Crypto Consensus

Blockchain networks come to agreement through either proof-of-work or proof-of-stake protocols

By Ryan Grace

Proponents of cryptocurrency tend to view blockchain technology as the future of the financial system because it improves efficiency by removing intermediaries.

In blockchains, everyone who’s participating can view the same information in real time, speeding up settlement and reconciliation. Blockchains are trustless, meaning users don’t rely on third parties to verify transactions or prove something is true.

Instead, blockchains verify transactions through “consensus,” a real-time process that calls upon participants to agree on the present state of the network.

While that might seem like a mishmash of unnecessary technical jargon, consensus could be the key to whether blockchains can support the machinations of the financial system.

For a blockchain to reach agreement on the current state of the network, 51% or more of the nodes running the blockchain’s code must attest to the validity of a transaction. That process records transactions and helps protect the blockchain from fraudulent activity. The process also rewards participants.

The most prevalent mechanisms for achieving consensus are proof-of-work (PoW) and proof-of-stake (PoS). The Bitcoin and Ethereum blockchains both use the former, though Ethereum is shifting to a PoS layer. (More on that later.)

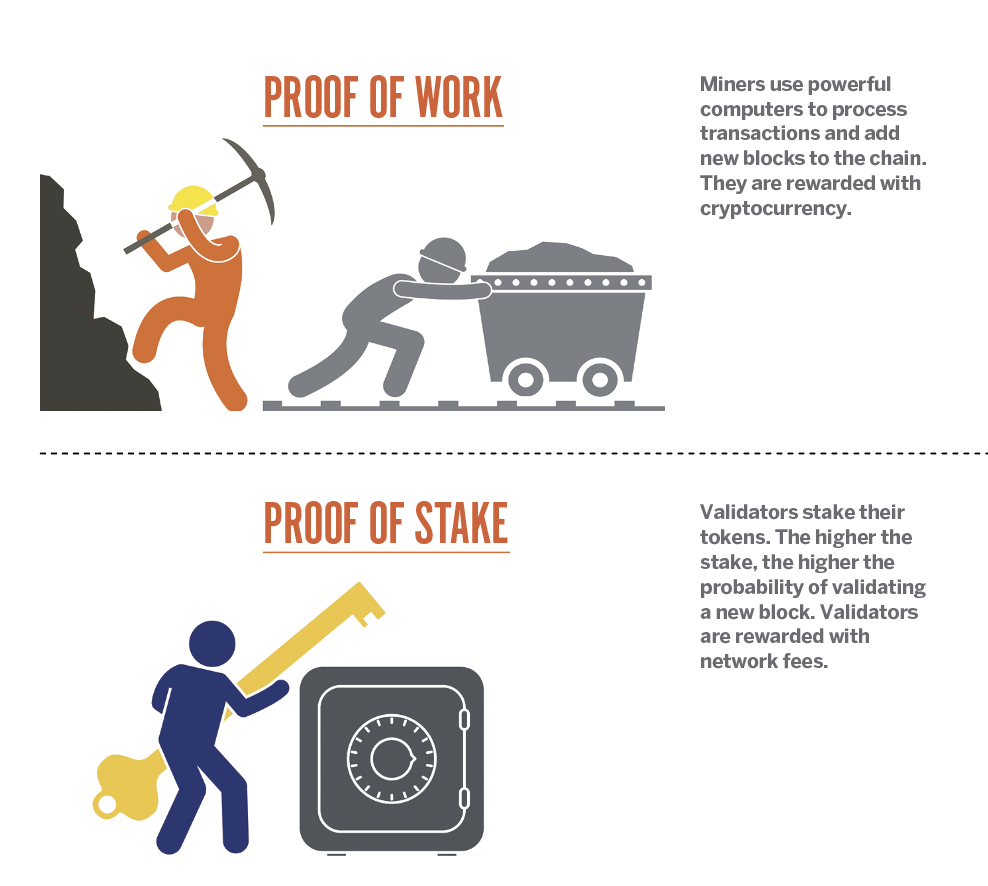

Proof-of-work

In a proof-of-work (PoW) blockchain network, miners race to process transactions and add newly processed blocks of transactions to the chain. They do it by solving a complex mathematical equation that connects the current block of transactions to the previous block in the chain.

Miners are rewarded with cryptocurrency for completing the computation. Bitcoin miners, for example, receive bitcoin as payment.

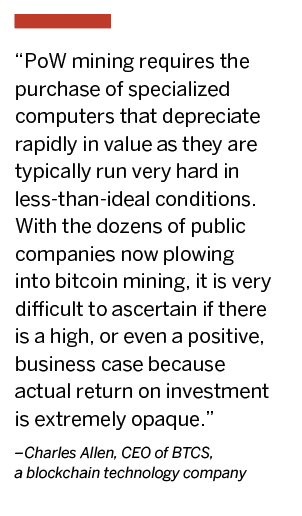

The process uses a lot of energy and computing power. The trade-off for the massive energy consumption is increased security.

Today, it’s virtually impossible to “hack” Bitcoin or a similar proof-of-work chain. To accomplish it, a bad actor would have to take control of 51% of the network’s computing power. That’s theoretically possible, but the cost would dwarf any fraudulent gains.

Proof-of-stake (PoS)

In a PoS network, miners are replaced by “validators” who have staked their own tokens in the network.

As opposed to PoW, where miners race to add transactions to the blockchain, PoS uses an election process. In this election, a single node is chosen to add the next block to the blockchain and receive the reward.

The process of selecting a validator is not entirely random. The responsibility is allocated to network participants depending on how many tokens they hold.

Validators are required to stake a certain number of tokens in the network. The higher a validator’s stake, the higher the probability of being chosen during the validator selection process. The process is less secure than achieving consensus via PoW but still results in a high degree of security.

To defraud a PoS blockchain, a bad actor would have to control 51% of the staked tokens across the entire network. That’s highly unlikely with a developed network. The larger a network, the more difficult such schemes become. In addition, validators who commit fraudulent transactions are penalized with a loss of staked tokens.

Trade-offs

Blockchains have to achieve consensus to function properly, but the process of reaching agreement has trade-offs. PoW chains are extremely secure but require an enormous amount of energy to power the network and verify transactions. PoS chains give up some degree of security but use less energy and can process many more transactions per second.

The Ethereum network is scheduled to complete a shift from PoW to PoS this year. If successful, it should result in a faster, more efficient and more scalable Ethereum network, which has been held back by its PoW consensus mechanism.

Given the efficiency of PoS, growth of these blockchains appears likely to continue. Once Ethereum makes the shift, its native token, ETH, will become the largest PoS token by market cap. Until then, the next largest PoS tokens by market cap are Cardano (ADA), Solana (SOL), Polkadot (DOT), Avalanche (AVAX) and Polygon (MATIC).

Ryan Grace, head of digital assets for tastytrade, is co-host and co-producer of the Jones and Friends show on the tastytrade network. @tastytraderyan