The Brawn Behind Beauty

Journeying from cradle to grave requires makeup, perfume, skincare and lots more

I don’t care what you say, Beyoncé, you did NOT “wake up like this.” Most of us don’t roll out of bed and immediately start strutting down the street. We shower, shave, wash our hair and our faces, moisturize, put on deodorant, apply cosmetics, brush our teeth, and maybe even spritz on some perfume before we’re ready to hit the streets.

The beauty industry, comprising skincare, makeup, perfume, hair care, deodorants, oral care and toiletries, is the quintessential definition of cradle to grave products. We all have a coterie of products that we regularly use to stay dateable, employable and maybe airline seat upgradable.

Sometimes all it takes is one gloriously unflattering angle on your latest Zoom call to realize you need a better eye cream.

So, in a world where men, women and now even children are fighting it out in the aisles of Sephora, what are the forecasted trends in the beauty industry and how much is too much to spend on skincare? (Asking for a friend.)

Portrait of a beauty industry

Beauty industry revenue amounted to $528 billion in 2022 and is expected to reach $688 billion by 2028, according to Statista. America spends more money chasing beauty than any other nation. (Hey, we can’t all be genetically blessed like Sweden.)

Americans spend an average of $1,754 a year on beauty products, cosmetics and services, a LendingTree survey indicates. Broken out by generation, millennials shell out an average of $2,670 a year, and Gen Z parts with a yearly average of $2,048.

Women who invest regularly in their appearance spend closer to $3,756 a year, with their male counterparts spending $2,928, a Groupon survey shows. That breaks down to an average monthly spend of around $313 by women in this group.

The beauty OG

One intrepid researcher discovered women use an average of 16 products just for their face before they leave the house. As a fun test, I counted the number of facial products I use.

Bear in mind, I report financial news to thousands of people in freakin’ HD streaming video. It’s in “I-can-see-your-pores-from-space” 4K, and my genetic makeup is nowhere near Swedish-influenced.

I use 32 products on just my face, every business day. This is a mix of skincare products, like my cleanser, and cosmetics, like eye shadow. I use five separate products on just my eyebrows. Without makeup, I legit look like Morgan Freeman. It takes a village to make me look average.

I tried to figure out how much I spend yearly on beauty and my calculator started smoking.

My favorite player in the beauty space is Ulta Beauty (ULTA). About 95% of customers who shop at Ulta are part of the company’s rewards program which offers perks and incentives to members. To qualify, Platinum Ulta members must spend $500 annually, and Diamond members must spend $1,200 annually.

Dear reader, I am not only Platinum, but in March 2024 I met my entire Platinum goal for 2025.

Meanwhile, Ulta’s stock took a hit last month when its CEO, Dave Kimball, noted that sales were moderating. Ulta’s stock has been down 22% over the past year but over the past five years it has outperformed the broader market and is up 1,300%.

Ulta’s customers come from a wide range of socioeconomic backgrounds because the company offers both mass market and luxury/prestige lines. Thus, Ulta’s bottom line is sensitive when customers switch out products for less expensive ones. Ulta also has a fruitful partnership with Target (TGT) with over 500 Ulta Beauty in-store locations.

The scrappy newcomer

Some 46% of Americans say social media has convinced them to spend more on beauty products. You can hardly open privately held TikTok or Instagram (which is owned Meta Platforms (META)) without seeing a dewy-cheeked influencer holding up a product while exclaiming, “OMG, you guys!! This will literally change your life! You must use this unless you want to be fugly forever!!”

With cheeky marketing ads and a “viral” super grip primer, E.l.f. Beauty (ELF) is a scrappy newcomer that’s firmly on the industry’s radar. E.l.f. Beauty (eyes, lip, face) has posted its first $1 billion fiscal year, growing sales by 77% and thus demonstrating a prowess in reaching younger consumers.

E.l.f. Beauty has posted sales gains in the high double-digit percentages quarter after quarter as consumers flock to its low-priced beauty products. They’re available at retailers like Walmart (WMT) and Target (TGT). The stock is up 30% year-to-date, and the company has a market cap of $10 billion. The stock is up a staggering 1,258% over five years.

Beauty and the beasts

Generation Alpha—those born between 2010 and 2023—is considered the first generation brought up in a fully digital world. They’re born clutching iPads, demanding Starbucks (SBUX) and matcha teas. They desperately need Drunk Elephant’s $55 eye cream.

