Crypto’s Next Frontier: Decentralized Finance

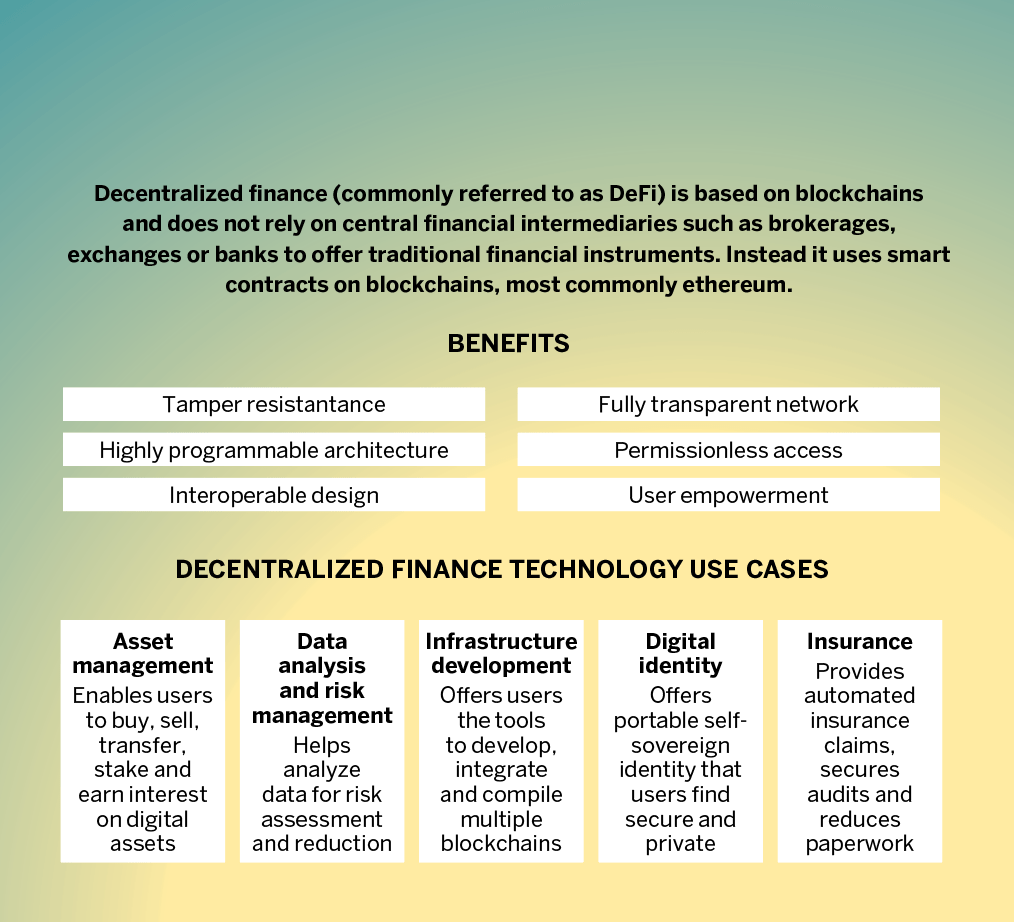

While many think of cryptocurrency as a way to make money or move it around, entrepreneurs and developers have started using the technology to solve problems with financial and commercial systems.

Some aim to rebuild the internet, others want to create frameworks for securing property rights, and a few choose to solve esoteric problems related to voting, data collection, prediction markets and other similarly obscure topics.

