Trading the Top-Performing Stocks and ETFs in 2023

Despite tempered performance in the S&P 500 so far in 2023, there have been plenty of big winners when it comes to single stocks and ETFs.

The U.S. stock market started 2023 on strong footing but hasn’t added to those gains in recent weeks, with equities trading mostly sideways since early April.

The ongoing banking crisis has undoubtedly throttled optimism in the stock market, along with the overhang of a potential recession. As a result of these factors, the S&P 500 is up only 8% in 2023, while the major indices from some of the world’s other big stock markets are up considerably more.

For example, the German DAX, the Korean KOSPI and the Japanese NIKKEI 225 are all up about 13% so far this year. Minus the banking crisis, the U.S. stock market would likely be performing on par with those markets in 2023.

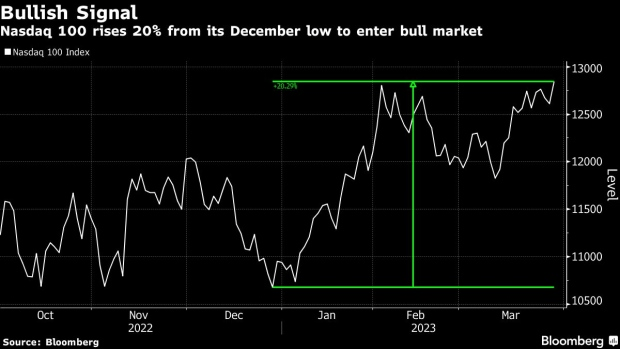

Despite the moderate overall return in the U.S. stock market, there have been some pockets of strength. To wit, the tech-heavy Nasdaq 100 is up roughly 23% so far this year, as illustrated below.

Along those lines, Bitcoin has also been a top performer in 2023, rising by 65% year-to-date. Bitcoin has undoubtedly benefited from its status as an “alternative store of value” amidst the banking crisis.

Considering the aforementioned trends, the list of top-performing stocks won’t come as much of a surprise, with equities from the technology sector exhibiting especially strong performance in early 2023.

Without further ado, the top stocks from 2023 are listed below (when filtering for companies with more than $10 billion in annual revenues):

- Carvana (CVNA), +158%

- Nvidia (NVDA), +99%

- Travelcenters of America (TA), +97%

- Meta (META), +90%

- Spotify (SPOT), +80%

- Builders Firstsource (BLDR), +79%

- OpenDoor Tech (OPEN), +76%

- Sea Limited (SE), +63%

- Tesla (TSLA), +60%

- Uber (UBER), +51%

- Advanced Micro Devices (AMD), +51%

- General Electric (GE), +50%

- Salesforce (CRM), +50%

- PulteGroup (PHM), +47%

- Tenet Healthcare (THC), +43%

Looking at the above list, Nvidia (NVDA) sticks out because it has rallied on exploding interest in artificial intelligence. Microsoft (MSFT) has experienced similar gains due to its new partnership with OpenAI—the creator of ChatGPT. Shares in Microsoft have rallied by nearly 30% year-to-date.

C3.ai Inc. (AI) has also benefited from the emerging AI trend, with shares in C3.al spiking by 80% so far in 2023. However, the stock isn’t included in the above list because of its small size.

When expanding the list of top stocks to include other companies with smaller market capitalizations, some additional 2023 outperformers include Oscar Health (OSCR, +175%), Redfin Corp (RDFN, +156%), NGL Energy Partners (NGL, +143%), DraftKings (DKING, +143%) and Cinemark Holdings (CNK, +108%).

Top-Performing ETFs in 2023

ETFs are built to track the returns of other investment products or themes, such as country-specific ETFs, equity index ETFs, or thematic ETFs that cover a certain product/commodity, such as steel, electric vehicles (EVs) or gold.

As such, the top-performing ETFs in any given year typically mirror the top-performing trends in the market. For this reason, ETFs geared toward the technology sector have been in favor year-to-date, as have Bitcoin-focused ETFs.

Listed below are some of the top-performing ETFs in 2023 (when filtering for funds with at least $500 million in total assets):

- ProShares Bitcoin Strategy ETF (BITO), +47%

- ARK Next Generation Internet ETF (ARKW), +32%

- ARK Innovation ETF (ARKF), +32%

- iShares US Technology ETF (IYW), +27%

- iShares US Home Construction ETF (ITB), +24%

- iShares MSCI Mexico ETF (EWW), +24%

- Fidelity Blue Chip Growth ETF (FBCG), +24%

- Global X Robotics and Artificial Intelligence ETF (BOTZ), +24%

- iShares Global Tech ETF (IXN), +23%

- Vanguard Mega Cap Growth Index Fund ETF (MGK), +23%

- Invesco QQQ Trust Series 1 (QQQ), +23%

- Technology Select Sector SPDR Fund (XLK), +23%

- Fidelity MSCI Information Technology Index ETF (FTEC), +22%

- Communication Services Select Sector SPDR Fund (XLC), +22%

- VanEck Gold Miners ETF (GDX), +13%

Considering the outperformance in the Nasdaq 100 so far in 2023, it’s no great surprise that the list of outperforming ETFs includes many tech-focused issues. Of the fifteen ETFs listed above, eight of them are geared toward the tech sector, including ARKF, ARKW, IYW, BOTZ, IXN, QQQ XLK and FTEC.

