Tesla’s Epic Rally Pulls EV Sector Higher in 2023

Strong sales growth in the EV sector are seen in the 130%+ year-to-date gains in Tesla

With half of the 2023 trading year officially in the books, one of the clear winners has been the technology sector. The tech-heavy Nasdaq Composite is up more than 30% so far this year.

Considering that electric vehicles (EVs) have been one of the hottest trends in the tech sector in the last several years (e.g. Tesla), it’s no great surprise that the 2023 tech rally has also lifted this niche of the stock market.

Tesla (TESLA) in particular has set a torrid pace so far in 2023. Year-to-date, Tesla shares are up more than 135%. The only mega-cap single stock to outperform Tesla this year is Nvidia (NVDA), which has rallied by more than 180% in 2023.

That said, the good times haven’t been rolling carte blanche in the EV industry. Instead, the 2023 EV rally has been a tale of two sectors—the “haves” versus the “have nots.”

Back in 2020, when the markets reversed amid the COVID-19 pandemic, most of the EV sector surged higher alongside Tesla. That hasn’t been the case in 2023.

This year, the companies with a firm grip on the EV industry—including legacy players with emerging EV divisions—have grabbed most of the positive momentum. On the other hand, many of the smaller, fringe players in the EV sector have experienced the opposite, and they are trading flat or down on the year.

This “haves vs. have nots” trend is illustrated through the year-to-date performance of some of the highest-profile companies in the EV sector, as detailed below:

- Tesla (TSLA), +137%

- Blue Bird (BLBD), +90%

- Li Auto (LI), +63%

- BYD (BYDDF), +23%

- Ford (F), +27%

- Toyota (TM), +16%

- Xpeng (XPEV), +16%

- General Motors (GM), +13%

- Lucid Group (LCID), +11%

- NWTN Motor (NWTN), +2%

- Nio Inc. (NIO), -2%

- Gogoro (GGR), -4%

- Rivian (RIVN), -8%

- Lion Electric (LEV), -10%

- Fisker (FSR), -21%

- Polestar (PSNY), -28%

- Nikola (NKLA), -43%

One of the clear differentiators in the above list appears to be market capitalization. Most of the 2023 winners are larger capitalized companies that exert greater influence in the industry.

In that regard, investors and traders appear to have thrown their weight behind companies that can theoretically leverage economies of scale. The EV sector is far from mature, but the above trend suggests that the market is sketching out a rough draft of the industry’s future winners and losers.

At this juncture, there’s no guarantee that the current trend holds. It’s entirely possible that some of the smaller players will rebound, especially if the global economy avoids a deep, protracted recession. On the other hand, if the economy starts to tank, then the winners in the above list could also reverse course, and give back some of this year’s gains.

