Sports Gambling: Trading on America’s Addiction to the NFL

The NFL is the most popular sports league in the United States, which means the annual kick-off of the new season typically triggers a surge in sports betting activity at PENN, DKNG

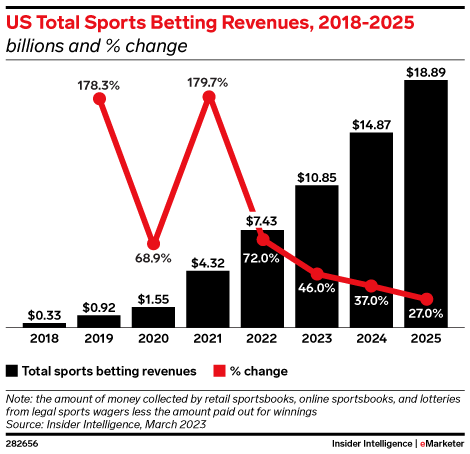

- Revenues in the online sports gambling sector are expected to clock in at roughly $11 billion in 2023, which would represent a 72% increase from 2022.

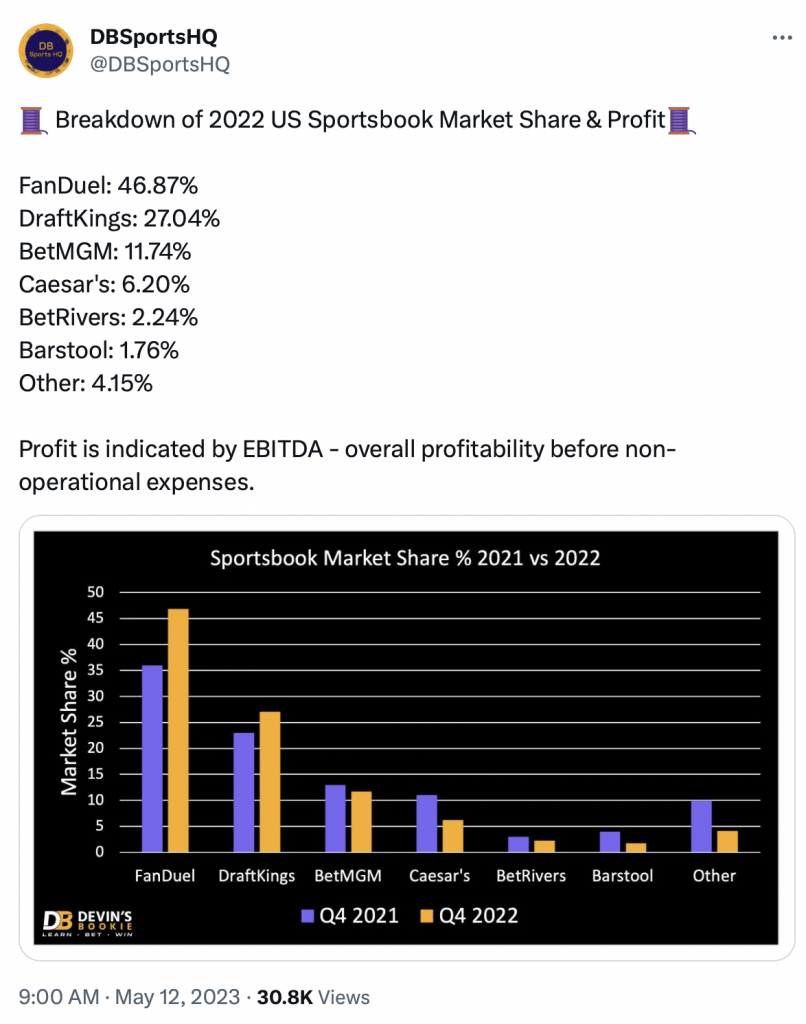

- The online sports gambling sector is currently dominated by four companies, which together control roughly 90% of the industry.

- The NFL is America’s favorite sports league, which is why the kick-off of the NFL season typically triggers a surge in American sports betting activity.

Sports betting has spread like wildfire since 2018, when the U.S. Supreme Court struck down the Professional and Amateur Sports Protection Act of 1992 (PASPA), which consequently allowed individual states to legalize sports betting activity.

Since that momentous decision, Americans have legally wagered roughly $245 billion on the outcomes of sporting events. And over that same period, the sports gambling industry has raked in roughly $15 billion in revenues.

However, the “house” now extends beyond just sports books—state governments have also horned in on the action— collecting an estimated $3.50 billion in tax-related revenue since the start of 2018.

