Is a Red-Hot VIX a Buy Signal?

Opportunities typically abound in high-volatility trading environments, but should choppy conditions in the market be viewed as a buy signal?

Volatility often gets a bad rap by the mainstream financial media—and rightly so, as volatile market conditions aren’t necessarily ideal for traditional “buy and hold” investors.

But elevated levels of market volatility can also be associated with new opportunities, whether that be buying one’s favorite stock at a discount, or selling rich volatility using options.

This type of mindset aligns well with Warren Buffett’s famous axiom, “be fearful when others are greedy, and be greedy when others are fearful.”

But the above begs the following question—does heightened volatility signal that a rally is imminent?

Research conducted by tastytrade suggests that the market’s natural upward bias does get stronger in the wake of elevated market volatility—indicating that the chances of a rally are stronger when a metric like the CBOE Volatility Index (VIX) is screaming.

But there’s a catch—high volatility trading environments are also associated with higher magnitude moves. That means that while the likelihood of upward movement may increase in a volatile market, the risk of a big move (in either direction) increases, too.

Logically, this makes sense, due to the strong correlation between risk and reward in the marketplace. Amidst a correction, the potential rewards from buying beaten-up stocks theoretically increases, but so do the risks.

Moreover, the catalyst for a strong bout of market volatility can also play a role, because whatever caused that period of volatility may not only shake up valuations, but also perceptions. Meaning some niches of the financial markets may rebound more quickly than others, while some may not rebound at all.

As an example, imagine a hypothetical implosion in the cryptocurrency sector catalyzed a severe stock market correction. An event like that would likely shake up market perceptions, with non-crypto-related sectors of the market recovering more quickly than companies/sectors with heavy exposure to the cryptocurrency sector.

Along those lines, it took the financial services sector a long time to recover in the wake of the 2008-2009 Financial Crisis.

The Numbers

Readers seeking to learn more about the nuances of this tastytrade research may want to review a new installment of Market Measures when timing allows.

On the show, the hosts walk viewers through a market study that examines overall market performance during historical periods of elevated volatility. In addition to market performance, the research also incorporates risk dynamic, via standard deviation (i.e. the variability of returns).

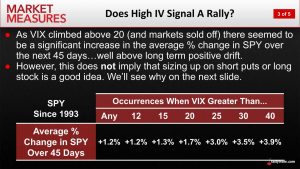

As one can see in the first image below, historical data confirms that the average percent gain in SPDR S&P 500 ETF Trust (SPY) did increase during periods in which the VIX was elevated. Moreover, the magnitude of gains in SPY appear to be correlated with the intensity of the volatility, as the returns tend to get larger as the VIX goes higher.

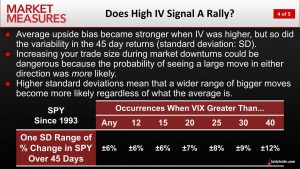

But as illustrated in the second image below, the probability of larger moves (in either direction) also increased as the VIX moved higher—meaning that overall risks in the marketplace also intensified.

The above suggests that while rising volatility may be indicative of a future rebound in prices, one must also recognize that the risks in said environment are substantially higher as well.

In sum, that suggests that trading small and staying nimble—two prudent tactics in any market environment—are paramount when the VIX starts ripping higher. Because trading too big, when uncertainty is peaking, can produce disastrous results.

To learn more about staying nimble, readers can review this installment of Options Jive. For more details on tastytrade’s research into using elevated market volatility as a buy signal, readers can follow this link.

To track everything moving the financial markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.