Trading Mergers and Acquisitions

Merger and acquisition (M&A) activity shrunk during the first half of 2020 by roughly 50% as compared to last year, but since July, the pace has picked up considerably.

The uptick in activity was punctuated by two recent mega-deals—the acquisition of Arm Limited by Nvidia (NVDA) and the acquisition of Immunomedics (IMMU) by Gilead (GILD)—together totaling more than $60 billion in fresh M&A activity.

The takeover of Arm is notable because it represents the second-largest deal ever in the technology sector. The 2016 purchase of EMC by Dell (DELL) and Silver Lake for $67 billion still stands as the largest in the space. Interestingly, the previous purchase of Arm by Japan’s Softbank Group (SFTBY) in 2016 stands as the fourth-largest.

Softbank booked roughly $8 billion in profit after a four year holding period by purchasing Arm for $32 billion in 2016 and then flipping it to Nvidia for $40 billion in 2020. Softbank might have been looking to book an impressive public win after ill-advised investments in WeWork and Uber (UBER), among others, contributed to losses of more than $12 billion last year.

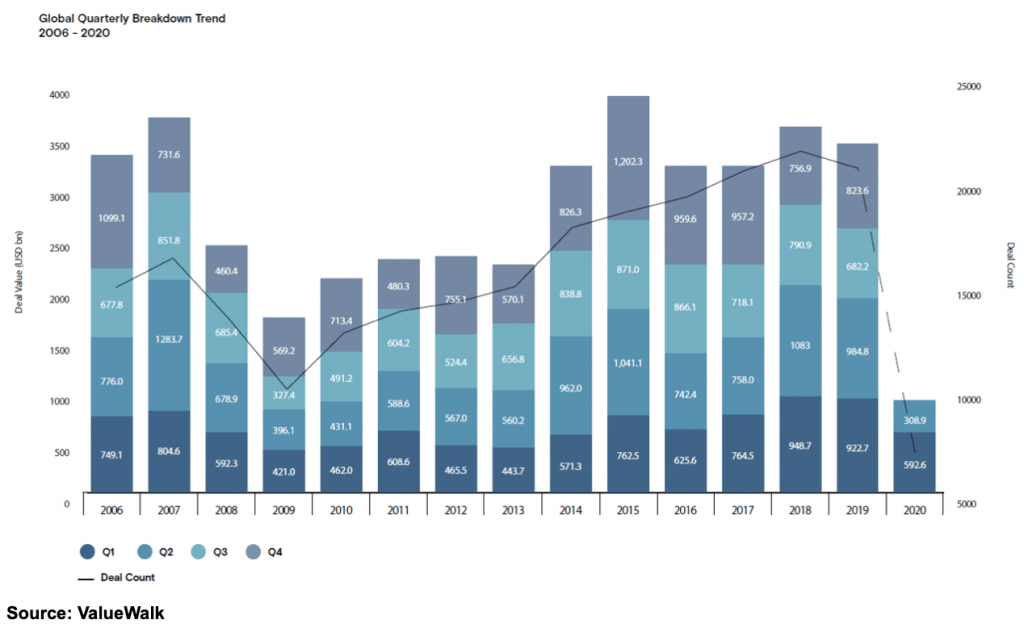

For context, there were roughly 50,000 global M&A transactions in 2019, representing about $3.8 trillion in value. So far in 2020, nearly 28,000 transactions have been announced, with a total value of $1.4 trillion (year-to-date).

Global M&A Activity by Year

Mergers and acquisitions both refer to the joining of two different companies, but under different circumstances. Mergers occur when two different companies combine to create a new joint entity. Acquisitions, referred to synonymously as buyouts, involve the takeover of one company by another.

From an investment and trading perspective, it’s buyouts that usually make the bigger splash because the acquirer traditionally pays a large premium for the target company. Announced deals, and even rumors of a potential deal, can therefore catalyze outsized, gap moves in target companies.

IMMU, for example, spiked from about $42/share to $85/share after the deal with Gilead was announced.

As a result of gargantuan returns such as this, (as well as, the challenging logistics of marrying for money) legions of investors and traders are constantly scanning the newswires for insights on potential tie-ups. In high-confidence situations, market participants take long stock or options positions with the intention of riding a potential M&A event.

The M&A space also attracts a group of investors/traders focusing on “risk arbitrage,” also called “merger arbitrage.” This strategy hinges on the deployment of stock and options positions after a deal is announced. The purpose of this approach is to try and take advantage of potential adjustments to the announced deal.

For example, a second bidder might materialize, driving up the stock price of the target company further. In other cases, government regulators might adopt a negative view of a potential deal, which could delay or derail the transaction. When deals are called off, the stock price of target companies often drifts back to the level observed before the deal was announced.

Merger arbitrage trading encompasses all of these situations, and more.

Readers seeking to learn more about the M&A trade may want to review a recent installment of Small Stakes on the tastytrade financial network. This episode highlights how stock indices react when buyouts are announced, and some tactics investors and traders can utilize to potentially gain exposure to more deals. To follow all the daily action in the financial markets, readers can also tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 3 p.m. Central time.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.