The top three states for sports gambling-related tax revenue include New Jersey, Nevada and New York, in that order. However, one can’t overlook the fact that heavyweight states like California, Florida and Texas have yet to legalize sports betting.

All eyes are on the sports gambling industry this fall because the NFL season represents the crown jewel of this still nascent industry. The 2023-2024 NFL season officially kicked off on September 7, when the Detroit Lions made an early season statement by beating last year’s Super Bowl winner—the Kansas City Chiefs.

Not surprisingly, the sports gambling world had widely expected that result—the betting favorite heading into kick-off was the Lions—despite the fact that Detroit was playing on the road and going up against last season’s league champions.

As with previous years, increased betting on NFL games is expected to be a big driver of sports gambling revenue growth in 2023.

According to research conducted by Variety and CRG Global, the NFL attracts the most attention from American sports bettors. For example, the aforementioned research found that “four out of five mobile sports bettors [81%]” placed a bet on the NFL during the month of October last year.

That was considerably higher than the next most popular leagues for gambling, which were the NBA (54%), the MLB (44%) and college football (34%).

Not surprisingly, that same research also demonstrated that there’s a strong correlation between betting activity and game viewership. For example, survey responses indicated that two-thirds of mobile gamblers were more likely to watch a game they’d wagered on.

That’s certainly music to the ears of NFL owners. According to the American Gaming Association (AGA), the NFL collects an extra $2.3 billion per year in revenues due to the advent of widespread, legal sports gambling. And that figure will undoubtedly rise alongside sports gambling revenues in the coming years.

The NFL’s popularity amongst sports bettors isn’t necessarily a surprise, considering that the NFL also has the most fans of any major sports league in the country.

During the 2022/2023 season, the average number of viewers for an NFL regular season game was estimated at roughly 16.7 million, according to Statista. In comparison, the NBA saw an average of only 1.6 million fans during the 2022/2023 season.

