Inflation Has a New Hedge

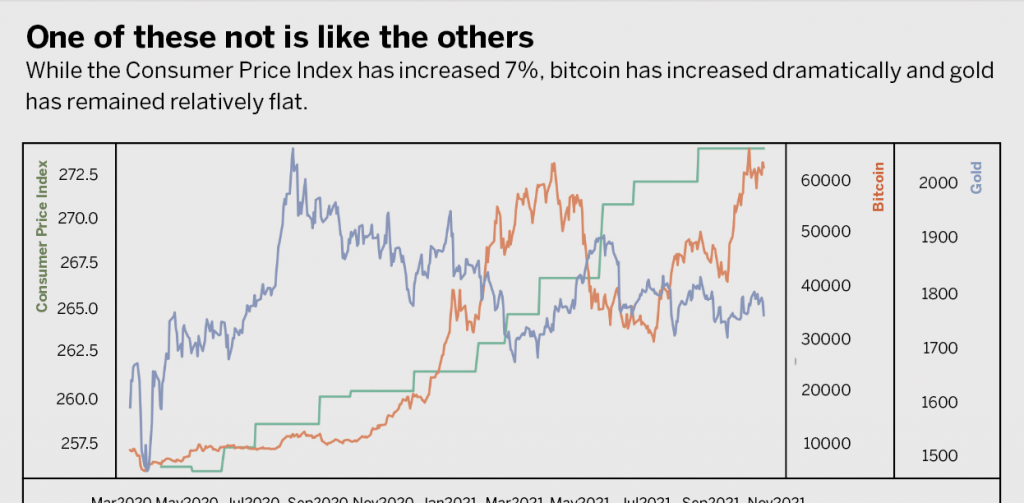

The best hedge against inflation? Bitcoin.

Because no matter what happens, the world will never have more than 21 million bitcoins. Plus, no one has shown that the price of bitcoin is tied to any other asset class.

With growth averaging 200% annually since its inception in 2009, bitcoin occupies a unique place in the world. It defies comparison with just about anything, including inflation. Think of it as an entity onto itself, uncorrelated with any real-world asset or even any financial asset.

What’s more, there’s no way to produce more bitcoins to meet increased demand. Once miners have created enough bitcoins to reach the cap of 21 million, they’ll have no way to produce more.

That’s not the case with gold, the go-to inflation hedge of the 1970s. The supply of Au, as it’s called in the periodical table, is virtually infinite. Latter-day ‘49ers will always be able to extract more of it from the earth. That’s true because mining gold that might seem inaccessible right now will become worthwhile if the price of the precious metal climbs high enough.

That will never happen with bitcoin. So, stripping out the volatility, the value of bitcoin will increase in price as long as governments print money and investors continue to move some of that money into bitcoin. It’s programmed to do that, and no one can change it.

However, investors should bear in mind that the supply of most other cryptocurrencies isn’t capped. Anyone can sit down at a laptop and magically create a new cryptocurrency with infinite supply. As long as people buy it, the price will continue to go up.

Cryptocurrencies like that don’t necessarily provide a hedge against inflation because more tokens can keep coming into the market. That’s exactly what can happen with some of the big names in crypto—like Dogecoin.

But don’t disparage the thousands of cryptocurrencies now circulating just because they weren’t designed with inflation-resistant ceilings on the number of possible tokens. Some have other advantages.

To program a decentralized-finance crypto that facilitates borrowing and lending, for example, the creator could build in inflation by increasing the number of tokens outstanding by 1,000% annually. That results in a high APR (annual percentage rate) for those who lock the tokens into liquidity pools to build capital. The problem is those tokens can lose value quickly.

Using another tokenomic model—called pre-mining—someone manufactures a huge quantity of tokens and keeps a lot of them. Ripple, a currency exchange, did that by minting 100 billion XRP tokens, retaining 65 billion and paying itself up to a billion tokens each month for years. So how good a hedge against inflation is that?

Meanwhile, institutional investors and even a few countries, such as El Salvador and Bulgaria, are buying bitcoins or investing in funds that track bitcoins. Endowments that include the Houston Firefighters Relief and Retirement Fund are taking positions in bitcoin, too.

Often the investment in bitcoin remains small relative to total portfolios. The Houston Firefighters, for example, have $5.5 billion in their pension fund, and about $25 million of it is in bitcoin and ethereum.

Inflation has made those cryptos more attractive to investors, but other factors are at work, too. In the modern investment landscape, it’s so difficult to generate safe yield that investors should have exposure to new opportunities to grow or at least preserve wealth. Having a little bitcoin does that.

Mark Helfman, crypto analyst at Hacker Noon, edits and publishes the Crypto Is Easy newsletter at cryptoiseasy.substack.com. He is the author of Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency. @mkhelfman