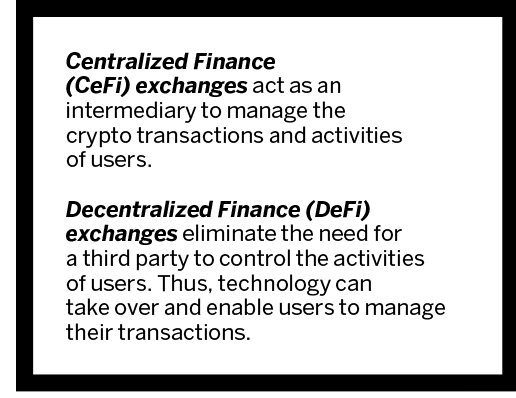

Over the past few years, a lot of time and effort have gone into decentralized finance, aka “DeFi,” which aims to solve a big problem with the way people do business with strangers, namely, they need someone to guarantee that the other person does what he or she agrees to do. Usually that role falls to banks, settlement companies and other intermediaries with a financial interest in seeing the deal go through.

This is the essence of finance: Multiple parties deal with one broker who settles the deal to everybody’s satisfaction.

In the legacy financial system, that process takes time and money. It also opens up opportunities for mistakes, fraud, data breaches, corruption, extortion and theft. Each step adds risk, cost and complexity.

DeFi to the rescue

With DeFi, computer protocols handle all of the steps involved in traditional finance. These protocols use cryptocurrency as the unit of account and the means of settling transactions and enforcing the rules. They work for everybody regardless of their location or circumstances—not just because the rules work all the time but also because it’s impossible to make the protocols do anything but follow the rules.

As a result, this technology promises to make borrowing and lending less expensive, put more idle assets into productive use, simplify the transfer of intellectual property and ownership rights, and give the poor and unbanked better access to financial markets.

Eventually.

For now, it suffers from the same problems all early-stage technologies face: It’s buggy, complicated and hard to use.

Financial inclusion

With DeFi, everybody can lend, borrow, create liquidity pools and investment funds, and participate in yield-producing activities. Already, DeFi platforms have serviced tens of billions of dollars in financial transactions.

To use the platforms, investors simply need a cryptocurrency wallet and a token that’s programmed to work with the platform. They don’t need to know anybody. They just need to download the right app.

There’s no way to turn anyone away from these platforms. The code will not judge how they’re dressed, what they look like, what accent they have or how much money they make. As long as they have the means to secure a loan, they can borrow any amount the protocol allows. As long as they have assets to offer, their money’s always good.

DeFi platforms have serviced tens of billions of dollars in financial transactions.

Anyone can also create financial products by using the protocols as building blocks. Insiders compare this to Lego bricks—stack them or arrange them to serve any purpose.

To expand access to credit and finance, no one any longer needs to fight the system. They can simply build a new one. All they need is a laptop, an internet connection and a little know-how.

Lower costs

For anybody willing to take a little time to learn how to use DeFi applications, the advantages become clear pretty quickly. With no middlemen or extra steps driving up costs, developers can create borrowing, lending and savings options that seem impossible with the traditional financial system.

For example, a savings account with Anchor Protocol generates up to 20% in stable interest each year with no minimum deposits and almost no fees ($1.42 in early August).

To oversimplify a bit, Anchor accomplishes that by incentivizing arbitrage in lending markets and using a separate cryptocurrency to boost yields.

Both the deposit and interest are denominated in U.S. dollars via a specialized cryptocurrency pegged to the value of a dollar.

Other protocols can generate even larger returns.

Borrowing costs can sometimes go lower than savings rates, depending on market conditions and the specific protocols of each cryptocurrency, which differ from one platform to another.

At times, borrowing and lending rates make it advantageous to borrow against existing holdings and deposit that borrowed money into a savings account.

That may seem like exotic financial engineering, and there’s some truth to that. But anybody can participate, not just the well-connected.

In any event, the markets adjust and such advantages usually disappear fairly quickly.

Because these protocols demand users borrow less than their collateral, the risks remain individual, not systemic. A cascade of liquidations can wipe out borrowers, but those liquidations will appear in the protocol’s vaults or will be distributed to other members of the network.

In other words, these protocols present tremendous risks to the individuals who use them but not to the financial systems they’re built on.

Or so we think.