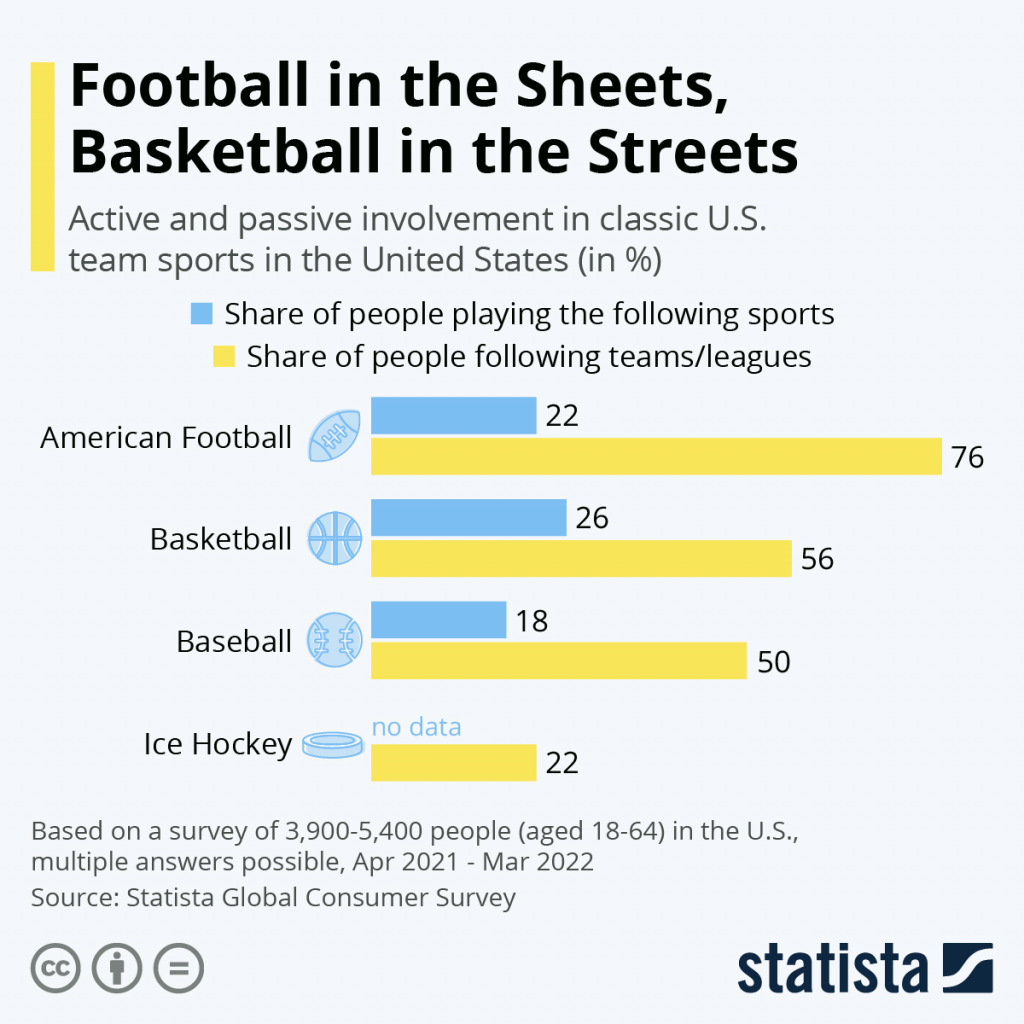

Moreover, an estimated 76% of Americans actively follow the NFL, as compared to 56% which follow the NBA, according to research conducted by Statista (highlighted below).

Just ahead of the NFL’s 2023 season kick-off, the American Gaming Association (AGA) released the results from a recent survey that indicated upwards of 73 million Americans are likely to make a wager focused on the NFL in 2023. According to AGA data, that figure represents an increase of about 60% from last year.

Competitive Landscape in the Sports Gambling Industry

Due to rising interest in legal sports betting, industry revenues are expected to clock in at roughly $11 billion in 2023, which would represent a 72% increase from 2022. By 2025, that figure could be closer to $19 billion, according to the projections of InsiderIntelligence.com (highlighted below).

Within the online sports gambling industry there’s two primary heavyweights—DraftKings (DKNG) and FanDuel.

According to Macquarie, these two companies controlled more than 75% of the online sports gambling market at the end of the first quarter in 2023. Of the two, FanDuel accounts for roughly 46% of the market, while DraftKings has 25%.

Rounding out the top four are BetMGM and Caesars, which control 12% and 7% of the market, respectively. According to gambling analytics firm Eilers & Krejcik, those four companies control 90% of the online sports gambling market in the United States.

It should be noted that in its most recent earnings report, DraftKings claimed to have increased its market share to 35%.

Regardless, one of the other major players in the industry—Penn Entertainment (PENN)—recently signed a blockbuster deal with ESPN. And as part of that deal, Penn Entertainment will launch an ESPN-branded sportsbook called “ESPN Bet,” which will operate in the 16 states where PENN currently offers mobile sportsbooks. ESPN Bet is expected to debut in November.

In the wake of the deal with ESPN, the CEO of PENN—Jay Snowden—said of the new venture’s potential, “There’s a lot of affinity for that brand [ESPN]. And so we think that’s going to be extremely complementary to what we’ve built over the course of the last three years.”

One of the other companies that’s looking to expand its footprint in the online sports gambling market is privately-held Fanatics. In April of this year, Fanatics first offered its new sports gambling app in Ohio and Tennessee.

However, Fanatics upped the ante in July when it bought the U.S. business interests of Australia-based PointsBet, which included existing (and much-coveted) sports betting licenses in New York, New Jersey, Pennsylvania and Michigan.

Now operating in 11 states, many industry experts believe that Fanatics could benefit from some favorable tail winds during the upcoming NFL season. Analyzing the impact of the deal on the industry, Eilers & Krejcik offered the following take on Fanatic’s near-term potential, “Backed by Fanatics’ resources for product development and marketing—and a massive database to market to—the operator could take significant share in our view.”

As of early September 2023, sports gambling has now been legalized in 38 states and the District of Columbia. Just ten years ago, that level of penetration in the U.S. market would have seemed unthinkable.

For many years, the only places that one could place a legal sports bet were Nevada and Atlantic City, New Jersey. Then, in the late 1980s, the Supreme Court ruled that Indian reservations should also be permitted to allow gambling, due to their unique sovereignty.

Today, there are roughly 1,000 physical casinos in the U.S. spread across 40 states. And in 38 U.S. states, there’s now millions of mobile sports casinos as well, tucked away in people’s pockets, purses and briefcases (i.e. smartphones and other mobile devices).

Unfortunately, the full impact of this new reality—both positive and negative—won’t fully be understood for some time. According to surveys conducted by the National Council on Problem Gaming, the percentage of gamblers that sought financial assistance due to problematic betting behavior rose from 2% in 2018 to 6% in 2021.

This trend suggests that the number of Americans suffering from addictive gambling behavior will also grow in the coming years, in tandem with the increased penetration of sports gambling in the American economy.

To follow everything moving the markets this year, including the sports gambling sector, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.