Is Bitcoin at the Bottom?

Barring economic catastrophe, this analyst believes the price of bitcoin is unlikely to go lower

Bitcoin may seem destined for lesser things.

Why? Because the world is running out of cash for speculative ventures like cryptocurrency as governments raise interest rates and tighten monetary policy. Meanwhile, the specters of criminal investigations and regulatory ambiguity are also casting shadows over the scene.

That’s more than enough uncertainty to give even the most aggressive investor a moment’s pause, but Bitcoin has one feature no other investment has: A blockchain that provides a pseudonymous record of all transactions.

Analysts can mine that public, verified data on bitcoin transactions to discover the relationships, behavior and actions of people who hold and use bitcoin as prices go up and down.

So, what does the data show?

Strong hands getting stronger

Despite the looming disasters that may result from recent attempts at austerity and regulation, bitcoin’s network shows the same behavior and technical signals as in previous, generational market bottoms.

If that holds true, bitcoin’s price hit its “forever” bottom at $17,600 on June 18.

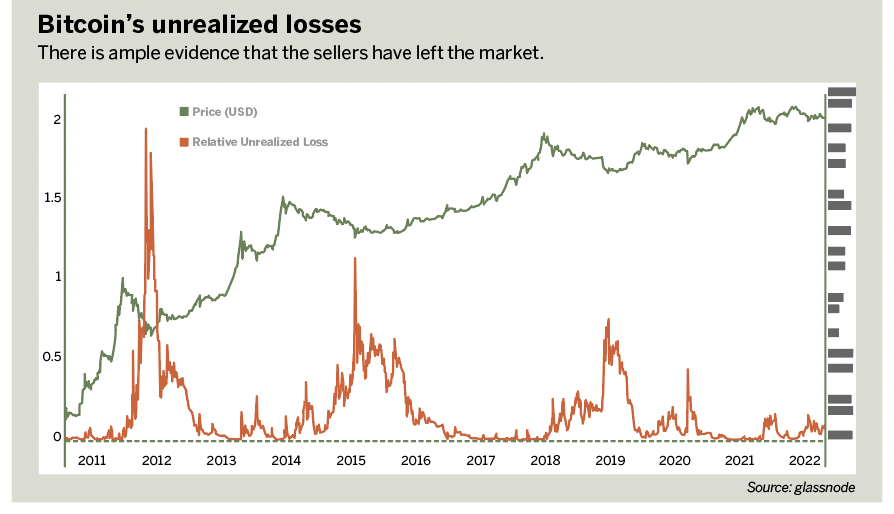

On and around that date, bitcoin holders sat on massive unrealized losses. When normalized for market cap as “relative unrealized loss,” June’s peak marked the fourth-highest reading ever.

What happened after those other three peaks?

Bitcoin’s price never went lower.

Around the same time, bitcoin’s network also saw massive realized losses as lending platforms liquidated assets and speculators panic-sold en masse. On June 13, the network collectively realized $5 billion in losses, its largest ever.

A few weeks earlier, the network shed $3.5 billion in losses. Bitcoin’s network realized $36 billion of cumulative losses in June.

While that may signal capitulation in the broad sense, the true believers still hold strong.

The vast majority of bitcoin holders didn’t sell after a rise of 50% and a drop of 75%. They held through an epic rise and record-breaking losses. They saw a meltdown of historic proportions and still haven’t sold for months, possibly years.

Now, no coins have been spent or sold in the last year from around 70% of bitcoin wallets. That’s the case despite the value of bitcoin doubling then falling by a half during that time.

Certainly, new owners may sell bitcoin as its price goes up.

But what about down?

These investors bought tens of billions of dollars worth of bitcoin in the middle of aggressive rate hikes, war and a collapse of some of the largest crypto businesses.

If there was a time to panic-sell, that time has long since passed.

Growing conviction among believers

Since June, the network has seen growth in the number of wallets of all sizes larger than $2,300.

Meanwhile, the number of new addresses mostly fell during that time, as did the number of smaller wallets and wallets larger than $20 million.

This suggests most of bitcoin’s network activity since June came from people who were already in the market. They’re accumulating larger holdings as small—likely retail—investors disappear and whales distribute some of their holdings.

To some extent, this shift reflects large movements of bitcoin out of exchanges and lending platforms into the self-custody of personal wallets.

Consider it crypto’s version of a flight to safety.

But regardless of the cause, the result is the same: more bitcoins in the hands of people who seem to want it more than they want their government’s money.

Given bitcoin’s historic volatility, the range of possible prices is always wide. Does it seem too far-fetched to think its price will never go lower than $17,600?

This time is different

For those who believe markets bottom when the sellers leave, there’s ample evidence that sellers have left. Until new sellers emerge in volume, it’s hard to see how prices can fall much lower (barring a financial catastrophe).

For those who think markets can go up only when new buyers arrive, there’s no evidence that new buyers have arrived. Trading volume, network usage, new wallets and exchange inflows remain subdued.

There’s also a strong headwind facing anybody who thinks crypto’s going to go on another of its amazing runs: Nobody has any money anymore.

Sidelined cash is great. If inflation persists and monetary policy keeps getting tighter, that cash will come off the sidelines—but it probably won’t end up in the crypto market. More likely, it will end up paying off loans, buying food and going wherever cash-strapped would-be buyers need for it to go.

At the same time, even the most ardent bitcoiners might sell if their financial circumstances get worse. You can’t eat bitcoin.

Some analysts think the U.S. Federal Reserve will tighten so hard it “breaks something” and has to reverse course, print more money and send asset prices up again. That’s what happened in 2018 when Jerome Powell, then secretary of the treasury, raised interest rates four times before reversing course to begin lowering them the next year. They say bitcoin would benefit from another so-called “Powell pivot.”

Maybe.

Or maybe bitcoin’s price will go up because it has nowhere else to go. Everybody who wanted to sell has already sold, and everybody who bought will need for its price to go a lot higher before they sell.

In that case, no amount of tightening will push bitcoin’s price lower than $17,600.

If anything, that tightening may stoke anger among traditional investors who realize their assets have only as much value as their governments allow. What happens when bitcoin’s price goes down only a little while the stock market goes down a lot?

At that point, disgruntled investors may make a pivot of their own to an asset that not even the U.S. Federal Reserve can control.

Mark Helfman, crypto analyst at Hacker Noon, edits and publishes the Crypto Is Easy newsletter at cryptoiseasy.substack.com. He is the author of Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency.

@mkhelfman