The Refinery Sector May Be Poised For Pullback

The refiners booked record profits in 2022, but after a strong rally in H1 2023, possible headwinds lie ahead

- Due to elevated gasoline prices, the refiners booked record profits in 2022.

- As a result, the refiner stocks have rallied in strong fashion during the last 18 months.

- However, Bank of America recently downgraded the sector, arguing that downward pressure in the oil market, and a possible global economic slowdown, could weigh on this group.

One sector of the stock market that’s quietly outperformed this year are the refiners—companies that process raw energy commodities into usable, commercial products.

Refiners are best known for converting crude oil into gasoline, but refining is also required for other key energy commodities such as diesel fuel, jet fuel, heating oil, lubricating oils, propane and butane.

On Aug. 15, Bank of America announced a downgrade of the refinery sector, noting that the firm was taking a strategic pause on the sector.

In the research note, Bank of America pointed out that after a strong run in the refiners during 2022 and early 2023, the risk-reward dynamic was shifting, and wouldn’t be as favorable for the refiners during the foreseeable future.

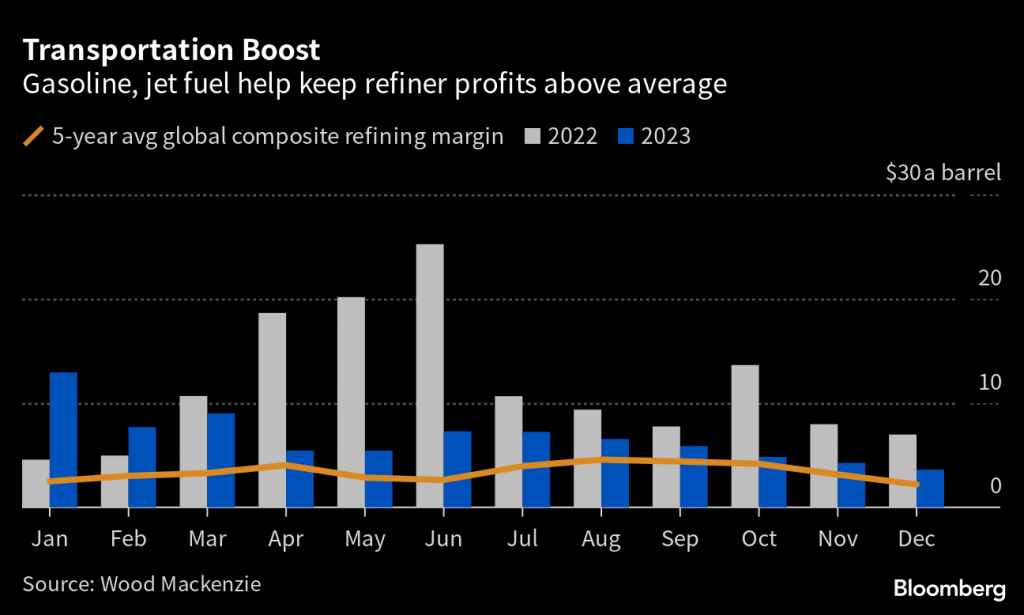

In the United States, summer is often referred to as the driving season, because gasoline demand tends to peak during the warmest months of the year. And with fall approaching, researchers at Bank of America note that “[profit] margins are peaking on transitory issues, leaving an unfavorable balance of risk at the same time when seasonal trends [typically] pressure margins.”

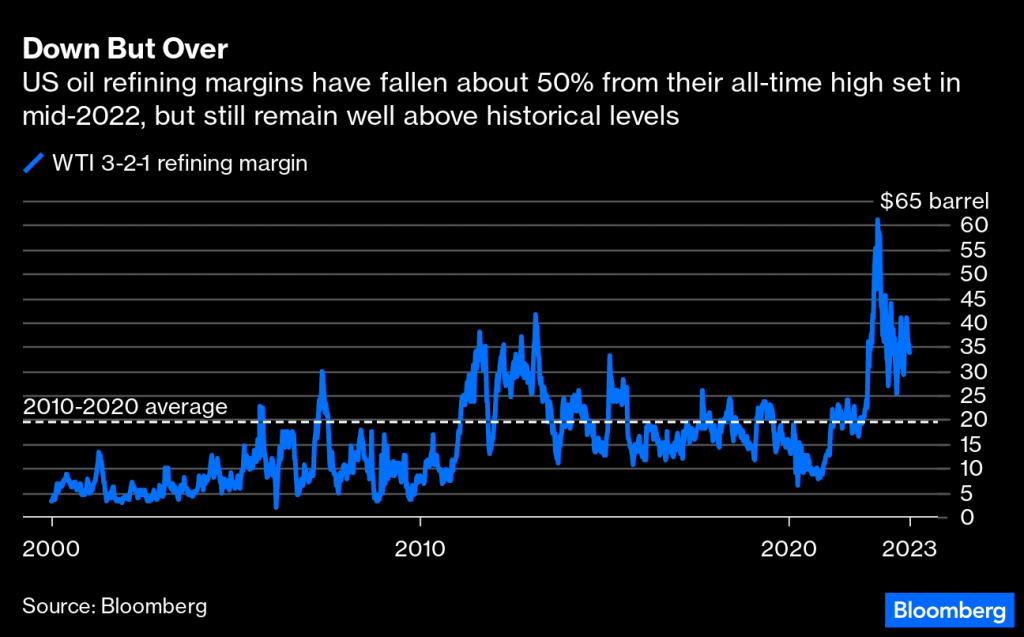

The graphic below highlights how refining margins have retreated this year from record highs in 2022.

