Tips for Expiring Options and Futures Positions

Options and futures are unique because unlike many other securities these derivatives have finite lives, and therefore specific expiration dates.

In the trading and investments industry, the term “expiration” refers to the fact that certain securities exist for a finite period of time.

For example, options, futures and futures options only exist through their expiration date, after which these contracts are invalid. That means when evaluating a potential options or futures trade, investors and traders need to consider not only price, but also time until expiration.

For example, a trader considering an options trade in Apple (AAPL) would need to decide whether he/she wants to open a position for a week, a month or multiple months—all of which are available choices.

The expiration aspect of a position is often referred to as “trade duration,” and denoted in terms of “days until expiration,” or DTE.

While most options and futures products have standardized expirations, those dates can sometimes be interrupted by holidays.

For example, the expiration date for listed monthly stock options in the United States is normally the third Friday of the contract month at 3 p.m. CST. But if the third Friday falls on a holiday, the expiration date will instead occur on the Thursday immediately prior to the third Friday.

Due to the varying expiration details of different products, it’s critical that investors and traders be aware of the exact date and time that a given product will expire before entering a position.

And once a position goes live, the investor or trader will also need to actively decide how to manage the position prior to expiration. For example, a long call owner might decide to close the position at a profit/loss, exercise the option, roll it to another expiration, or allow it to expire worthless.

Of course, that decision will rest heavily on the performance of the option/future during its lifetime.

Short Options and 45 Days-Until-Expiration

The tastytrade financial network has covered the expiration topic extensively and conducted a detailed series of market studies to provide additional context and insight into the expiration process.

One theme studied extensively by tastytrade is the optimal duration of short option trades. While the trade duration depends heavily on a trader’s outlook, strategic approach and risk profile, the research studies on short options conducted by tastytrade revealed that a 45-day duration has historically produced the most attractive results, on average.

The graphic below summarizes the findings from one such study, and highlights the historical efficiency of 45 days-until-expiration:

As shown in the above data, the 75 DTE and 110 DTE trade durations also produced attractive results, albeit suboptimal as compared to the 45-day window. One also can’t overlook the added risk associated with holding the position for a longer period of time.

When to Exit an Expiring Position

While the duration of a potential position is an important factor, so too is the length of time that a position remains open.

A key consideration regarding expiration is therefore deciding when one should close a position—or more specifically—understanding whether there is an optimal window of time to close a position prior to expiration.

It’s important to keep in mind that as options get closer to their expiration day, the theta decay of out-of-the-money (OTM) options slows down. This is a result of lower absolute option prices and the existence of tail risk (i.e. sudden, unexpected, extreme moves).

The slowdown in decay for short options—alongside a low absolute option price—is the definition of a declining risk-reward ratio. Basically, if a short option has already collapsed such that the absolute value of the option is minimal, and all that remains is tail risk, is that position worth keeping open?

In order to better understand this declining risk-reward ratio in terms of options approaching expiration, the tastytrade team ran a series of back-tests on historical S&P 500 options from 2005 to 2019.

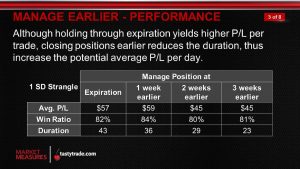

Analyzing that data, the tastytrade research team discovered that by closing a position two weeks prior to expiration, the winning percentage of the trades (on average) increased to 84%. The results of this market study are highlighted below.

Exiting a position two weeks before expiration (on average) allowed a trader to access the highest percent of winning trades as well as the highest average P/L per day. However, the trader did have to sacrifice a portion of the total average trade P/L in the process.

Further research by tastytrade on this subject provides additional evidence that the two-week window does help with trade and capital efficiency.

This research showed that profits only increased by 3% when holding a trade through the last week of an option’s life, and 16% when holding through the last two weeks. That means, on average, 84% of short premium profits are collected during the first 30 days of the trading cycle (assuming 45 days-until-expiration was the original trade duration).

Trading Across Expirations

Another benefit of multiple expirations is the ability for market participants to deploy spreads across different time periods (i.e. across multiple expirations). These positions are typically referred to as calendar spreads.

A calendar spread is executed by simultaneously buying and selling options with the same strike price, but different expiration months. When executed for a debit (i.e. cash comes out of the account), this position entails selling the near-month option in favor of purchasing an out-month option.

Debit calendar spreads (aka long calendar spreads) are theoretically bullish volatility because after the near-term option rolls off, the position is left with only the long premium leg of the trade. If volatility expands, the remaining leg of the trade should benefit.

Moreover, debit calendar spreads can be directionally bullish or bearish, depending on whether one executes a debit calendar call spread (bullish) or a debit calendar put spread (bearish).

Calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option prior to the near-term expiration. In this scenario, the premium from that short option bleeds off and funnels straight into the trader’s wallet.

Along those lines, if the underlying makes a big unexpected move in either direction, the most a debit calendar spread trader can lose is the amount of premium paid to establish the position—meaning the debit calendar spread is a defined risk position.

To learn more about how volatility can vary across different expiration periods, readers may want to review a new episode of Market Measures on the tastytrade financial network.

For more information on the other expiration topics explored in this post, readers may want to review the following links when scheduling allows:

- Tasty Bites: 45 Days Expiration Target

- Market Measures: Managing Positions Prior to Expiration

- Best Practices: Calendar Spread Mechanics

- Closing the Gap: Options and Futures Expirations

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.