When media outlets breathlessly scrambled to cover the hottest gifts for the 2023 holiday season, it wasn’t toys, clothes or even electronics that tween girls wanted. No, they wanted premium skincare even though they’ve never seen a W2 in their life.

“Videos of young girls crowding Sephora aisles with baskets carrying hundreds of dollars’ worth of products have dominated TikTok for several weeks,” writes Katie Camero for USA Today.

“People say the store looks like an elementary school for beauty obsessed 10-year-olds, some of whom have been caught treating employees poorly and destroying displays,” Camero continues.

Yes, a tiny, angry flock of baby Karens is coming to take your retinol. Bad news for overworked retail employees, but excellent news for brands wanting to extend how long they keep customers on their balance sheets.

I am a full-glam, full-beat, girlie girl™ but baby Vonetta was allowed to use only Aveeno, Noxzema and maybe the dregs of whatever Clinique product my mom was planning to throw out.

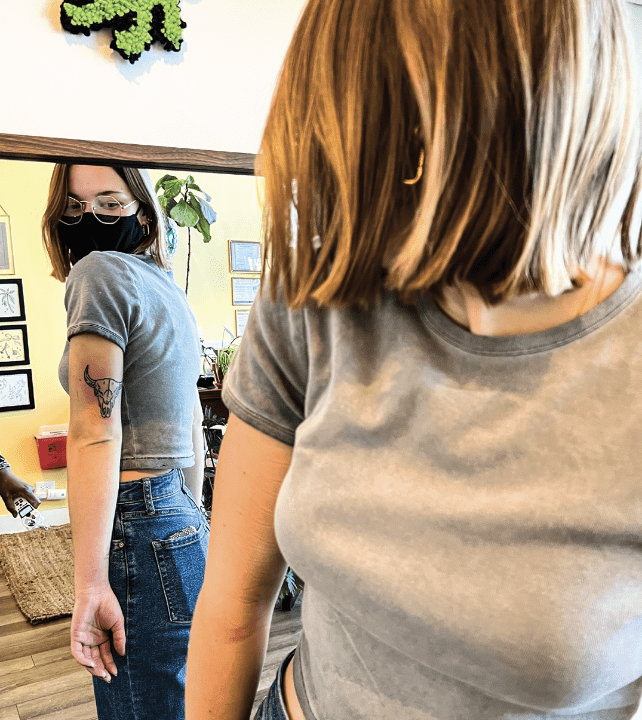

It’s not just sassy tweens, joining up. The beauty industry continues to open its arms for men. Congrats to all the dudes who learned you shouldn’t use the same soap to wash both your ass and your face. Welcome!

Gentlemen, this is a safe space. Men’s skincare spending includes grooming aids for beards and facial hair, hair products, shaving products and supplements for men’s health.

Comparatively, women overwhelmingly prefer to shop in-store for their beauty needs while men prefer to shop online. Digital pharmacy startup Hims & Hers Health (HIMS) offers men’s skincare, hair loss treatment products and sexual wellness products all in the same place.

Hims & Hers stock is up over 75% year-to-date and surged recently on news the company will start offering GLP-1 injections. GLP-1 is commercially available in the blockbuster weight loss drugs Wegovy and Ozempic. The beauty industry continues to widen as more men discover the liberation of a really good eye cream.

Beauty resides in the eye of the stockholder

Beauty overall grew 9% in the prestige market and 2% in the mass market in the U.S. in Q1 ‘24, says business analytics company Circana. Consumers making over $100,000 a year are more likely to shop prestige, and those making under $100,000 are more likely to shop mass market.

Some aspects of the beauty biz are weathering a slowdown, but unless you’re the lone operator of a lighthouse in Maine, you can’t stop washing your face, brushing your teeth or putting on deodorant.

However, beauty as a sector is known for customer disloyalty. Consumers believe products stop working or they think they’ve found a better hair color or an even more rejuvenating face mask.

So, brands continue to innovate and flood the market. As of 2022, 4,305 companies were manufacturing cosmetic and beauty products in the U.S., according to IBISWorld.

Brands are scrambling to capture our attention with new ingredients. Snail mucin is the hottest current one, I’d say. Yes, people pay top dollar to put the mucus of a gastropod onto their faces.

They’re also trying to capitalize on “clean” or “eco” trends. However, as the industry develops, brands can be confident they will have a customer for the long haul. If you see a lady who looks like Morgan Freeman fighting a 10-year-old in Sephora, just mind your business.

Vonetta Logan, a writer and comedian, appears daily on the tastylive network. @vonettalogan