Theoretically sound

That’s nice in theory, but DeFi is a new and unproven technology. It has existed for only a few years. Some of the most robust and active protocols are less than two years old. Who’s to say they will work the way their users expect?

They also come with a steep learning curve. It can be tricky enough to buy cryptocurrency, and it’s even trickier to use a cryptocurrency wallet. Interacting with a smart contract? Forget about it.

Worse, almost every DeFi protocol has suffered a hack or failure that led to funds stolen or assets liquidated.

Take, for example, Thorchain, a protocol that enables anybody to exchange any digital asset for any other. If it succeeds, it will serve as the global settlement layer for the exchange of all property that can get recorded digitally.

Ambitious? Yes. And fraught with risk.

Thorchain is a work in progress by an anonymous network of collaborators, developers, community leaders and advocates. While the work happens in public, the team’s identities remain private.

Already, the protocol has fallen victim to at least four breaches significant enough to pause some or all of the platform’s functionality. In the most recent attack, somebody hijacked $8 million in cryptocurrency. Considering the platform holds only about $100 million worth of assets, that’s no small sum.

Worse, the hackers proved they could have stolen the remaining $92 million but chose not to as a lesson to the team.

Other attacks stole an additional $5 million from Thorchain users.

While Thorchain’s treasury policy covered all losses, one can hardly expect billions of dollars of transaction volume to flow across a platform that can get hijacked seemingly at will.

Perhaps that will change with new iterations and other improvements, but Thorchain is closer to the norm than the exception.

In August, hackers stole more than $600 million from Poly Network, a DeFi bridge protocol. Since last year, hacks against platforms that include dYdX, Harvest Finance, Balancer, Aave, Akropolis, Pickle Finance, Warp Finance, Origin Protocol and almost every other DeFi platform, have led to hundreds of millions of dollars in other losses.

But it’s not just hacks and exploits that pose risks to users. Sometimes, the protocols simply fail.

During the global financial panic of March 2020, the MakerDAO protocol liquidated almost all of its balance sheet. Prices fell so fast that the immutable rules of the protocol forced all borrowers to either add collateral or forfeit their funds. Most borrowers could not act fast enough to cover their positions, so the protocol wiped them out.

Think of the debacle as the ultimate margin call.

Regulatory nightmare

Let’s not forget the legal side of things.

With DeFi, algorithms enforce the protocols. Humans have no say in the matter.

So, who’s responsible for the results? When protocols fail, should developers be held accountable? Or does that responsibility fall on users who don’t have any control over the programs?

What happens if the code fails or someone hacks it to defraud its users? What if a network flaw results in a loss of funds? In the real world, people can sue somebody for damages or try to recover losses. How does one sue a computer protocol? Can the courts subpoena a smart contract? Do developers have some safe harbor or an expectation of “caveat imperator?”

Should anyone even have a right to seek compensation? They used a technology that has no owner or counterparty. At what point does the blame fall on them?

What about tax reporting? Computer algorithms don’t generate 1099s, and the value of their related cryptocurrencies changes all the time. In any event, all the participants live in different places with different rules. Whose rules do they have to follow?

Governments certainly want to know who’s moving money and where it’s going. How far can they go to find that information? Should governments force users to disclose personal data on public blockchains? Can they compel developers to build know-your-customer and anti-money-laundering features into application interfaces? At what point does that infringe on privacy rights or personal security?

Clarity WIlL Come

For all its potential, DeFi will need a lot of time before it can replace the traditional financial system.

If history is a guide, this process will take years. It took the internet 13 years to move from plain text bulletin boards to the worldwide web, and it took even longer for microchips to yield desktop computers.

DeFi went from concept to reality in roughly two years. It will take a lot longer to do the things its proponents claim it will—though probably not as long as

some skeptics might think.

Mark Helfman, author of Bitcoin or Bust: Wall Street’s Entry Into Cryptocurrency, edits and publishes the Crypto Is Easy newsletter at markhelfman.com. @mkhelfman