Those Elusive 500% Annual Returns

Luckbox’s April 2020 issue, Darknet Diaries, took aim at the criminal underground operating within the anonymous, encrypted underbelly of the internet’s deep web. There, drug dealers use e-commerce sites to peddle their wares, ill-gotten gains are laundered with ease, scams target the pocketbooks of unsuspecting web surfers and terrorism finds financiers.

Because it’s often thought of as anonymous and thus untraceable, cryptocurrency became the dominant medium of exchange for such operations—within the deep web as well as transcending its surface. But in practice, crypto is more pseudonymous than anonymous. In fact, crypto is traceable and transparent if the authorities can match wallet IDs with their owners.

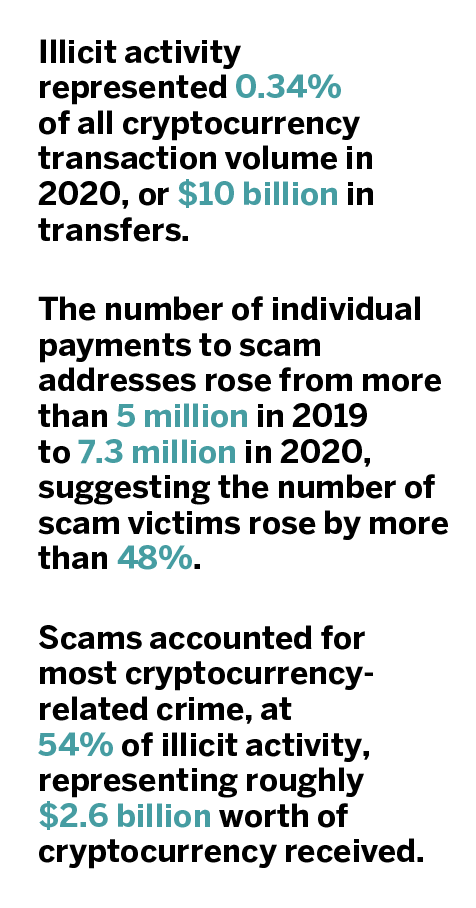

Hence, blockchain analysis companies, such as Chainalysis, can quantify criminal crypto activity. In its latest study, The 2021 Crypto Crime Report, the firm sheds light on the evolving face of crypto crime, including a recent surge in scam victims.

With a $100 minimum deposit of bitcoin, investors could purportedly take advantage of state-of-the-art artificial intelligence-powered trading software to rake in guaranteed returns of 0.5% daily, amounting to as much as 500% annually.

If that sounds fishy, it should. It was the sales pitch for 2020’s largest cryptocurrency scam, conducted by South African fraudsters under the banner of “Mirror Trading International,” or MTI.

In total, MTI collected as much as $589 million from more than 471,000 deposits, according to blockchain analysis company Chainalysis. With that many deposits, the scheme’s too-good-to-be-true promises suckered victims believed to number in the hundreds of thousands.

Scams like MTI’s represent the highest-grossing form of cryptocurrency-based crime worldwide, according to Chainalysis’ 2021 Crypto Crime Report. Although scam revenues declined from around $9 billion in 2019 to just under $2.7 billion in 2020, the number of payments—consequently suggesting the number of victims—increased more than 48%.

So, what happened to MTI? It didn’t take long before scam allegations grew loud enough to attract regulators’ attention.

First came a cease-and-desist order from the Texas State Securities Board accusing MTI of directing a multi-level marketing scam and operating in Texas without a license. Then, South Africa’s Financial Sector Conduct Authority (FSCA) stepped in with similar accusations, announcing a formal investigation into the company and urging investors to withdraw their funds.

But before FSCA’s could conclude its investigation, a South African hacker group called Anonymous ZA published leaked MTI data exposing security vulnerabilities and bonuses paid to 63 profiles categorized as “founders.” Those profiles, representing 0.038% of all users, received as much as 4.7% of all bonus revenues paid to MTI members.

The jig was up.

In the following months, the home of two MTI principals was raided and the FSCA’s investigation uncovered unreported losses and missing bitcoins. MTI’s CEO, Johann Steynberg, disappeared from South Africa. Like much of the bitcoin fronted by MTI investors, Steynberg remains missing at press time.

The FBI joined forces with South African liquidators to recover funds for U.S. investors, but Steynberg, like much of the bitcoin fronted by MTI’s investors.

Tales from the Africrypt

South Africa was home to the biggest cryptocurrency scam of 2020 with Mirror Trading International, or MTI. But the country has already outdone itself in 2021 to the tune of $3.6 billion—more than all of 2020’s crypto scams combined.

In a story similar to MTI’s, the founders of cryptocurrency investment platform Africrypt vanished along with investors’ bitcoin. They left not long after Africrypt Chief Operating Officer Ameer Cajee announced to clients in April that the company had been hacked.

A law firm’s investigation discovered the company’s pooled funds had been tumbled and mixed to make them virtually untraceable. If never recovered, the crypto lost to the Africrypt scam is three times greater than that lost to MTI.