On top of that, the communications sector traditionally shares a strong positive correlation with the technology sector, which helps explain why the Communication Services Select Sector SPDR Fund (XLC) and the Technology Select Sector SPDR Fund (XLK) are both outperforming in 2023.

The 10-year positive correlation between XLC and XLK is +0.90, which is even stronger than the traditional link between gold and silver, at +0.89.

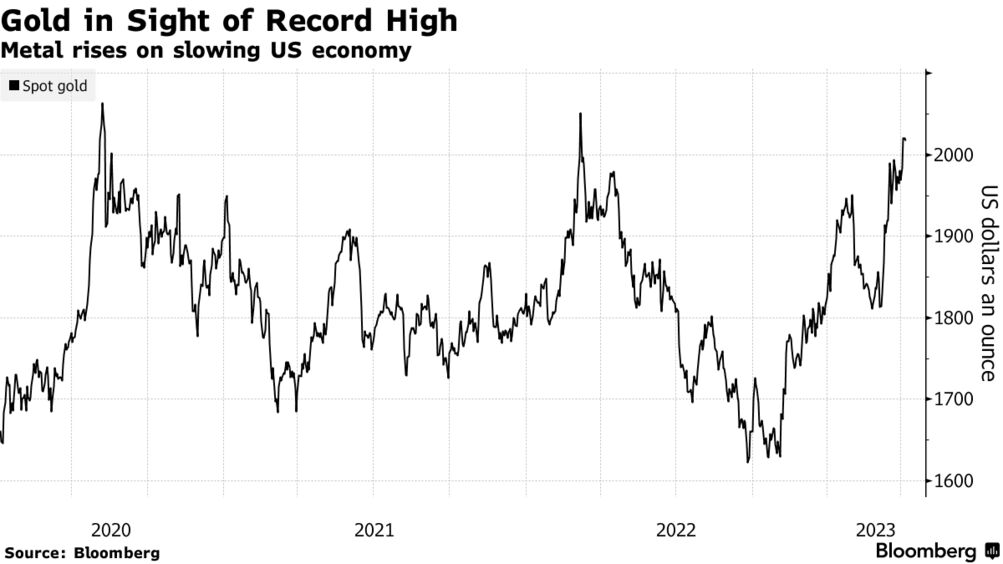

Gold has also been a notable out-performer in 2023, which helps explain why GDX has been a top-performing ETF. Gold prices are currently trading just shy of their all-time high. As of May 10, gold is trading $2,020/ounce, while the all-time closing high in gold is $2,070/ounce.

Gold historically outperforms during periods of economic instability (i.e. a banking crisis) because many market participants view it as a “safe haven,” and pile into gold when fear enters the financial markets. This is typically referred to as a “flight to safety” or a “flight to quality.”

Mexican Stock Market Shines in 2023

One of the bigger surprises in 2023 has been the Mexican stock market. The primary Mexican country ETF—the iShares MSCI Mexico ETF (EWW)—has rallied by about 25% so far this year. But looking back even further, the EWW is up about 40% since the start of 2021.

The rally in Mexican shares appears to have been triggered by the alignment of several favorable trends. At the top of the list is the aggressive stance taken by Mexico’s central bank, the Bank of Mexico.

Since the start of 2022, the Bank of Mexico has raised benchmark rates from 5.50% to 11.25%. And when it comes to tightening monetary policy in the wake of the COVID-19 pandemic, Mexico has actually been a leader—raising rates more quickly (and earlier) than many other countries around the world.

The Mexican economy also appears to be benefiting from a recent “nearshoring” trend.

Nearshoring refers to the practice of moving one’s business operations closer to where the goods/services are consumed. Mexico has been a direct beneficiary of this trend, as businesses located in Asia and elsewhere in the world have been moving their businesses closer to the United States.

The Mexican government reported in 2022 that hundreds of companies had inquired about moving their operations—in full or in part—to Mexico. And most often those inquiries centered on cities or regions located close to the U.S. border.

To learn more about trading country ETFs like the iShares MSCI Mexico ETF (EWW), readers can check out this installment of Options Jive on the tastylive financial network. To follow everything moving the markets, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.