial guests, such as Alex Jones, Kanye West and, um, Miley Cyrus? We think he’ll parlay this success into an eventual political run culminating in Rogan! the Musical in the year 2070, written by the sentient AI of Lin-Manuel Miranda.

Bubbles and personal domes

You could go all-in and bet on the biotech sector with companies like Eli Lilly (LLY), Moderna (MRNA) and Regeneron (REGN), but we think those stocks are already priced to perfection. Things get fun in the personal protective equipment sector of the market and the nascent companies making “personal safety domes” and our favorite—murder-hornet protection suits. Not since the full-body condom scene in Naked Gun has full-body protection been so comical, yet so necessary. The Shield Pod from a company called Under the Weather offers this solution, and more are slated to hit the market. And what does one wear when fighting giant venomous hornets? A snazzy suit that officials in Washington state donned in their nighttime raid of a murder-hornet hive. Five stars!

Those are my predictions for 2021, but the real winners will be to continue to sell premium and to hope for two-sided action. No one can really predict what’s going to happen, but the only way to benefit is to be engaged. And involvement by retail traders is one trend from 2020 that we hope stays strong for a long time.

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network and hosts the Connect the Dots podcast. @vonettalogan