Trading Japanese Stocks and ETFs Amid 2023 Rally

Japanese stocks were the strongest in the world during the first half of 2023 as a weakening yen, increased exports and a drive to improve Japanese corporate governance contribute to the region's desirability

Prior to the start of 2023, Japanese stocks traded mostly sideways for almost two years. From the start of 2021 through the end of 2022, the Nikkei 225 index declined by 5%.

However, since the start of 2023, the Japanese stock market has been one of the hottest on earth. The Nikkei 225 rallied by more than 30% in H1 2023, and is currently up about 26% year-to-date.

That’s nearly twice the return in the S&P 500, which has added about 15% so far in 2023.

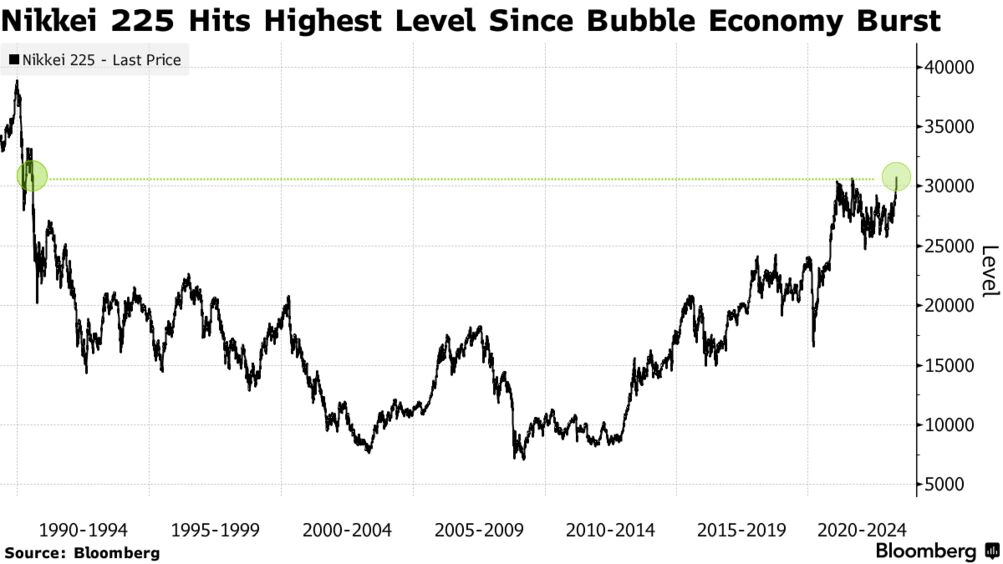

Amidst that first-half run, the Nikkei broke through some key barriers. In early June, the index hit its highest closing price in 33 years when it closed above 32,000.

But that’s still well short of the index’s all-time high, which was set in December 1989 at 38,915. Today the index trades at around 32,300.

So why has the Japanese market suddenly stolen the global spotlight?

That’s largely in the eye of the beholder, but it appears that Japanese stocks have benefited from a confluence of positive factors, including low interest rates, a weak yen, rebounding economic growth and some key developments related to corporate governance.

The fact that Warren Buffett recently ratcheted up Berkshire Hathaway’s (BRK.B) exposure to the Japanese market certainly hasn’t hurt the situation, either. Japanese stocks have experienced a surge in foreign interest this year, which has also been constructive for the rally.

Top-performing Japanese single-stocks and ETFs

Listed below are some of the top-performing stocks in the Japanese market so far in 2023—many of which are well-known Japanese brands:

- Panasonic (PCRFY), +45%

- Mitsubishi Electric (MIELY), +41%

- Asics (ASCCY), +38%

- Nissan (NSANY), +32%

- Honda (HMC), +30%

- Mazda (MZDAY), +27%

- Yamaha (YAMHY), +26%

- Hitachi (HTHIY), +24%

- Komatsu (KMTUY), +21%

- Subaru (FUJHY), +21%

- Canon (CAJPY), +20%

- Suzuki (SZKMY), +20%

- Nippon Steel (NPSCY), +19%

- Sony (SONY), +19%

- Toyota (TM), +17%

In addition to the single stocks, most of the Japanese-focused ETFs have also outperformed in 2023, as highlighted below:

- WisdomTree Japan Hedged Equity Fund (DXJ), +30%

- Xtrackers MSCI Japan Hedged Equity ETF (DBJP), +27%

- iShares Currency Hedged MSCI Japan ETF (HEWJ), +26%

- Franklin FTSE Japan Hedged ETF (FLJH), +25%

- WisdomTree Japan Hedged SmallCap Equity Fund (DXJS), +21%

- ProShares Ultra MSCI Japan (EZJ), +20%

- First Trust Japan AlphaDEX Fund (FJP), +13%

- iShares MSCI Japan Value ETF (EWJV), +13%

- iShares MSCI Japan ETF (EWJ), +12%

- iShares JPX-Nikkei 400 ETF (JPXN), +12%

The Japanese yen and rebounding economic growth

Outside of the hot start for Japanese stocks, another major storyline in the Japanese economy has been the yen.

Unlike the Nikkei 225, the Japanese yen has actually been trending lower and is currently trading at the lower-end of its five-year range against the U.S. dollar.

Over the last five years, the dollar/yen exchange rate has ranged between roughly 105 and 150, and today it sits at about 142.

A weaker yen isn’t necessarily a positive for Japanese tourists when they travel abroad, but it has provided a lift for many Japanese businesses. A weaker yen theoretically makes Japanese exports cheaper, and therefore more attractive to foreign buyers.

Case in point, Japanese exports surged to record levels in fiscal year 2022. Last year, Japan exported roughly 15.5% more than it did in 2021, with a total value of roughly $750 billion. That’s the highest total on record.

That surge in exports has also contributed to stronger economic growth. In Q1 2023, Japan’s gross domestic product (GDP) grew by 2.7%, which was the highest since Q3 of 2020.

Considering all of the above, one can see why Japan’s export-focused economy has been thriving in the current environment, and why that optimism has likely spilled over into the stock market.

Renewed focus on corporate governance and shareholder value

One of the other key developments in the Japanese market has been a drive to improve corporate governance and shareholder value.

These types of reforms can be as simple as additional diversification at the highest levels of the organization (i.e. more diversified personnel in the C-suite and the board of directors), or increasing the dividend payout for shareholders. And both of those examples have seen an uptick in interest among the Japanese corporate sector in 2023.

However, regulators in Japan are also trying to reform other aspects of the system, with the goal of improving the overall shareholder experience in Japan.

For example, one headwind in the Japanese stock market has been inadequate liquidity. In order to try and improve overall liquidity in the market, the Tokyo Stock Exchange (TSE) recently redefined tradable shares. This change is expected to boost liquidity and provide additional depth to the Japanese stock market.

Another key initiative of the TSE has been an attempt to rectify the fact that about half of the stocks in the Tokyo Stock Price Index (TOPIX) trade below book value. Generally speaking, companies that trade below book value hail from the “value” universe, due to limited expectations for their revenues and profitability.

Earlier this year, the Tokyo Stock Exchange announced that it would compel companies trading below their book values to devise new capital improvement plans, with the hope of unlocking additional potential.

At the end of the day, this initiative is intended to drive greater profitability by encouraging companies to hold less cash, to shutter unprofitable divisions/subsidiaries, and to invest in new initiatives and technology. Moreover, Japanese companies are also being encouraged to increase stock buybacks and/or increase dividends.

Cumulatively, these moves have been well received by the investment community—both inside and outside Japan. And the overall attractiveness of the Japanese market has arguably improved considerably since the start of the year.

Asli Colpan, a professor of corporate strategy at Kyoto University, recently told CNBC, “Better corporate governance has been attracting more international investors including recent ones like Warren Buffett’s Berkshire Hathaway; and more international investors are putting more pressure for compliance—forming a virtuous cycle.”

All things considered, the above helps explain why Japanese holdings have been so popular in 2023, and why the Japanese market renaissance could persist into 2024 and beyond.

To learn more about trading country-focused ETFs like the iShares MSCI Japan ETF (EWJ), check out this installment of Options Jive on the tastylive financial network. To follow everything moving the markets this summer, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.