As part of its research note, Bank of America downgraded several well-known names in the refining sector from outperform to neutral, including HF Sinclair (DINO), Marathon (MPC), PBF Energy (PBF), Phillips 66 (PSX), and Valero (VLO).

Brief review of sector performance since 2020

Much like other businesses, the economic model in the refinery sector hinges on supply and demand. However, another big consideration is the relative price of refinery inputs (i.e. the raw commodities) versus the price at which the finished products can be sold.

Ideally, refiners prefer when the cost of their inputs (crude oil, for example) is low, and the price at which the finished products are sold (gasoline, for example) is high. And input/output dynamics typically add another layer of complexity to the refiners’ overall business model.

Imagine for example, a scenario in which gasoline prices are high. While that may seem like a preferable situation for refiners, that type of environment can also drive down demand. Meaning that high gasoline prices may be preferred, but not sky-high gasoline prices.

Along those lines, a critical shortage of raw inputs can lead to reduced inventories, and in turn declining revenues.

Considering the wide variety of business environments they can face, the refiners—more so than other business sectors—are often forced to navigate a complex and ever-changing landscape. And recent history helps illustrate how varying conditions have impacted the refinery sector since the start of the COVID-19 pandemic, including the intensification of the war in Eastern Europe.

Global demand for gasoline fell off a cliff in 2020. And due to reduced demand, the refining sector fell on hard times. Looking at an example from the industry, shares in PBF Energy (PBF) dropped by roughly 80% during the first quarter of 2020 as refiner profits evaporated.

Then, as the global economy recovered, so did the refiners’ revenue potential. From April 2020 through April 2022, PBF shares rallied by more than 350%, bringing the stock back above $30/share, which is exactly where it was trading before the pandemic started.

However, in the wake of the COVID-19 pandemic, the refining sector was almost immediately forced to grapple with the war in Ukraine. As a result of widespread international boycotts of Russian crude, prices skyrocketed across the energy sector.

According to data compiled by McKinsey & Company, those developments pushed 2022 refiner profit margins to some of the highest levels on record.

The positive operating environment triggered a rally in the refining sector. Last year, shares in PBF rallied from roughly $13/share all the way above $40/share by year-end. And the refinery sector has continued to outperform in 2023. Year-to-date, shares in PBF are up another 25%, with the stock currently trading about $47/share.

That said, optimism in the sector has been fading, as evidenced by Bank of America’s recent downgrade.

Pullback in crude oil and the deteriorating Chinese economy

It’s probably no coincidence that Bank of America happened to downgrade the refiners after a tough week in the broader energy markets. Crude oil dropped by about $5/barrel since Aug. 10, bringing a barrel of West Texas Intermediate (WTI) down to about $80/barrel.

Crude oil prices had been rallying since early June, but hit a speed bump in August due to rising anxieties over the state of the Chinese economy.

On Aug. 7, one of China’s largest property developers—Country Garden—failed to make required interest payments on some of its dollar-denominated bonds, and as a result, is currently teetering on the brink of technical default.

The failed payments triggered a 30-day grace period, which means a technical default can’t occur until early September—assuming Country Garden doesn’t make the required interest payments in the interim. Country Garden has already warned that the company’s losses from operations could be upwards of $8 billion for the first half of 2023.

Country Garden’s downfall is especially concerning because one of China’s other large property developers—Evergrande—officially filed for bankruptcy on Aug. 17. As a result, the problems in China’s property are starting to look systemic, as opposed to being isolated within a small group of companies/regions.

The property sector has long been a key cog in the Chinese economy, with some estimates indicating that it constitutes roughly 22.5% of total annual GDP in the country.

On top of these worrying developments, the post-COVID recovery in China has also flamed out, which has forced the Chinese central bank to try and accommodate the economy. On Aug. 14, in response to the Country Garden debacle, the People’s Bank of China lowered the rate on its one-year loans by 15 basis points, to 2.5%.

That’s the second time the Chinese bank has cut rates in the last three months, which comes in sharp contrast to most other developed countries, which have been steadily raising benchmark interest rates since last year.

Circling back to the energy sector, deterioration in the Chinese economy can often bleed over into global energy markets because China is one of the world’s largest importers of energy-related commodities. So, when China’s economy is under pressure, energy markets often decline, in anticipation of reduced demand.

Taken together, these developments help explain why crude oil prices have likely pulled back in recent days. And sobering news out of China may also help explain why Bank of America turned neutral on the refiners, due to declining confidence in the global economy.

To track and trade the refining sector, readers can add the following symbols to their watchlists (sorted by year-to-date return):

- Par Pacific Holdings (PARR), +60%

- Marathon Petroleum (MPC), +30%

- CVR Energy (CVI), +20%

- HF Sinclair (DINO), +16%

- Phillips 66 (PSX), +13%

- PBF Energy (PBF), +11%

- Valero Energy (VLO), +11%

- Shell (SHEL), +9%

- VanEck Oil Refiners ETF (CRAK), +9%

- Delek US Holdings (DK), +8%

- Valvoline (VVV), +3%

For more context on where the refiners fit in the broader energy sector, check out this installment of Futures Measures on the tastylive financial network. To follow everything moving the markets on a daily basis, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.