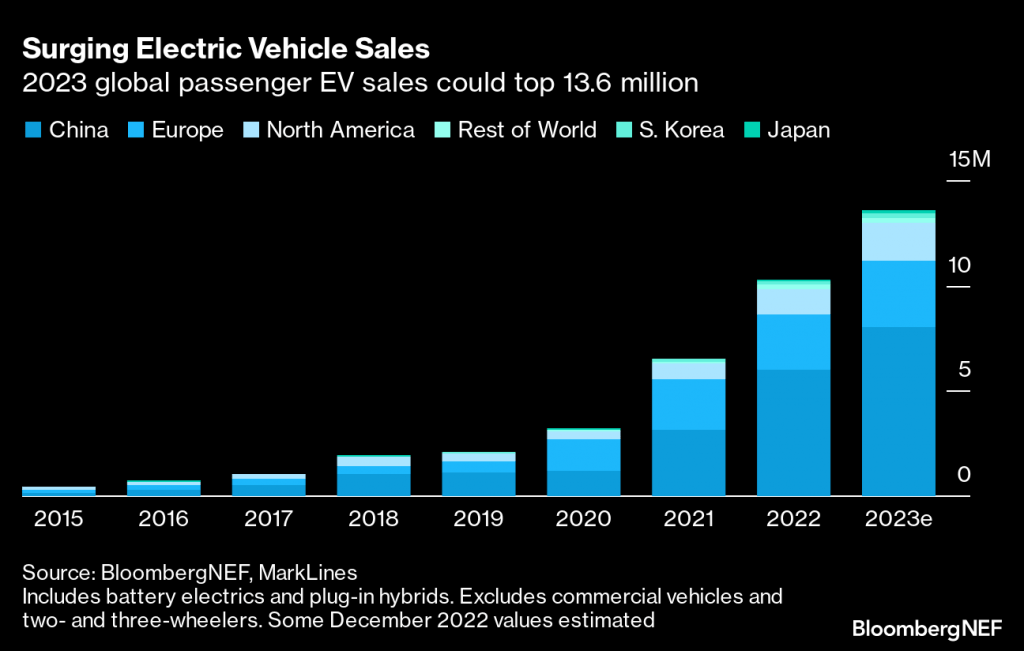

Global sales continue to strengthen

In Q1 of 2023, global EV sales increased by about 25% as compared to Q1 of 2022, according to figures compiled by the International Energy Agency (IEA). At the current pace, the IEA projects that overall 2023 EV sales are expected to clock in at around 14 million in 2023, which would represent an increase of about 35% as compared to calendar year 2022.

To put the aforementioned data in perspective, overall new passenger vehicle sales clocked in at about 75 million units globally last year, which means EVs would constitute about 18% of total passenger vehicle sales in 2023.

The largest global markets for EVs are China and Europe, but the United States is quickly gaining ground. In 2022, EV sales in the U.S. rose by 55% as compared to the year prior, according to IEA data.

That said, China’s thirst for EVs continues to grow. Last year, the IEA estimated that Chinese purchases constituted 60% of total global EV sales. Moreover, at least half of the world’s total EV fleet is currently domiciled in China.

That said, in the next five to six years, the market is expected to shift to some degree. IEA projections indicate that China will retain its top position in the year 2030, but with only 40% of annual EV sales, as opposed to 60%.

Europe is also expected to grow its current EV market share from 15% to 25% by 2030. But the most significant shift is expected to occur in the U.S. The U.S. share of global EV sales is projected to increase from 8% in 2022 all the way to 20% by 2030, according to the IEA.

EV makers have been cutting prices this year, which is a key piece of the 2023 sales narrative. Tesla first made waves in the sector in Q1 when it dropped prices across the board for its EVs.

Ford responded in kind by lowering the prices of its electric vehicles, including two separate price drops for the Mustang Mach-E. However, the F-150 Lightning has actually moved in the opposite direction, and is now priced about $11,000 higher than when it first launched.

If the global economy continues to slide into recession, EV manufacturers may have to provide further price relief in order to sustain the current level of sales.

Lithium-ion battery shortage

The global auto industry suffered from a global chip shortage in recent years, but the latest challenge for the EV sector is a shortage of lithium-ion batteries.

Currently, lithium-ion batteries power virtually every EV on the road, which means these batteries are absolutely critical to the industry.

However, the current level of demand for EVs far outstrips the available supply. In short, that means lithium-ion batteries are in extremely high demand and are expensive. The shortage ties back not only to the limited supply of raw lithium, but also to the limited capacity of global battery manufacturers.

According to Joshua Cobb, a senior auto analyst for BMI, the shortages could be acute in the near future. Cobb recently told ABCNews, “There will be a shortage of EV battery supplies.”

The situation has been so critical that some global EV manufacturers are partnering with lithium miners/refiners to secure access to this critical material. Some EV manufacturers are also partnering with lithium-ion battery producers for the same reason.

General Motors, for example, announced in late January that it had invested $650 million with Lithium Americas (LAC) to develop a lithium mine in Nevada. GM has also partnered with LG to build four battery production plants in the U.S. to supply its ambitious EV expansion plan.

