What You Need to Know About the Frequency of Big Stock Market Moves

Historical data indicates that multiple large-magnitude moves in the stock market occur very rarely during the same week.

Historical market data indicates that volatility tends to pick up in the financial markets heading into fall.

In 2021, that pattern has held true, as relatively big market moves in both directions have occurred throughout the month of September.

Case in point, the S&P 500 has moved between 1% and 2% on three different occasions since Friday, Sept. 17. Those included one rally and two selloffs—including the one on Sept. 30.

Considering the recent volatility, one might wonder how often the stock market experiences large corrections during the same week. Not very often, especially for larger magnitude moves, according to research conducted by tastytrade.

Before diving into the data, let’s first review the likelihood of multiple small moves during the same week, which is a lot more common.

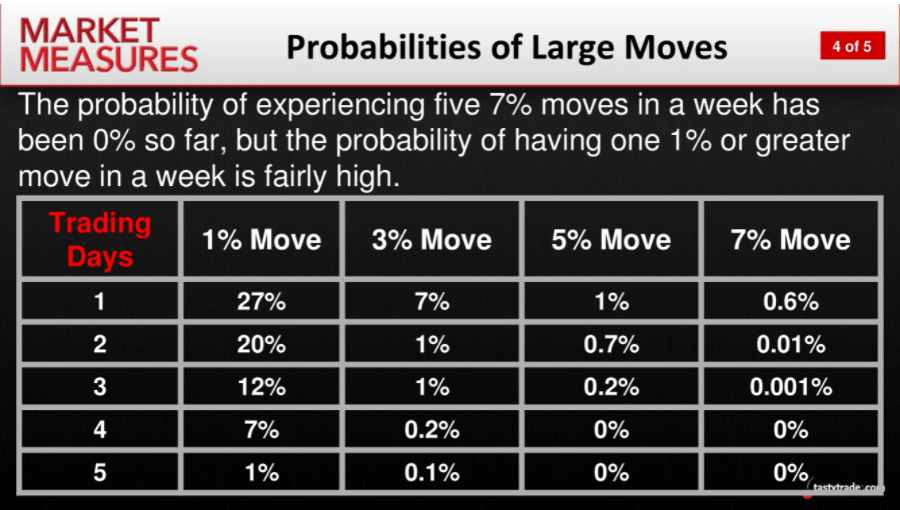

Going back to the year 2000, historical data from SPDR S&P 500 ETF (SPY) illustrates that a 1% move in the stock market (up or down) is relatively common. tastytrade research reveals that in any five-day trading window from the year 2000 to present, 1% moves have occurred about 27% of the time.

However, when expanding the filter to include bigger moves in the stock market—3%, 5% and 7%—the associated probabilities drop considerably.

Since 2000, the chance of a 3% move in the stock market during any five-day trading window is about 7%, whereas the chances of a 5% or 7% move are even more minuscule—1% and 0.6%, respectively.

Moreover, the likelihood of multiple large-magnitude moves during the same five-day trading window is even lower. For example, the chance of two 7% moves in the same week—based on historical data in SPY—is roughly 0.01%.

The chart below summarizes tastytrade’s findings on the historical likelihood of big moves in the stock market.

As shown above, the chance of multiple big moves in the market during any five-day trading period (going back to the year 2000) is fairly low.

The only thing that appears to occur with any degree of regularity is multiple 1% moves during the same five-day trading period—something that has occurred in 20% of instances.

That means that the multiple 1%-2% moves observed in the stock market since Sept. 17 aren’t necessarily abnormal, especially during the fall trading season, which tends to be more volatile.

Interestingly, trading in the CBOE Volatility Index (VIX) on Sept. 30 appears to support the notion that multiple 1%-2% moves aren’t abnormal. Despite a 50 point pullback in the S&P 500 on Sept. 30, the VIX barely budged—moving up less than a point.

Typically, big downward moves in the broad market indexes are accompanied by corresponding spikes in the VIX. The fact that the VIX barely moved on Sept. 30 provides further evidence that “fear” hasn’t overtaken the markets—at least not yet.

However, if the magnitude of the moves increases, and the stock market starts making multiple moves of 3%-7% in the same week, investors and traders may want to take note. In that scenario, the VIX would undoubtedly spike higher.

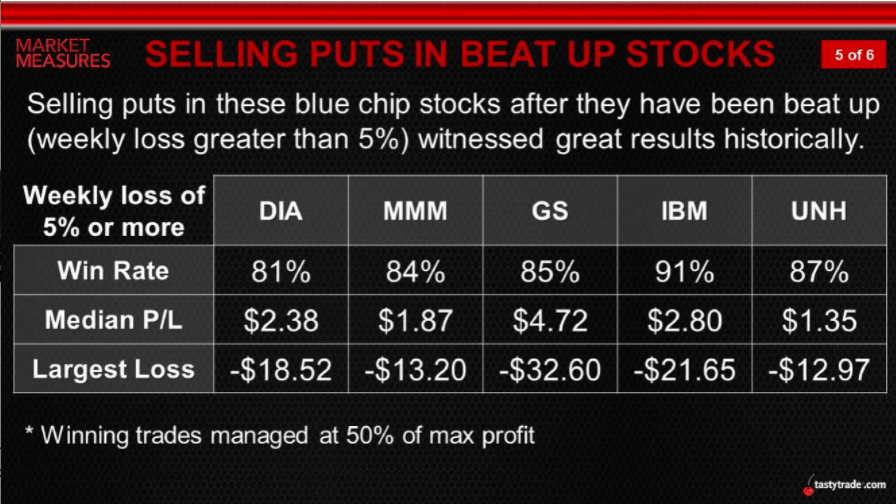

In terms of specific opportunities to look out for, previous research conducted by tastytrade has revealed that 5% corrections in “blue chip” stocks can provide good opportunities for selling puts. To learn more about that strategy, readers may want to review this previous episode of Market Measures: Selling Puts in Beat Up Stocks.

To learn more about trading volatility after a selloff, readers can review this new installment of Options Trading Concepts Live on the tastytrade financial network.

For updates on everything moving the markets, TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. Central Time—is also recommended.

Get Luckbox! Subscribe to receive 10-issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.