Tesla, on the other hand, has vertically integrated and incorporated both lithium refinement and battery production into its own in-house operations. Tesla broke ground on its lithium mining facility in May of this year, and is expected to produce enough lithium to supply the production of roughly 1 million EVs annually by 2025.

Tesla is likewise building in-house capabilities to produce lithium-ion batteries. At the end of last year, the company announced it had produced nearly 900,000 of its “4680 battery cells” in the span of seven days. That level of production is expected to be enough to equip “one out of every three cars produced at Giga Texas,” according to research conducted by Armen Hareyan, the editor-in-chief of TorqueNews.com.

China’s BYD has also taken a stake in a lithium miner, while Ford has signed supply contracts stretching out 11 years into the future with lithium producers on two different continents. As such, it’s virtually assured that other EV manufacturers will be announcing partnerships with lithium miners and battery producers in the coming months.

If the battery shortage becomes more critical, that too could serve as a headwind for EV sales, as well as the EV niche of the stock market.

Tesla partners with rivals on EV charging technology

One other major development in 2023 has been the acceptance of the Tesla EV charging standard by other EV manufacturers in the North American market. This is important because it should help drive faster expansion of the EV charging network in the U.S.

This became possible when GM and Ford both recently agreed to adopt Tesla’s proprietary EV charging standard. Rivian has also come on board, and Volvo recently announced it would adopt Tesla’s charging technology for passenger vehicles that it sells in North America. Other U.S.-focused EV manufacturers will likely follow suit in the near future.

Moreover, on June 27, SAE International—an association of engineers that sets technical standards for aircraft and vehicles—announced it would establish a standard based on the Tesla charging connector. The Tesla charging system has been widely praised for being easy to use and reliable.

While certainly beneficial for Tesla, the move arguably makes it easier for other EV manufacturers to participate in future iterations of the standard. In that regard, Tesla will be giving up a significant degree of control over the technology’s future evolution.

As a result of the agreements, customers of both Ford, GM and Rivian will be able to access roughly 12,000 of Tesla’s fast chargers in the U.S. starting early next year. Tesla has upwards of 20,000 charging stations across the country, and is reserving some of those for Tesla drivers only.

Strong growth in the U.S. charging network could help speed up EV adoption over the next several years.

Performance in the broad EV sector

Much like the EV-specific manufacturers, the broader EV sector has also been a bit of a mixed bag in 2023. The companies listed below operate in five niches of the EV sector, including battery production/technology, charging stations, energy storage, lithium processing and safety/autonomous driving.

- Kandi Technologies (KNDI), +71%

- Fluence Energy (FLNC), +60%

- EnerSys (ENS), +45%

- Luminar (LAZR), +41%

- Livent (LTHM), +40%

- QuantumScape (QS), +35%

- EVgo (EVGO), -4%

- Ballard Power Systems (BLDP), -8%

- ChargePoint (CHPT), -8%

- Wallbox (WBX), -14%

- Hyliion (HYLN), -22%

- Plug Power (PLUG), -22%

- Blink Charging (BLNK), -48%

Considering the deal involving Tesla’s charging technology, it’s no great surprise to see that some of the EV charging-focused stocks (BLNK, CHPT, WBX) have suffered this year.

On the other hand, companies involved in battery production/technology (KNDI, LTHM, QS) and energy storage (ENS, FLNC) have outperformed so far in 2023, along with the “haves” among the EV manufacturers.

Because most of the ETFs focusing on the EV sector count Tesla among their holdings, the majority of those ETFs have also seen positive year-to-date gains, as highlighted below:

- Simplify Volt RoboCar Disruption and Tech ETF (VCAR), +47%

- Global X Autonomous & Electric Vehicles ETF (DRIV), +25%

- Fidelity Electric Vehicles and Future Transportation ETF (FDRV), +23%

- Amplify Lithium & Battery Technology ETF (BATT), +16%

- KraneShares Electric Vehicles & Future Mobility Index ETF (KARS), +9%

- SPDR S&P Kensho Smart Mobility ETF (HAIL), +7%

To follow everything moving the markets in 2023, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.